Commercial distribution finance has emerged as a vital lifeline for businesses seeking to expand their reach and unlock growth potential. This specialized financing solution provides tailored support for the distribution sector, empowering businesses to overcome challenges and achieve their strategic objectives.

Summertime is upon us, and that means it’s time for outdoor concerts. Darien Lake is one of the most popular concert venues in Western New York, and this year’s lineup is sure to please music lovers of all ages. With a variety of genres represented, there’s something for everyone at Darien Lake this summer.

Commercial distribution finance encompasses a diverse range of financial products and services designed to meet the unique needs of distributors. It offers flexible funding options, customized payment terms, and expert guidance, enabling businesses to optimize their supply chain operations, expand into new markets, and enhance their overall competitiveness.

Overview of Commercial Distribution Finance

Commercial distribution finance is a specialized financial solution designed to assist businesses in managing and optimizing their distribution channels. It provides funding for various aspects of the distribution process, enabling companies to expand their reach, improve efficiency, and increase profitability.

Key components of commercial distribution finance include inventory financing, accounts receivable financing, and purchase order financing. These financing options allow businesses to access capital to purchase inventory, extend credit to customers, and cover expenses associated with purchase orders.

Utilizing commercial distribution finance offers several benefits, including improved cash flow, reduced risk, increased sales, and enhanced supply chain efficiency. However, it also poses certain challenges, such as potential interest charges and the need for thorough financial planning.

The summer concert season is heating up at Darien Lake , with a lineup of top-tier artists taking the stage. From country music legends like Tim McGraw and Luke Combs to pop sensations like Maroon 5 and Lizzo, there’s something for everyone at Darien Lake this summer.

Types of Commercial Distribution Finance

There are several types of commercial distribution finance available, each tailored to specific business needs. Here’s a comprehensive list:

- Inventory financing:Provides funding to purchase and maintain inventory, allowing businesses to meet customer demand and avoid stockouts.

- Accounts receivable financing:Advances funds against outstanding customer invoices, enabling businesses to improve cash flow and reduce collection risks.

- Purchase order financing:Provides financing to cover the costs of raw materials or components required to fulfill purchase orders, ensuring timely delivery and avoiding production delays.

- Factoring:A combination of accounts receivable financing and debt collection services, where businesses sell their invoices to a factoring company to obtain immediate funds.

- Warehouse financing:Provides financing to purchase or lease warehouse space, enabling businesses to store inventory efficiently and optimize distribution operations.

- Transportation financing:Provides funding for transportation costs, such as shipping, trucking, and logistics, ensuring timely delivery of goods.

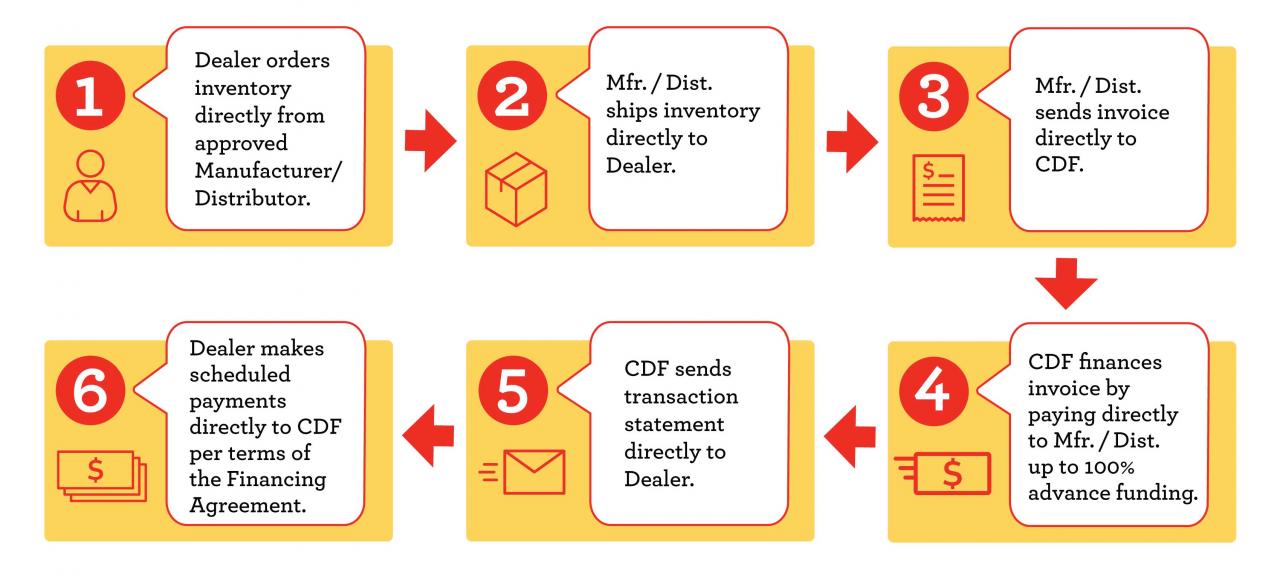

Process of Obtaining Commercial Distribution Finance

Obtaining commercial distribution finance typically involves the following steps:

- Business evaluation:Financial institutions assess the business’s financial health, creditworthiness, and distribution capabilities.

- Documentation:Businesses provide financial statements, business plans, and other relevant documentation to support their application.

- Approval:The financial institution reviews the application and makes a decision on whether to approve the financing.

- Funding:Once approved, the financial institution disburses the funds to the business.

Eligibility criteria may vary depending on the type of financing and the financial institution, but generally include factors such as revenue, profitability, and the quality of the business’s receivables.

Case Studies and Examples: Commercial Distribution Finance

Numerous businesses have successfully utilized commercial distribution finance to drive growth and expansion. Here are a few examples:

- Example 1:A manufacturing company used inventory financing to purchase additional raw materials, enabling them to increase production capacity and meet growing demand.

- Example 2:A wholesale distributor utilized accounts receivable financing to extend credit to new customers, expanding their market reach and increasing sales.

- Example 3:A logistics company obtained purchase order financing to cover the costs of a large shipment, ensuring timely delivery and avoiding penalties.

Trends and Innovations in Commercial Distribution Finance

Commercial distribution finance is constantly evolving, with emerging trends and innovations shaping the industry:

- Digitalization:Technology is transforming the distribution finance landscape, enabling automated processes, real-time data analysis, and enhanced transparency.

- Data analytics:Financial institutions are leveraging data analytics to assess risk, customize financing solutions, and improve decision-making.

- Alternative lending:Non-traditional lenders are entering the market, providing flexible and innovative financing options to businesses.

- Supply chain integration:Commercial distribution finance is becoming increasingly integrated with supply chain management systems, optimizing inventory management and reducing costs.

Last Recap

As the distribution landscape continues to evolve, commercial distribution finance will undoubtedly play an increasingly critical role in supporting business growth and innovation. By leveraging the benefits of this financing solution, businesses can gain a competitive edge, drive operational efficiency, and ultimately achieve long-term success.