Focus on personal finance – In the realm of personal finance, a world of possibilities awaits those seeking to navigate the complexities of managing their financial well-being. This comprehensive guide delves into the intricate details of personal finance, empowering individuals with the knowledge and strategies to achieve financial success.

From budgeting techniques to investment strategies, this guide provides a roadmap for understanding and mastering personal finance.

Personal Finance Management

Personal finance management involves overseeing and managing your financial resources to achieve your financial goals. It encompasses various aspects, including budgeting, tracking expenses and income, and planning for the future.

Budgeting Techniques

- 50/30/20 Rule: Allocate 50% of income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-Based Budgeting: Assign every dollar of income to a specific category, ensuring no money is left unaccounted for.

- Envelope System: Divide cash into envelopes labeled for different spending categories, promoting mindful spending.

Tracking Expenses and Income

Keeping track of your expenses and income is crucial for managing your finances effectively. Utilize tools such as spreadsheets, budgeting apps, or simply a notebook to record all transactions.

Financial Planning

Financial planning is the process of setting and achieving financial goals through strategic planning and decision-making. It involves assessing your current financial situation, identifying goals, and developing a roadmap to reach them.

Setting Financial Goals

- Establish clear and specific goals, whether it’s saving for a down payment, retiring early, or funding a child’s education.

- Prioritize goals based on their importance and urgency.

- Set realistic timelines and milestones to track progress.

Role of Financial Advisors

Financial advisors can provide personalized guidance and support in developing and implementing financial plans. They can help you assess your risk tolerance, optimize investments, and make informed decisions.

Debt Management

Managing debt responsibly is essential for financial stability. Understanding different types of debt and their impact can help you create a plan to repay debt and avoid excessive borrowing.

Types of Debt

- Secured Debt: Backed by collateral, such as a mortgage or car loan.

- Unsecured Debt: Not backed by collateral, such as credit cards or personal loans.

Creating a Debt Repayment Plan

- Prioritize high-interest debt first.

- Consider debt consolidation or refinancing to lower interest rates.

- Negotiate with creditors to adjust payment terms.

Consequences of Excessive Debt

Excessive debt can lead to financial distress, including damage to credit scores, increased interest payments, and even bankruptcy.

Bagi individu yang ingin memasuki dunia keuangan, associate degree in finance dapat menjadi pilihan pendidikan yang tepat. Program gelar ini dirancang untuk membekali siswa dengan dasar yang kuat dalam prinsip-prinsip keuangan, akuntansi, dan ekonomi. Dengan menyelesaikan gelar ini, lulusan dapat memenuhi syarat untuk berbagai posisi entry-level di bidang keuangan, seperti analis keuangan, perwakilan layanan pelanggan, dan asisten akuntan.

Investing and Savings

Investing and saving are crucial for long-term financial growth and security. Understanding the basics of investing and the various options available can help you make informed decisions about how to grow your wealth.

Benefits of Investing

- Potential for higher returns than savings accounts.

- Inflation protection.

- Compound interest, which can exponentially increase your wealth over time.

Investment Options

- Stocks: Represent ownership in a company and offer potential for growth but also carry higher risk.

- Bonds: Loaned money to companies or governments, providing fixed income but lower potential returns.

- Mutual Funds: Diversified portfolios that invest in a range of assets, offering a balance of risk and return.

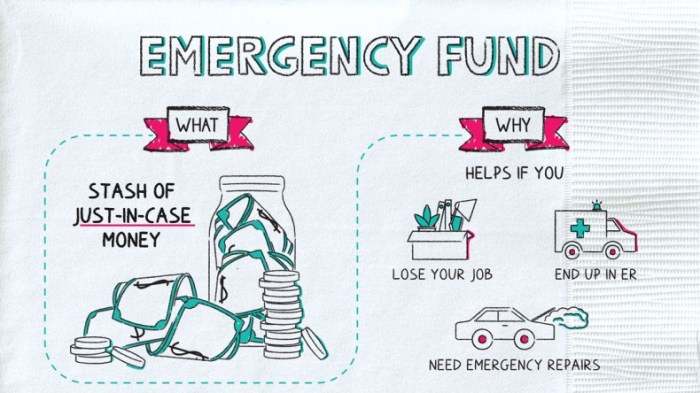

Building an Emergency Fund and Saving for Retirement, Focus on personal finance

An emergency fund provides a safety net for unexpected expenses, while retirement savings ensure financial security in your later years.

Individuals seeking a career in finance can pursue an associate degree in finance , which typically takes two years to complete. This degree provides a solid foundation in financial principles, accounting, and economics. Graduates can find employment as financial analysts, loan officers, and personal bankers.

Credit and Loans: Focus On Personal Finance

Credit and loans are financial tools that can be used to access funds when needed. Understanding credit scores and different types of loans can help you make informed decisions about borrowing money.

Concept of Credit and Credit Scores

Credit scores represent your creditworthiness, influencing your ability to qualify for loans and interest rates. Factors affecting credit scores include payment history, credit utilization, and length of credit history.

Types of Loans

- Personal Loans: Unsecured loans used for various purposes, such as debt consolidation or home improvements.

- Mortgages: Secured loans used to purchase real estate.

- Auto Loans: Secured loans used to purchase vehicles.

Managing Credit and Improving Credit Scores

- Make timely payments on all debts.

- Keep credit utilization low.

- Build a long and positive credit history.

Last Recap

Embarking on this journey of personal finance empowers individuals to take control of their financial destiny. By embracing the principles and strategies Artikeld in this guide, readers can unlock the secrets of financial freedom and secure a brighter financial future.