Educacion financiera – Financial literacy is the foundation upon which individuals can build a secure financial future. It empowers them to understand financial concepts, manage their money effectively, and make informed financial decisions throughout their lives.

From budgeting and money management to investment planning and debt reduction, financial literacy provides the tools and knowledge necessary to navigate the complexities of personal finance. By understanding the principles of financial literacy, individuals can unlock opportunities for financial growth, stability, and independence.

Financial Literacy Basics

Financial literacy is the ability to understand and manage your finances effectively. It encompasses a range of skills, including budgeting, saving, investing, and managing debt. Financially literate individuals are able to make informed decisions about their money and achieve their financial goals.

Importance of Understanding Financial Terms and Principles

Understanding financial terms and principles is essential for financial literacy. These terms and principles provide the foundation for making informed financial decisions. For example, understanding the concept of compound interest can help you make wise investment choices. Similarly, understanding the principles of budgeting can help you manage your money effectively and avoid debt.

Examples of How Financial Literacy Can Empower Individuals

- Make informed financial decisions:Financially literate individuals are able to make informed decisions about their money. They can compare different financial products and services, such as loans, credit cards, and investments, to find the best options for their needs.

- Achieve financial goals:Financial literacy can help you achieve your financial goals. By understanding your financial situation and creating a financial plan, you can take steps to reach your goals, such as buying a home, saving for retirement, or paying off debt.

- Avoid financial pitfalls:Financial literacy can help you avoid financial pitfalls. By understanding the risks associated with different financial products and services, you can make informed decisions and protect yourself from financial harm.

Budgeting and Money Management

Financial literacy is incomplete without understanding the significance of budgeting and money management. It is the cornerstone of financial stability, empowering individuals to make informed decisions about their finances, plan for the future, and achieve their financial goals.

Budgeting Methods

There are various budgeting methods, each with its strengths and weaknesses:

- Zero-Based Budgeting:Assigns every dollar of income to specific categories, ensuring no money is left unaccounted for.

- 50/30/20 Rule:Allocates 50% of income to needs, 30% to wants, and 20% to savings and debt repayment.

- Envelope System:Divides cash into different envelopes for specific categories, limiting spending within each category.

- Reverse Budgeting:Pays fixed expenses first, then allocates remaining income to savings and discretionary spending.

Effective Money Management

Effective money management involves:

- Saving:Setting aside a portion of income regularly for emergencies, future goals, or retirement.

- Investing:Using savings to generate potential returns over time through various investment options.

- Debt Reduction:Prioritizing debt repayment, using strategies like debt consolidation or debt avalanche.

- Financial Planning:Creating a comprehensive plan that Artikels financial goals, strategies, and timelines.

Investment and Retirement Planning

Investment and retirement planning are essential aspects of financial literacy that can help individuals secure their financial future. Understanding the various investment options available, their potential risks and returns, and the importance of retirement planning can empower individuals to make informed decisions about their financial well-being.

