Horse trailer financing opens up a world of possibilities for equestrian enthusiasts, making it easier to transport your beloved horses safely and comfortably. From secured loans to lease-to-own options, there’s a financing solution tailored to every need.

Whether you’re a seasoned pro or a first-time buyer, understanding the ins and outs of horse trailer financing is crucial for making an informed decision. This comprehensive guide will provide you with all the essential information you need to navigate the financing process with confidence.

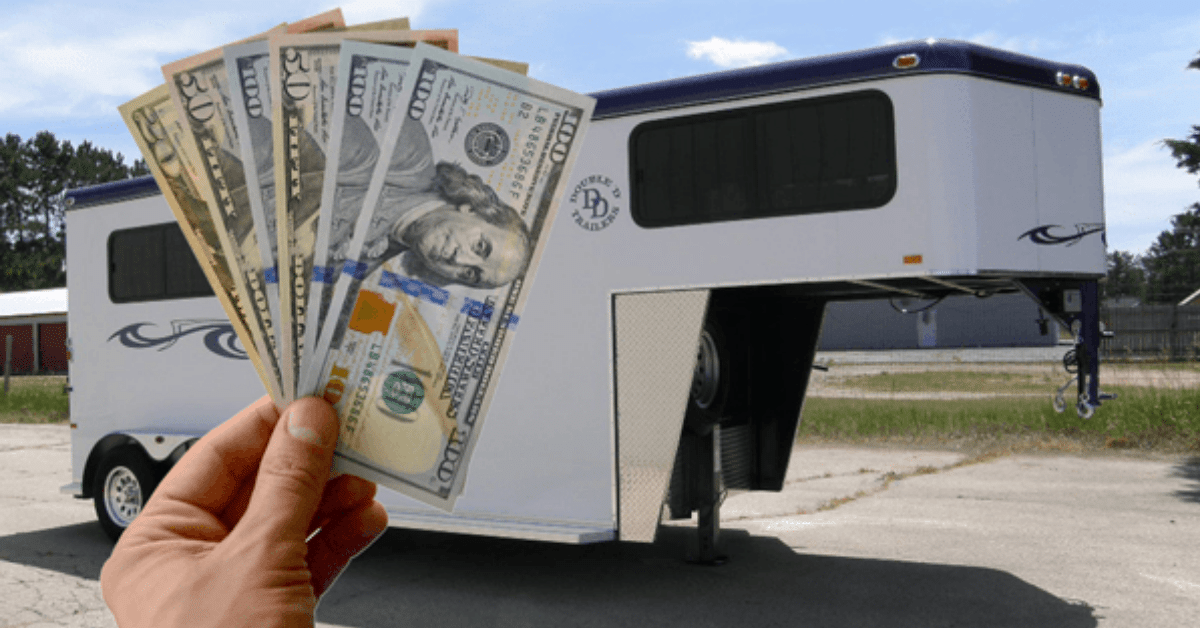

Horse Trailer Financing

Horse trailer financing provides options for individuals and businesses to purchase horse trailers without paying the full cost upfront. Understanding the different types of financing available, interest rates, loan terms, and repayment options can help you make informed decisions and secure the best financing for your needs.

Types of Horse Trailer Financing

There are several types of financing available for horse trailers:

- Secured Loans:Backed by collateral, such as the horse trailer itself, which serves as security for the loan. Secured loans typically offer lower interest rates.

- Unsecured Loans:Not backed by collateral, making them riskier for lenders. As a result, they usually come with higher interest rates.

- Lease-to-Own Options:Allow you to lease a horse trailer with the option to purchase it at the end of the lease term.

Pros and Cons of Each Financing Type, Horse trailer financing

Secured Loans

- Pros:Lower interest rates, longer loan terms

- Cons:Risk of losing collateral if you default on the loan

Unsecured Loans

- Pros:No collateral required

- Cons:Higher interest rates, shorter loan terms

Lease-to-Own Options

- Pros:Lower monthly payments, potential to own the trailer at the end of the lease

- Cons:May not build equity, mileage restrictions, early termination fees

Financing Options for Different Credit Profiles

Financing options vary based on your creditworthiness. Lenders evaluate your credit score, debt-to-income ratio, and financial history to determine your eligibility and interest rates.

Good Credit

- Qualify for lower interest rates and longer loan terms

- May have access to a wider range of financing options

Fair Credit

- May face higher interest rates and shorter loan terms

- May need to provide additional documentation or collateral

Poor Credit

- May have limited financing options

- May face high interest rates and strict loan terms

Interest Rates and Loan Terms

Interest rates and loan terms for horse trailer financing vary depending on the lender, loan type, and your credit profile.

The automotive industry is experiencing a surge in demand for automotive finance manager jobs . As car sales continue to rise, dealerships are seeking qualified professionals to manage their financing operations. These positions offer competitive salaries and benefits, making them an attractive career option for individuals with a background in finance or automotive sales.

Interest Rates

Interest rates are typically fixed or variable. Fixed rates remain the same throughout the loan term, while variable rates can fluctuate with market conditions.

Loan Terms

Loan terms typically range from 12 to 84 months. Longer loan terms result in lower monthly payments but higher total interest paid.

Down Payment and Collateral Requirements

Down payments and collateral can impact your financing options.

The automotive industry is experiencing a surge in demand for automotive finance manager jobs . These professionals are responsible for managing the financial aspects of vehicle sales and leases, ensuring that customers receive the best possible financing options.

Down Payment

- A down payment reduces the amount you borrow and can lower your monthly payments

- Typical down payment requirements range from 10% to 20%

Collateral

- Collateral, such as the horse trailer itself, can secure the loan and reduce the risk for the lender

- Lenders may require collateral if you have poor credit or are seeking a large loan amount

Final Thoughts: Horse Trailer Financing

In the world of horse trailer financing, preparation is key. By researching your options, comparing interest rates and loan terms, and understanding the role of down payments and collateral, you can secure the financing that aligns with your budget and needs.

Remember, the right financing solution will empower you to hit the road with your equine companions, creating unforgettable memories that will last a lifetime.