How much to invest in crypto per month – Determining the ideal amount to invest in cryptocurrency per month requires careful consideration of various factors. This comprehensive guide delves into the intricacies of crypto investing, empowering you with the knowledge to make informed decisions and maximize your returns.

As 2023 draws to a close, investors are already looking ahead to 2024 and considering their crypto investment strategies. With the cryptocurrency market constantly evolving, it’s essential to stay informed about the latest trends and potential investment opportunities. To help you navigate the crypto landscape, experts recommend exploring emerging cryptocurrencies with strong fundamentals and growth potential.

By diversifying your portfolio with a mix of established and up-and-coming coins, you can potentially maximize your returns while mitigating risks. For more insights on which cryptocurrencies to invest in 2024, consider reading the comprehensive guide at what crypto to invest in 2024 .

From understanding your financial goals and risk tolerance to navigating market trends and managing risk, this guide covers all aspects of crypto investing, ensuring you have the tools to succeed in this dynamic market.

Factors to Consider When Determining Investment Amount

Determining the right amount to invest in cryptocurrency per month requires careful consideration of several factors. These factors include:

- Financial goals:Define your investment goals, such as saving for retirement, purchasing a home, or generating passive income.

- Risk tolerance:Assess your tolerance for risk and the potential for losses. Cryptocurrency investments are inherently volatile, so it’s important to invest within your risk tolerance.

- Income, expenses, and savings:Consider your monthly income, expenses, and savings to determine how much you can realistically invest in cryptocurrency.

For example, if your financial goal is to retire early and you have a high risk tolerance, you may choose to invest a larger portion of your income in cryptocurrency. Conversely, if you are nearing retirement and have a low risk tolerance, you may prefer to invest a smaller amount.

Historical Performance and Market Trends: How Much To Invest In Crypto Per Month

Analyzing historical cryptocurrency returns and market trends can provide insights into potential investment opportunities. Consider the following:

