Achieving Financial Independence and Prosperity – Embark on the journey to financial independence and prosperity, where we unravel the secrets to securing your financial future. In this comprehensive guide, we’ll delve into the key principles, strategies, and mindset shifts that will empower you to achieve financial success.

We’ll explore the pillars of financial independence, the art of crafting a solid financial plan, and the nuances of debt management and investments. Discover how to cultivate multiple income streams and maintain financial well-being throughout your life.

Understanding Financial Independence and Prosperity

Financial independence and prosperity are states of financial well-being where individuals have accumulated sufficient wealth to cover their living expenses without relying on employment or other external sources of income. Achieving financial independence allows individuals to pursue their passions, travel, or simply enjoy a more comfortable lifestyle without the constraints of financial worries.

Key factors contributing to financial prosperity include:

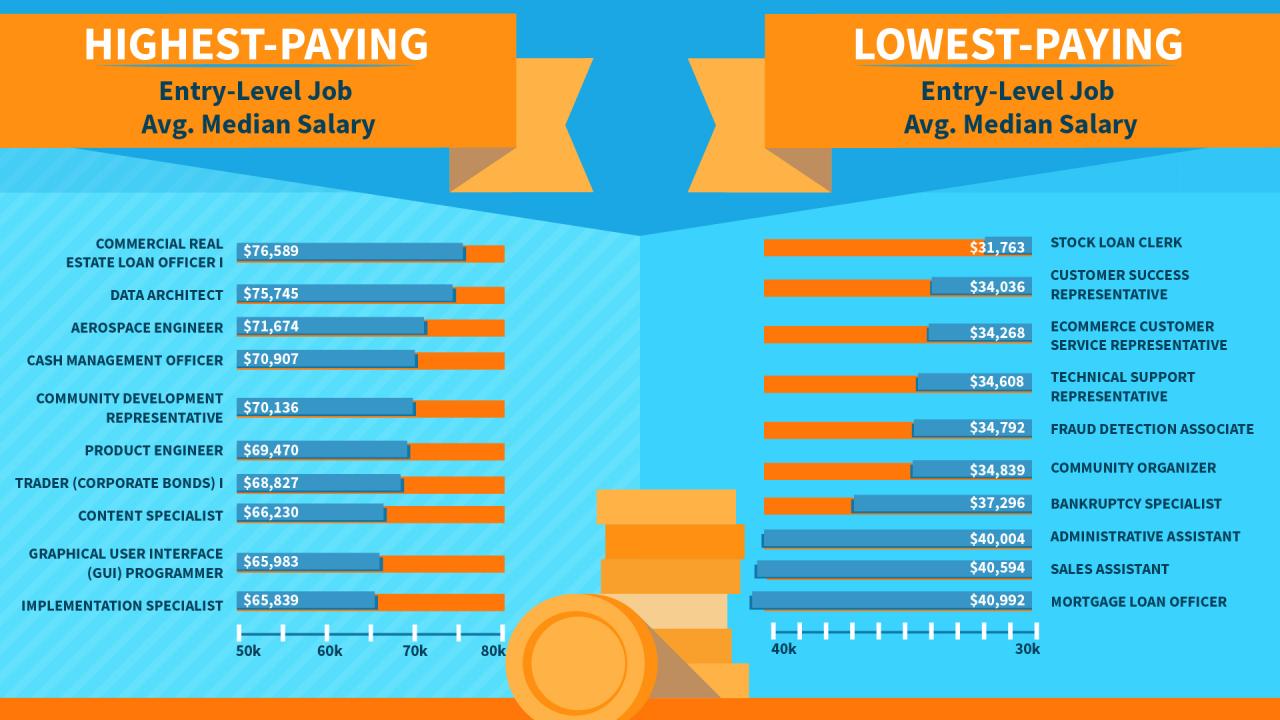

– Income: Generating a steady and substantial income is essential for building wealth.

– Saving: Setting aside a portion of income for future use is crucial for accumulating wealth.

– Investing: Growing wealth over time through investments in stocks, bonds, real estate, or other assets.

– Minimizing expenses: Reducing unnecessary expenses and living within one’s means allows for greater savings and investment.

– Financial literacy: Understanding financial concepts, managing debt, and making informed investment decisions are vital for long-term financial success.

Examples of Individuals Who Achieved Financial Independence

- Warren Buffett: Known as the “Oracle of Omaha,” Buffett is a legendary investor who built his wealth through value investing.

- Oprah Winfrey: A media mogul, Winfrey became a billionaire through her talk show, production company, and various business ventures.

- Dave Ramsey: A financial expert, Ramsey founded the Ramsey Solutions company and has helped millions of people achieve financial freedom.

Establishing a Comprehensive Financial Plan

A comprehensive financial plan is a roadmap that guides you towards achieving your financial goals. It involves assessing your current financial situation, setting goals, and developing strategies to achieve them. Establishing a comprehensive financial plan is crucial for managing your finances effectively and securing your financial future.

Setting Financial Goals and Objectives

The foundation of a financial plan lies in setting clear and achievable financial goals. These goals should be specific, measurable, attainable, relevant, and time-bound (SMART). Define your short-term, mid-term, and long-term goals, considering your financial aspirations and priorities. Consider goals such as saving for a down payment on a house, retiring comfortably, or funding your children’s education.

Budgeting and Tracking Expenses

Budgeting is essential for managing your cash flow and achieving your financial goals. Create a budget that Artikels your income and expenses. Track your expenses meticulously to identify areas where you can save or redirect funds. By understanding your spending habits, you can make informed decisions about your financial choices and allocate your resources wisely.

