As the cryptocurrency market continues to evolve, investors are eager to identify the best crypto to invest in now. With the right strategies and knowledge, it’s possible to navigate the volatile waters and make informed decisions that can lead to potential profits.

This comprehensive guide will delve into the intricacies of the crypto market, exploring key trends, fundamental technologies, promising projects, investment strategies, and emerging innovations. By understanding these factors, investors can position themselves to make wise choices and capitalize on the opportunities presented by the ever-changing cryptocurrency landscape.

Market Analysis: Best Crypto To Invest In Now

The cryptocurrency market is a complex and dynamic ecosystem influenced by various factors. Market trends are driven by macroeconomic conditions, regulatory changes, technological advancements, and investor sentiment.

The future of crypto in the next 5 years is highly uncertain, but it is likely to see increased adoption and regulation. As more people learn about the benefits of cryptocurrencies, such as their security and anonymity, they are likely to become more widely used.

Additionally, governments are likely to introduce regulations to protect consumers and prevent fraud. These regulations could help to legitimize cryptocurrencies and make them more attractive to investors.

Currently, the market is experiencing a period of consolidation following a period of rapid growth. Economic uncertainties, geopolitical tensions, and regulatory scrutiny have contributed to a decrease in investor confidence and a decline in cryptocurrency prices.

Cryptocurrencies have emerged as a significant force in the financial landscape, and their future holds immense potential. Experts predict that the future of crypto will witness widespread adoption, driven by advancements in blockchain technology and regulatory clarity. As cryptocurrencies gain mainstream acceptance, they are expected to reshape industries and transform global finance.

Cryptocurrency Fundamentals

Cryptocurrencies are digital assets built on blockchain technology, which provides a decentralized and secure way to record transactions.

Key features include:

- Decentralization:No single entity controls the network, reducing the risk of censorship or manipulation.

- Transparency:Transactions are recorded on a public ledger, providing visibility and accountability.

- Security:Cryptographic algorithms and consensus mechanisms ensure the integrity and immutability of the blockchain.

