Corporacion Financiera Nacional (CFN), Ecuador’s leading development finance institution, stands as a pillar of economic progress. Its mission-driven approach and comprehensive suite of financial services have fueled Ecuador’s economic growth, fostering job creation, financial inclusion, and sustainable development.

Since its inception, CFN has played a pivotal role in shaping Ecuador’s financial landscape, providing access to capital for businesses and entrepreneurs, driving innovation, and supporting infrastructure projects.

History of Corporacion Financiera Nacional (CFN)

Corporacion Financiera Nacional (CFN) is a public development bank established in Ecuador in 1942. It plays a crucial role in supporting economic development by providing financial services to businesses and infrastructure projects.

The opportunity finance network is a vital resource for small businesses and entrepreneurs seeking financial assistance. This network provides access to capital, technical assistance, and mentorship programs, empowering businesses to grow and create jobs. Through partnerships with banks, credit unions, and community development financial institutions, the network offers a range of financing options tailored to the unique needs of underserved communities.

Key Events in CFN’s History

- 1942:CFN is founded as the Development Bank of Ecuador.

- 1964:CFN’s name is changed to Corporacion Financiera Nacional.

- 1970s-1980s:CFN expands its operations and becomes a major source of financing for private sector development.

- 1990s:CFN faces financial challenges and undergoes a restructuring.

- 2000s:CFN regains financial stability and becomes a key player in Ecuador’s economic recovery.

- 2010s:CFN focuses on supporting sustainable development and infrastructure projects.

Mission and Objectives of CFN

CFN’s mission is to promote economic development in Ecuador by providing financial services to businesses and infrastructure projects. Its core objectives include:

- Providing access to financing for businesses, especially small and medium-sized enterprises (SMEs).

- Supporting infrastructure development in key sectors such as energy, transportation, and water.

- Promoting sustainable development and environmental protection.

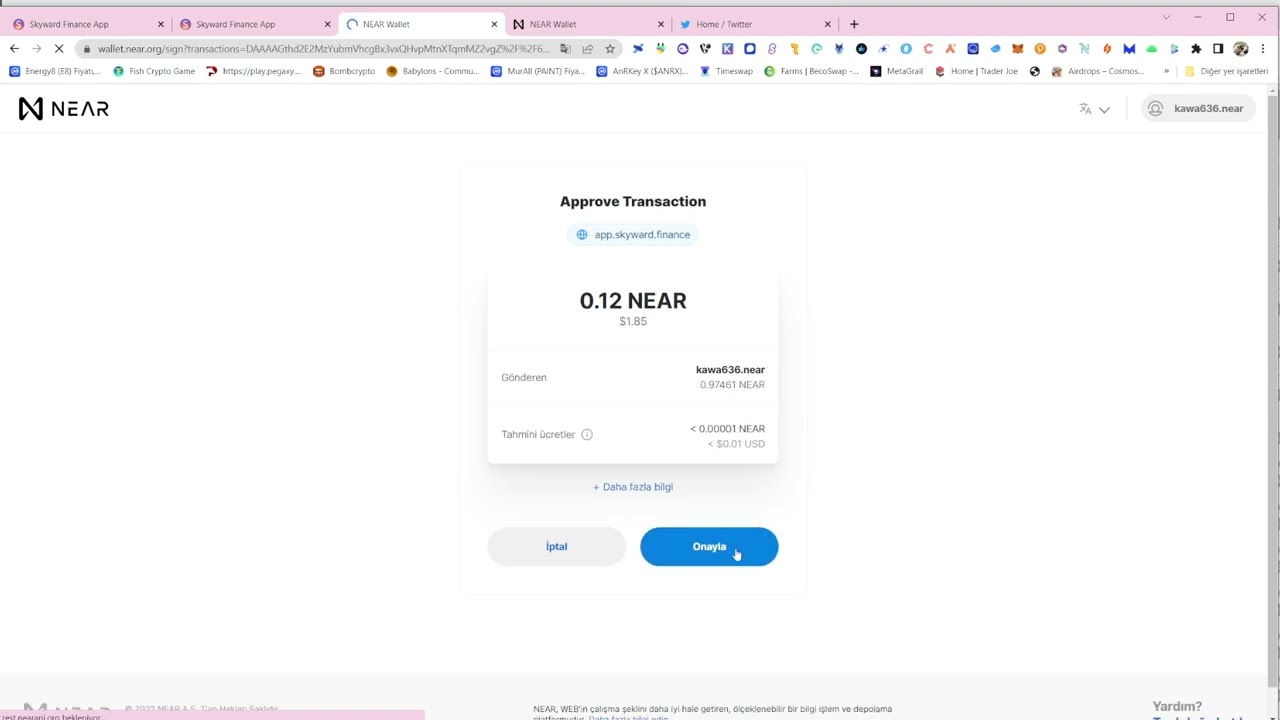

Products and Services Offered by CFN

CFN offers a wide range of products and services to meet the needs of its clients. These include:

Loans, Corporacion financiera nacional

- Commercial loans

- Project finance loans

- Infrastructure loans

Equity Investments

- Direct equity investments

- Indirect equity investments through investment funds

Guarantees

- Loan guarantees

- Bond guarantees

Technical Assistance

- Project feasibility studies

- Business planning

- Financial management

Financial Performance of CFN: Corporacion Financiera Nacional

CFN’s financial performance has been strong in recent years. In 2022, CFN reported a net income of $200 million, an increase of 10% compared to the previous year. The bank’s total assets grew to $5 billion, a 5% increase from 2021.

Closing Notes

As Ecuador embarks on a new chapter of economic growth, CFN remains steadfast in its commitment to empowering businesses, driving sustainable development, and fostering financial inclusion. Its unwavering dedication to the nation’s prosperity ensures that CFN will continue to be a cornerstone of Ecuador’s economic success story.