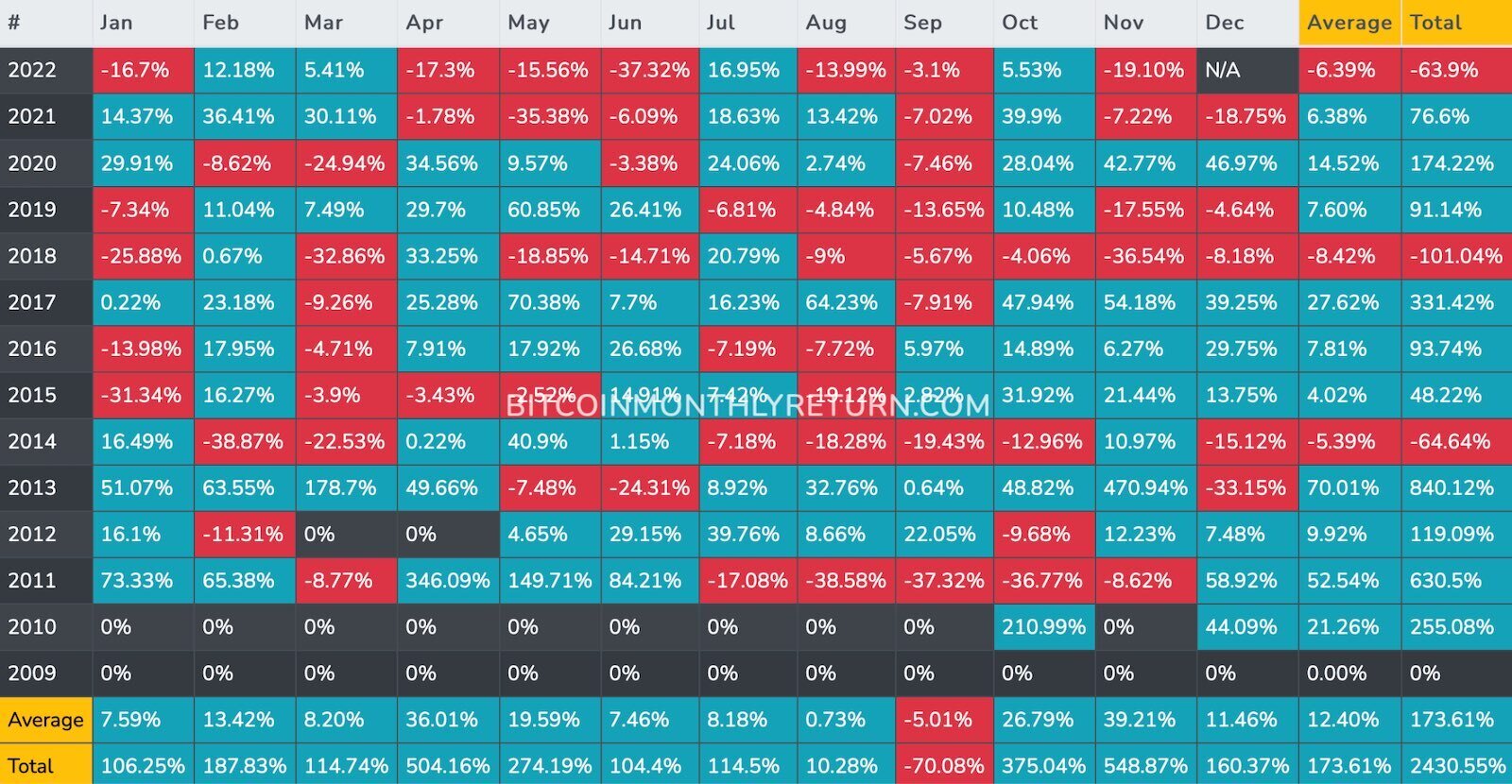

- Historical returns:Cryptocurrencies have historically exhibited high volatility, with periods of both significant gains and losses. Past performance does not guarantee future results, but it can provide some indication of the potential risks and rewards.

- Market trends:Cryptocurrency markets are influenced by a variety of factors, including news events, regulatory changes, and technological advancements. Monitoring market trends can help investors identify potential opportunities and adjust their investment strategies accordingly.

For instance, if the cryptocurrency market is experiencing a bullish trend, investors may consider increasing their investments. Conversely, if the market is in a bearish trend, they may choose to reduce their exposure.

Investment Strategies and Diversification

There are various investment strategies to consider when investing in cryptocurrency, including:

- Dollar-cost averaging:This strategy involves investing a fixed amount of money in cryptocurrency at regular intervals, regardless of market conditions.

- Lump-sum investing:This strategy involves investing a large sum of money in cryptocurrency at one time.

Diversification is a key strategy to reduce risk in cryptocurrency investments. This can be achieved by investing in multiple cryptocurrencies, as well as other asset classes such as stocks, bonds, or real estate.

As the year 2023 draws to a close, investors are eagerly anticipating the potential investment opportunities that lie ahead in the cryptocurrency market. For those looking to make informed decisions about their investments, it is crucial to stay abreast of the latest trends and projections.

According to experts, the year 2024 is expected to present a range of promising opportunities in the crypto realm. This comprehensive guide provides insights into the specific cryptocurrencies that are anticipated to yield substantial returns in the coming year.

For example, an investor may choose to allocate a portion of their portfolio to Bitcoin, Ethereum, and Litecoin, and another portion to traditional investments.

Risk Management and Portfolio Monitoring

Cryptocurrency investments carry inherent risks, including:

- Volatility:Cryptocurrency prices can fluctuate significantly, leading to potential losses.

- Security risks:Cryptocurrency exchanges and wallets can be vulnerable to hacking and theft.

- Regulatory uncertainty:Cryptocurrency regulations are still evolving, which can create uncertainty for investors.

To manage these risks, investors should:

- Set stop-loss orders:These orders automatically sell a cryptocurrency when it reaches a predetermined price, limiting potential losses.

- Monitor market conditions:Stay informed about cryptocurrency news and market trends to make informed investment decisions.

- Store cryptocurrency securely:Use reputable cryptocurrency exchanges and wallets that offer strong security measures.

Tax Implications and Legal Considerations

Cryptocurrency investments have tax implications that vary depending on jurisdiction. It’s important to:

- Understand tax laws:Familiarize yourself with the tax laws applicable to cryptocurrency investments in your country.

- Keep accurate records:Maintain records of all cryptocurrency transactions for tax purposes.

Additionally, there may be legal considerations related to cryptocurrency investments, such as:

- Regulatory compliance:Cryptocurrency exchanges and businesses must comply with relevant regulations.

- Investment scams:Be aware of potential scams and fraudulent investment schemes.

Final Review

In conclusion, investing in cryptocurrency requires a tailored approach that considers your financial goals, risk tolerance, and market conditions. By following the strategies Artikeld in this guide, you can create a diversified crypto portfolio that aligns with your investment objectives and sets you on the path to achieving your financial aspirations.