Cryptocurrency Projects and Ecosystems, Best crypto to invest in now

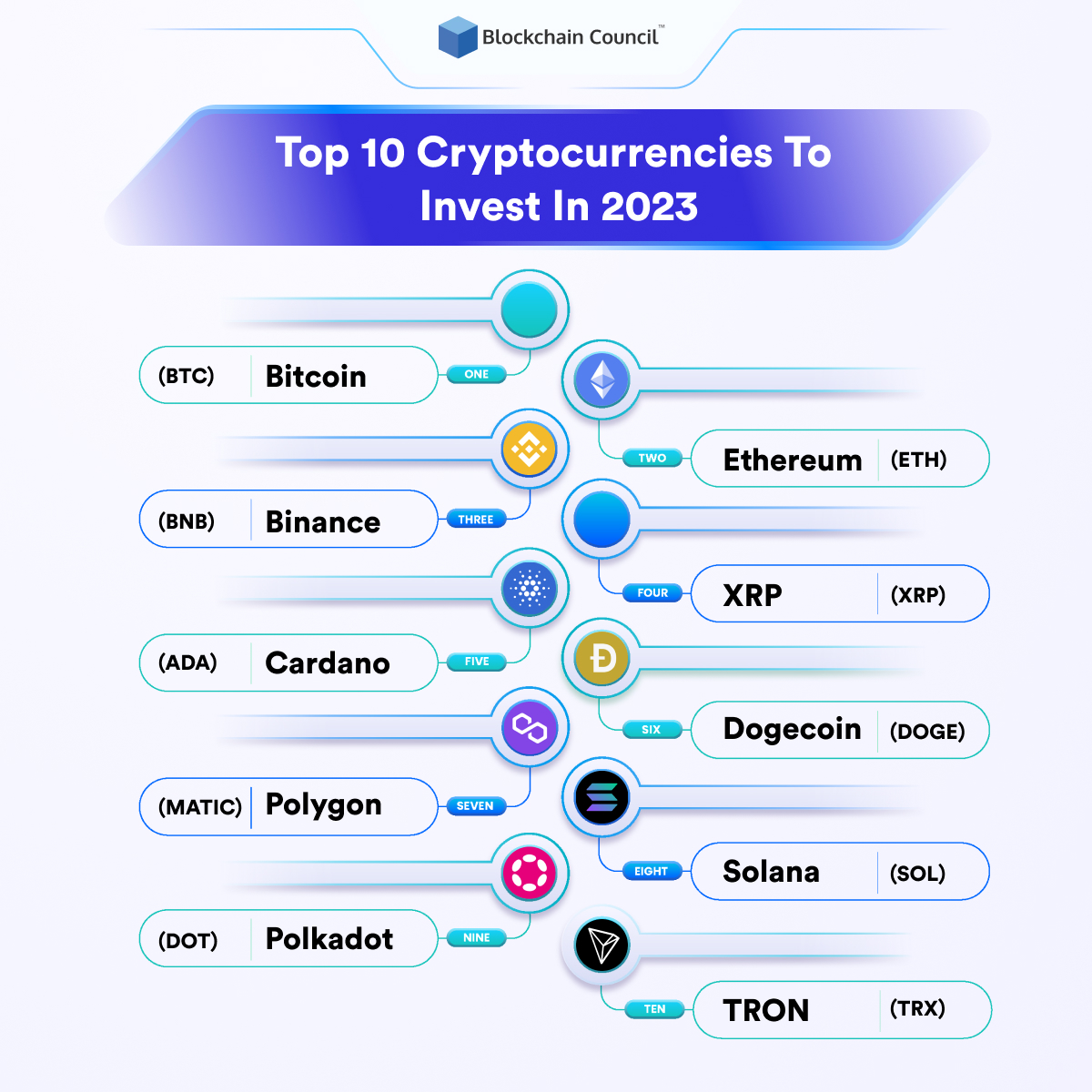

Numerous cryptocurrency projects are actively developing and expanding their ecosystems. Some promising projects include:

- Ethereum (ETH):A blockchain platform for decentralized applications, smart contracts, and NFTs.

- Bitcoin (BTC):The original cryptocurrency, known for its security and store of value.

- Solana (SOL):A high-performance blockchain with low transaction fees and fast processing speeds.

Investment Strategies and Risk Management

Investing in cryptocurrencies involves risk. Different investment strategies include:

- Short-term trading:Buying and selling cryptocurrencies within a short period to capitalize on price fluctuations.

- Long-term holding:Holding cryptocurrencies for an extended period, anticipating their long-term growth potential.

- Diversification:Investing in a mix of cryptocurrencies to reduce risk.

Risk management is crucial. Investors should consider factors such as:

- Volatility:Cryptocurrency prices can fluctuate rapidly.

- Security:Cryptocurrency exchanges and wallets can be vulnerable to hacking.

- Regulation:Regulatory changes can impact cryptocurrency markets.

Technical Analysis and Market Indicators

Technical analysis involves using charts and indicators to identify potential trading opportunities. Common indicators include:

- Moving averages:Smoothing out price data to identify trends.

- Relative Strength Index (RSI):Measuring the strength of price movements.

- Bollinger Bands:Identifying areas of overbought and oversold conditions.

Technical analysis is not foolproof and should be used with caution.

Cryptocurrency Exchanges and Trading Platforms

Cryptocurrency exchanges provide a platform for buying, selling, and trading cryptocurrencies. Factors to consider when choosing an exchange include:

- Fees:Trading fees can vary significantly between exchanges.

- Security:Exchanges should implement robust security measures to protect user funds.

- Liquidity:Exchanges with high liquidity offer better execution prices and reduce slippage.

Emerging Trends and Future Prospects

The cryptocurrency industry is constantly evolving, with new trends emerging regularly. Some notable trends include:

- DeFi (Decentralized Finance):Financial services built on blockchain technology, offering alternatives to traditional banking.

- NFTs (Non-Fungible Tokens):Unique digital assets representing ownership of digital or physical items.

- Metaverse:Virtual worlds where users can interact, socialize, and conduct economic activities.

The future of cryptocurrencies is uncertain but holds significant growth potential. However, it is essential to invest responsibly and be aware of the risks involved.

Wrap-Up

Investing in cryptocurrency requires a multifaceted approach that encompasses market analysis, technical expertise, and a keen understanding of the underlying technologies and projects. By embracing a holistic perspective and adopting a disciplined investment strategy, investors can increase their chances of success in the dynamic and potentially lucrative world of cryptocurrency.