Investment Options

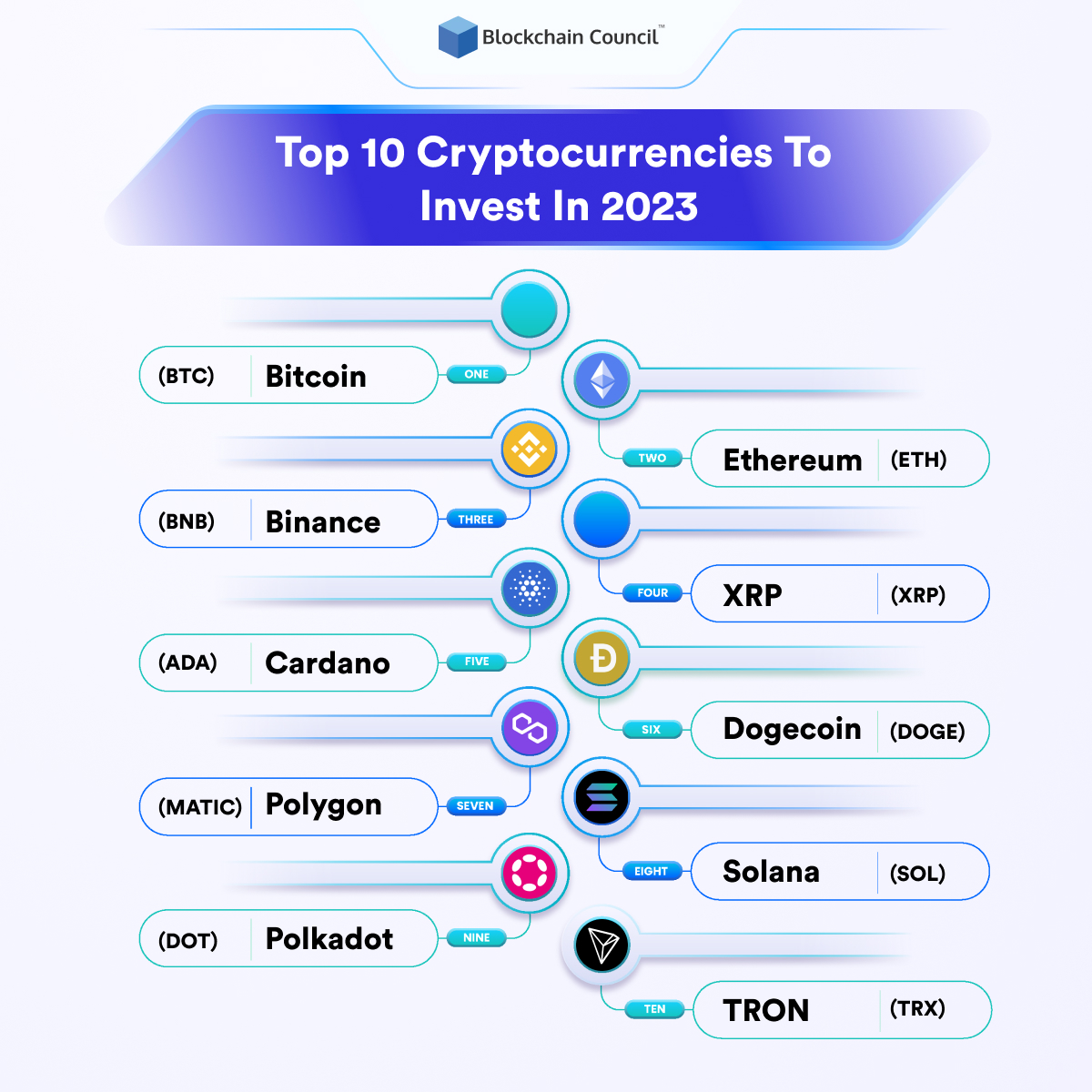

There are various investment options available, each with its own risk and return profile. Common investment options include:

- Stocks:Represent ownership in a company and offer the potential for high returns but also carry higher risk.

- Bonds:Loans made to companies or governments that provide regular interest payments and are generally considered less risky than stocks.

- Mutual funds:Pooled investments that offer diversification and professional management, making them suitable for investors with varying risk tolerance.

- Exchange-traded funds (ETFs):Similar to mutual funds, but traded on stock exchanges like stocks, offering flexibility and diversification.

- Real estate:Physical property that can generate rental income or appreciation in value, but requires significant upfront investment and ongoing maintenance.

Retirement Planning

Retirement planning is crucial for ensuring financial security during the later years of life. Different types of retirement accounts offer tax advantages and incentives to encourage individuals to save for their future. Common retirement accounts include:

- 401(k) plans:Employer-sponsored retirement plans that allow employees to contribute a portion of their paycheck pre-tax, reducing their current tax liability.

- IRAs:Individual retirement accounts that offer tax-advantaged savings for retirement, with different types such as traditional IRAs and Roth IRAs.

- Annuities:Insurance contracts that provide a guaranteed stream of income during retirement.

Creating a Diversified Investment Portfolio

Creating a diversified investment portfolio is essential to manage risk and enhance potential returns. Diversification involves investing in a mix of assets with different risk and return characteristics. By spreading investments across different asset classes, such as stocks, bonds, and real estate, investors can reduce the impact of market fluctuations on their overall portfolio.

Credit and Debt Management: Educacion Financiera

Understanding the nuances of credit and debt management is crucial for maintaining financial stability. Credit, when used responsibly, can provide access to funds for various expenses, but mishandling debt can lead to severe financial consequences. This article explores different types of credit, effective debt management strategies, and the impact of poor credit management on financial health.

Types of Credit

There are various types of credit available, each with its own terms and interest rates. Some common types include:

-

-*Revolving Credit

Allows borrowers to repeatedly borrow and repay funds, such as credit cards.

-*Installment Credit

Requires borrowers to repay fixed amounts over a specified period, such as car loans or mortgages.

-*Secured Credit

Charli XCX is set to perform at the Chupitos Bar in Dallas on May 20th. The English singer-songwriter is known for her hits like “Boom Clap” and “Fancy.” Tickets for the show are on sale now. Click here for more information.