Managing Debt and Investments

Debt and investments are two sides of the same financial coin. Managing them effectively is crucial for achieving financial independence and prosperity. Let’s explore the different types of debt, strategies for managing them, and the principles of investing for a diversified portfolio.

Achieving financial independence and prosperity requires a sound mind and body. It’s important to take care of our mental health as it can impact our financial decisions. By following Easy Tips to Boost Mental Health , we can reduce stress, improve focus, and increase our overall well-being.

This will empower us to make better financial choices and ultimately achieve our goals of financial independence and prosperity.

Debt Management

- Good Debt vs. Bad Debt: Good debt, such as mortgages or student loans, can lead to asset appreciation or career advancement. Bad debt, such as credit card debt or payday loans, typically has high interest rates and does not contribute to long-term financial growth.

- Debt Consolidation: Combining multiple debts into a single loan with a lower interest rate can reduce monthly payments and simplify debt management.

- Debt Repayment Strategies: The debt snowball method involves paying off the smallest debt first, while the debt avalanche method focuses on paying off the debt with the highest interest rate first.

Investing Principles, Achieving Financial Independence and Prosperity

Investing involves allocating funds to various assets with the goal of generating returns and growing wealth over time. Key principles include:

- Diversification: Spreading investments across different asset classes, such as stocks, bonds, and real estate, reduces risk.

- Risk Tolerance: Investors should assess their tolerance for risk and invest accordingly. Higher risk investments have the potential for higher returns, but also carry more risk of loss.

- Compounding: Reinvesting earnings from investments allows returns to accumulate over time, leading to exponential growth.

Maximizing Returns and Minimizing Risks

- Asset Allocation: Determine the optimal mix of assets based on risk tolerance and financial goals.

- Rebalancing: Periodically adjust the asset allocation to maintain the desired risk level and maximize returns.

- Tax Optimization: Utilize tax-advantaged accounts, such as 401(k)s and IRAs, to reduce tax liability and increase returns.

Building a Sustainable Income Stream: Achieving Financial Independence And Prosperity

Establishing a solid financial foundation requires building a sustainable income stream. This involves exploring various income-generating strategies that align with your skills, interests, and financial goals. A key aspect of this is creating multiple income sources and diversifying your portfolio to mitigate risks and enhance financial stability.

Passive Income

Passive income refers to earnings generated without actively working for it. Examples include:

- Rental properties: Owning and renting out properties can provide a steady stream of passive income.

- Dividend-paying stocks: Investing in companies that pay dividends can generate regular income.

- Online courses: Creating and selling online courses can provide a passive income stream.

Entrepreneurship

Starting your own business can be a rewarding way to generate income and build wealth. However, it requires significant effort, dedication, and risk-taking. Successful entrepreneurial ventures often involve:

- Identifying a market need: Solving a problem or fulfilling a desire for a target audience.

- Creating a valuable product or service: Offering something that meets the needs and wants of customers.

- Building a strong brand: Establishing a recognizable and reputable business identity.

Diversification

Diversifying your income sources is crucial for managing risk and ensuring financial stability. This means not relying on a single source of income. By spreading your investments across different asset classes, industries, and income streams, you can reduce the impact of fluctuations in any one area.

Maintaining Financial Well-being

Financial well-being encompasses a state of financial security, freedom, and control over one’s financial life. Maintaining financial well-being requires ongoing effort and commitment to prudent financial management practices. This includes continuous learning, seeking professional guidance when needed, and staying motivated to achieve long-term financial goals.

Financial Literacy and Ongoing Education

Financial literacy empowers individuals with the knowledge, skills, and confidence to make informed financial decisions. It encompasses understanding basic financial concepts, such as budgeting, saving, investing, and managing debt. By continuously enhancing their financial literacy through books, articles, online resources, and workshops, individuals can make informed decisions that contribute to their financial well-being.

Financial Advisors

Financial advisors can provide valuable guidance and support in managing finances. They offer personalized advice based on individual circumstances, goals, and risk tolerance. Financial advisors can assist with investment planning, retirement planning, tax optimization, and estate planning. Their expertise can help individuals navigate complex financial matters and make informed decisions that align with their long-term financial objectives.

Achieving financial independence and prosperity requires resilience, perseverance, and a positive mindset. Life’s challenges can sometimes leave us with past trauma that may hinder our financial journey. If you find yourself struggling with past experiences, consider seeking professional help or exploring resources like Tips for Healing Past Trauma . Healing past trauma can empower you to move forward with greater confidence and resilience, allowing you to focus on achieving your financial goals.

Staying Motivated and Disciplined

Achieving financial goals requires motivation and discipline. Setting realistic goals, breaking them down into smaller steps, and tracking progress can help maintain motivation. Celebrating successes, no matter how small, can also boost morale. Additionally, surrounding oneself with supportive individuals who share similar financial goals can provide encouragement and accountability.

End of Discussion

Achieving financial independence and prosperity is not a mere aspiration; it’s a reality that awaits those who embrace the principles Artikeld in this guide. Remember, financial freedom is not a destination but an ongoing journey of growth, discipline, and smart decision-making. Embrace the lessons within, take action, and witness the transformative power of financial independence.

Essential FAQs

What is the key to achieving financial independence?

The foundation of financial independence lies in understanding your financial goals, creating a comprehensive plan, managing debt effectively, investing wisely, and cultivating multiple income streams.

How can I create a solid financial plan?

Crafting a robust financial plan involves setting clear financial goals, budgeting your expenses, tracking your progress, and regularly reviewing and adjusting your strategy.

What are the benefits of investing?

Investing offers the potential for long-term wealth growth, helps beat inflation, and provides a source of passive income.