Auto finance super centers have emerged as a one-stop solution for car buyers seeking competitive financing options. These specialized centers offer a comprehensive range of services tailored to meet the diverse needs of borrowers. Whether you’re a first-time buyer or a seasoned car enthusiast, this guide will delve into the world of auto finance super centers, providing insights into their key features, benefits, and drawbacks, empowering you to make informed decisions about your vehicle financing.

Auto finance super centers have gained popularity due to their convenience, efficiency, and access to multiple lenders. By consolidating various loan options under one roof, they allow borrowers to compare interest rates, loan terms, and fees from different lenders, increasing the likelihood of securing the most favorable deal.

Auto Finance Super Center: An Overview

An auto finance super center is a one-stop destination for all your car financing needs. It offers a wide range of loan options, competitive interest rates, and flexible repayment terms. By consolidating multiple lenders and dealerships under one roof, super centers provide convenience and efficiency to car buyers.

Benefits of using an auto finance super center:

- Access to a wide range of loan options from multiple lenders

- Competitive interest rates and flexible repayment terms

- Convenience of having everything under one roof

- Expert guidance and assistance from experienced loan officers

Drawbacks of using an auto finance super center:

- Potential for higher fees and closing costs compared to traditional lenders

- May not offer the lowest interest rates available

- Can be overwhelming for first-time car buyers

Reputable auto finance super centers:

- Capital One Auto Finance

- Santander Consumer USA

- Ally Financial

Services Offered by Auto Finance Super Centers

Auto finance super centers offer a comprehensive range of services to meet the needs of car buyers.

Loan options:

- New and used car loans

- Refinancing loans

- Lease financing

- Bad credit loans

Other services:

- Vehicle history reports

- Extended warranties

- Gap insurance

- Credit counseling

Applying for a loan at an auto finance super center:

