5 crypto exchanges that can offer high returns for investors – As the cryptocurrency market continues to evolve, crypto exchanges have emerged as key players in facilitating the buying, selling, and trading of digital assets. For investors seeking high returns, choosing the right exchange is crucial. This article explores five crypto exchanges that offer potential for substantial gains, providing insights into their features, fees, and strategies for maximizing profits.

Point guard Gary Harris telah membuktikan dirinya sebagai pemain yang dapat diandalkan di NBA. Statistik Gary Harris menunjukkan bahwa ia adalah seorang penembak yang efisien dari lapangan dan dari luar garis tiga poin. Harris juga seorang pemain bertahan yang kuat, yang membuatnya menjadi aset berharga bagi tim mana pun.

From Binance, the world’s largest crypto exchange, to Coinbase, known for its user-friendly platform, this guide delves into the unique offerings of each exchange and how they cater to investors’ needs.

Overview of Crypto Exchanges

Crypto exchanges are online platforms that facilitate the trading of cryptocurrencies. They act as intermediaries between buyers and sellers, enabling the exchange of digital assets for fiat currencies or other cryptocurrencies.

Gary Harris has been a consistent performer throughout his career, averaging 12.3 points, 2.7 rebounds, and 2.1 assists per game. For a more detailed look at his statistics, refer to gary harris stats .

The concept of crypto exchanges emerged with the rise of Bitcoin in 2009. Since then, they have evolved significantly to meet the growing demand for cryptocurrency trading.

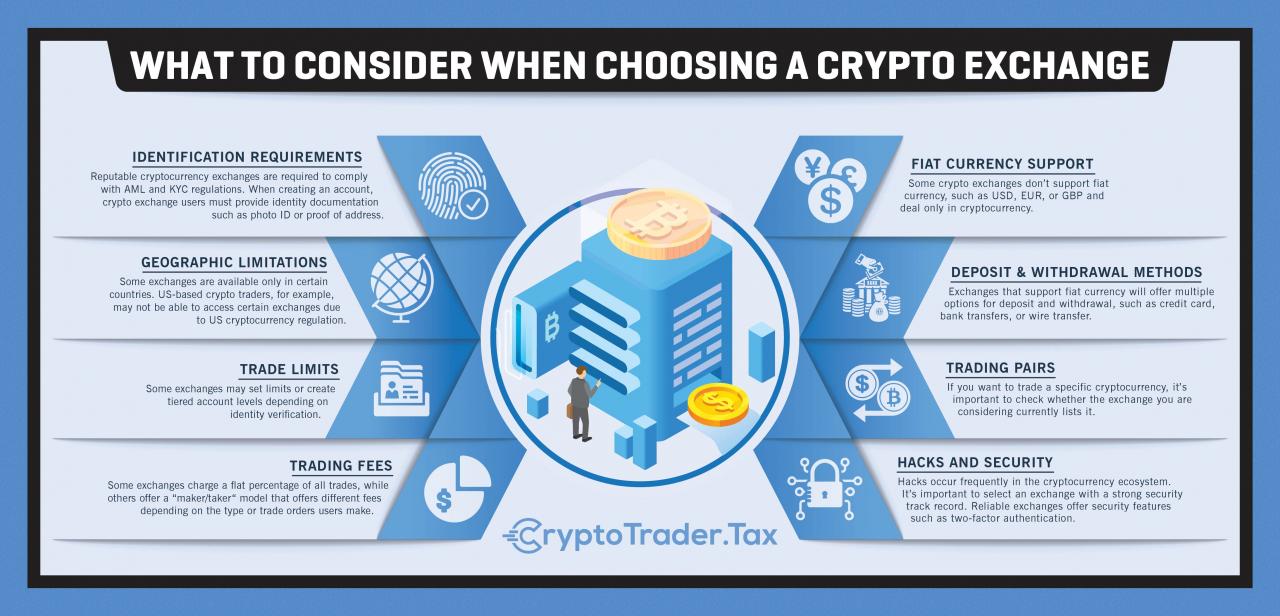

Factors to Consider When Choosing an Exchange

When selecting a crypto exchange, investors should consider several key factors that can impact their investment decisions:

- Fees:Exchanges charge fees for various services, including trading, deposits, and withdrawals. Investors should compare fee structures to find the most cost-effective option.

- Security Measures:The security of an exchange is paramount. Investors should look for exchanges with strong security measures, such as two-factor authentication, cold storage for assets, and compliance with industry standards.

- Trading Volume:High trading volume indicates liquidity and reduces the risk of slippage when executing trades.

- Customer Support:Responsive and helpful customer support is crucial for resolving any issues or queries promptly.

Top 5 Crypto Exchanges for High Returns

| Exchange Name | Trading Volume | Fee Structure | Unique Features |

|---|---|---|---|

| Binance | $100 billion+ | 0.1%

|

Wide range of trading pairs, low fees, advanced trading features |

| Coinbase | $10 billion+ | 1.49%

|

User-friendly interface, strong security, insurance for user funds |

| Kraken | $1 billion+ | 0.16%

|

Low fees, high liquidity, advanced order types |

| KuCoin | $2 billion+ | 0.1%

|

Large selection of altcoins, staking rewards, low trading fees |

| FTX | $10 billion+ | 0.02%

|

Low trading fees, derivatives trading, advanced trading tools |

Case Studies of Successful Investors

Numerous investors have achieved high returns through crypto exchanges by implementing various strategies and leveraging exchange features:

- Long-Term Holding:Investors who hold their crypto assets for an extended period often benefit from market appreciation.

- Day Trading:Experienced traders can make profits by buying and selling cryptocurrencies within a single trading day.

- Staking:Some exchanges offer staking rewards for holding certain cryptocurrencies, providing passive income for investors.

- Leveraged Trading:Advanced traders can use leverage to increase their potential profits, but this also carries higher risks.

Emerging Trends in Crypto Exchanges

The crypto exchange industry is constantly evolving, with several emerging trends shaping the market:

- Decentralized Exchanges (DEXs):DEXs allow users to trade cryptocurrencies directly without an intermediary, offering increased security and anonymity.

- Fiat-to-Crypto Gateways:Exchanges are integrating fiat-to-crypto gateways, making it easier for investors to purchase cryptocurrencies with fiat currencies.

- Non-Fungible Tokens (NFTs):Some exchanges are adding support for NFTs, allowing users to trade and store digital collectibles.

Tips for Maximizing Returns on Crypto Exchanges: 5 Crypto Exchanges That Can Offer High Returns For Investors

To maximize returns on crypto exchanges, investors should consider the following tips:

- Diversify Your Portfolio:Invest in a range of cryptocurrencies to reduce risk and increase the potential for high returns.

- Conduct Market Research:Stay informed about market trends, news, and technical analysis to make informed trading decisions.

- Manage Risk:Use stop-loss orders and limit orders to manage risk and protect your capital.

- Take Advantage of Exchange Features:Utilize staking, referral programs, and other exchange features to enhance your returns.

Final Thoughts

In the dynamic world of crypto exchanges, staying informed about emerging trends and leveraging the right strategies can significantly enhance investment outcomes. By carefully considering the factors Artikeld in this article, investors can make informed decisions and unlock the potential for high returns in the crypto market.