Backed by collateral, such as a house or vehicle, which the lender can seize if the borrower defaults.

-*Unsecured Credit

Not backed by collateral, making it riskier for lenders and often resulting in higher interest rates.

Managing Debt Effectively

Effective debt management involves responsible borrowing and timely repayment. Strategies include:

-

-*Creating a Budget

Tracking income and expenses helps identify areas where spending can be reduced to allocate funds for debt repayment.

-*Debt Consolidation

Combining multiple debts into a single loan with a lower interest rate, simplifying repayment and potentially saving money.

-*Credit Counseling

Seeking professional guidance from a non-profit credit counseling agency can provide personalized advice and assistance in managing debt.

Consequences of Poor Credit Management

Poor credit management can have detrimental effects on financial well-being. Consequences include:

-

-*High Interest Rates

Lenders perceive borrowers with low credit scores as high-risk, resulting in higher interest rates on loans and credit cards.

-*Limited Access to Credit

Low credit scores can make it difficult to qualify for loans or credit cards, limiting access to funds for essential expenses.

-*Damaged Credit History

Late payments and defaults remain on credit reports for years, negatively impacting credit scores and making it harder to rebuild credit.

Improving Credit Scores

Improving credit scores requires responsible credit use and timely payments. Tips include:

-

-*Making Payments on Time

Payment history is the most influential factor in credit scores.

-*Reducing Credit Utilization

Using only a small portion of available credit shows lenders responsible borrowing habits.

-*Monitoring Credit Reports

Regularly reviewing credit reports for errors and disputing inaccuracies can help maintain a positive credit history.

By understanding credit and debt management principles, individuals can make informed financial decisions, effectively manage debt, and improve their financial well-being.

Financial Planning for Different Life Stages

Financial planning is crucial at every stage of life, as each stage presents unique challenges and opportunities. Understanding these challenges and tailoring financial strategies accordingly can help individuals achieve their financial goals and secure their future.

Young Adulthood

Young adults typically face challenges such as managing student loans, building credit, and saving for a down payment on a home. It is essential to create a budget, prioritize expenses, and explore options for student loan repayment. Additionally, establishing good credit habits by paying bills on time and managing debt responsibly is crucial.

Family Life, Educacion financiera

Families often face increased expenses, such as childcare, education, and healthcare. It is essential to adjust the budget to accommodate these expenses and consider additional sources of income if necessary. Additionally, planning for future expenses, such as college education or retirement, becomes more important.

In a highly anticipated concert, the renowned pop star Charli XCX is set to perform in Dallas, Texas, on March 28th at The Factory in Deep Ellum. The show is part of her North American “Crash” tour, which supports her latest album of the same name.

Fans can expect an electrifying performance filled with her signature blend of pop, electropop, and punk influences. Tickets for the Charli XCX Dallas concert are now available for purchase.

Retirement

Retirement planning involves ensuring a steady income stream and managing expenses in the absence of regular employment. It is essential to start saving early and invest wisely to accumulate a sufficient retirement nest egg. Additionally, considering healthcare costs and downsizing expenses to reduce living costs can help ensure financial stability during retirement.

Financial Education Resources

Financial education empowers individuals to make informed decisions about their finances, leading to improved financial well-being. Accessing reputable resources is crucial, as they provide unbiased information and guidance.

Books

Books offer in-depth exploration of financial concepts. Consider the following:

- “The Psychology of Money” by Morgan Housel

- “The Richest Man in Babylon” by George Clason

- “Your Money or Your Life” by Vicki Robin and Joe Dominguez

Websites

Websites provide up-to-date information and interactive tools:

- Consumer Financial Protection Bureau (CFPB): https://www.consumerfinance.gov

- National Endowment for Financial Education (NEFE): https://www.nefe.org

- Money Under 30: https://www.moneyunder30.com

Organizations

Organizations offer workshops, counseling, and community programs:

- United Way: https://www.unitedway.org

- Financial Planning Association (FPA): https://www.financialplanningassociation.org

- Credit Unions: Local credit unions often provide financial education programs

Success Stories

Individuals who have improved their financial well-being through education serve as inspiration:

- Sarah, a single mother, increased her savings by 25% after attending a budgeting workshop.

- John, a college graduate, paid off his student loans in record time using strategies learned from online resources.

- Maria, a small business owner, expanded her business after receiving guidance from a financial counselor.

Epilogue

In the realm of personal finance, financial literacy reigns supreme. It is the key to unlocking financial empowerment, enabling individuals to make informed decisions that can shape their financial well-being for years to come. By embracing financial literacy, individuals can take control of their financial futures and achieve their financial goals.