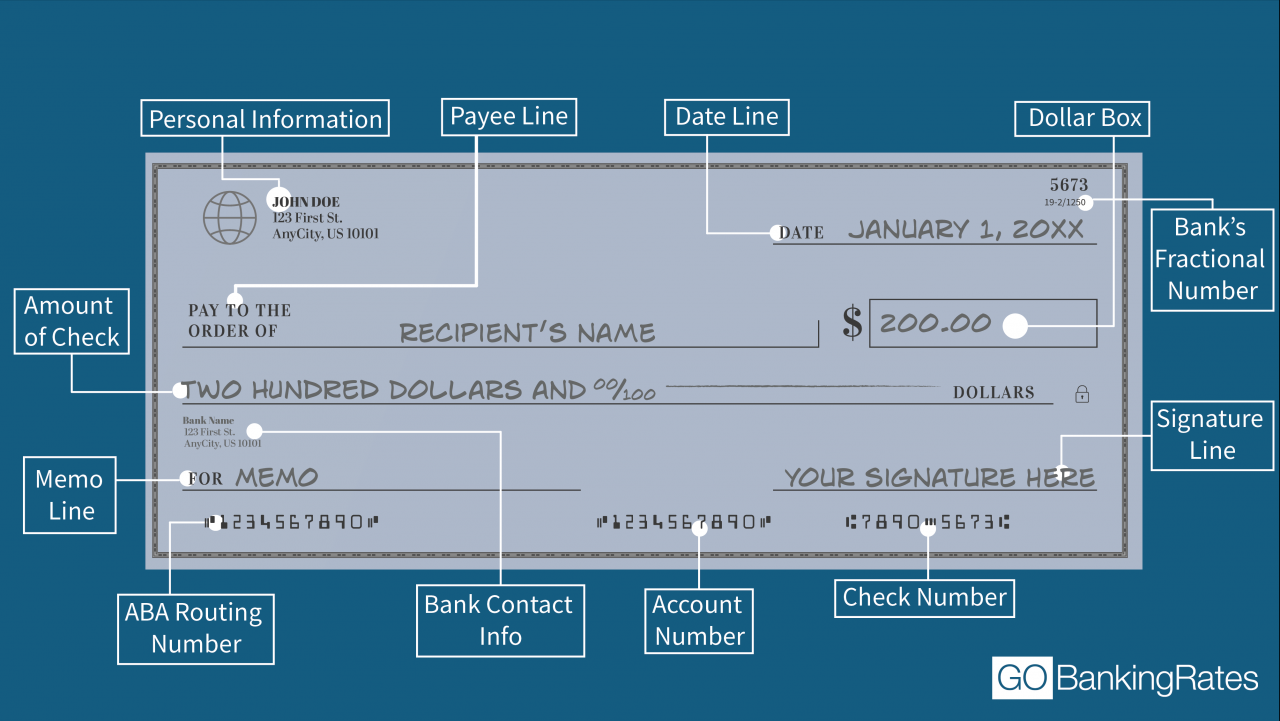

- Gather your financial information (income, expenses, assets, and liabilities)

- Shop around and compare interest rates from multiple lenders

- Choose a loan option that meets your needs and budget

- Submit a loan application and provide supporting documentation

- Get pre-approved for a loan

- Find a car and negotiate the purchase price

- Finalize the loan and purchase the car

Factors to Consider When Choosing an Auto Finance Super Center

When selecting an auto finance super center, consider the following factors:

Interest rates:

Compare interest rates from multiple super centers and choose the one with the lowest rate that meets your needs.

Fees and closing costs:

Be aware of any fees and closing costs associated with the loan. These can include application fees, origination fees, and documentation fees.

Loan terms:

Consider the loan term, which is the length of time you will have to repay the loan. Longer loan terms result in lower monthly payments but higher overall interest costs.

Reputation and customer service:

Read online reviews and talk to friends or family members who have used auto finance super centers to get an idea of their reputation and customer service.

Automotive financing options are essential for many car buyers, and Lincoln Auto Finance offers a range of solutions to meet their needs. Lincoln Auto Finance provides competitive rates, flexible terms, and personalized service to help customers secure financing for their dream Lincoln vehicle.

Tips for Negotiating with Auto Finance Super Centers

To get the best possible loan terms at an auto finance super center, follow these tips:

Shop around and compare interest rates:

Don’t settle for the first loan you’re offered. Get quotes from multiple super centers and compare interest rates, fees, and loan terms.

Negotiate the interest rate:

Once you’ve found a loan you like, try to negotiate a lower interest rate. Be prepared to provide documentation to support your request, such as a higher credit score or a lower debt-to-income ratio.

Negotiate the monthly payment:

If you can’t get a lower interest rate, try to negotiate a lower monthly payment. This can be done by extending the loan term or by making a larger down payment.

Avoid common pitfalls:

For those in the market for a new or used vehicle, Lincoln Auto Finance offers a range of financing options to help make the purchase more affordable. With flexible terms and competitive rates, Lincoln Auto Finance can tailor a plan to fit individual budgets and needs.

Be aware of common pitfalls when negotiating with auto finance super centers. These include being pressured into a loan you don’t want, paying excessive fees, or getting a loan with a high interest rate.

Alternatives to Auto Finance Super Centers

If you’re not sure whether an auto finance super center is right for you, consider these alternatives:

Banks and credit unions:

Banks and credit unions offer traditional car loans with competitive interest rates. They may also offer other financial products and services, such as checking accounts, savings accounts, and credit cards.

Online lenders:

Online lenders offer car loans with a streamlined application process and quick funding. They may also offer lower interest rates than traditional lenders.

Leasing:

Leasing a car can be a good option if you don’t want to own the car outright. With a lease, you make monthly payments to rent the car for a specific period of time. At the end of the lease, you can return the car or purchase it.

Final Review: Auto Finance Super Center

In conclusion, auto finance super centers offer a valuable resource for car buyers seeking a streamlined and efficient financing experience. By carefully considering the factors Artikeld in this guide, borrowers can navigate the complexities of auto financing and secure the best possible loan terms for their vehicle purchase.

Whether you choose to utilize the services of a super center or explore alternative financing options, understanding the landscape of auto financing will empower you to make informed decisions and drive away in the car of your dreams.