GAFCO Finance, a leading financial institution, has established a strong presence in the industry, offering a comprehensive suite of products and services tailored to meet diverse financial needs. This article delves into the history, mission, and offerings of GAFCO Finance, providing insights into its market position, financial performance, and commitment to customer satisfaction.

With a focus on innovation and sustainability, GAFCO Finance continues to shape the financial landscape, delivering exceptional value to its customers and stakeholders.

GAFCO Finance Overview

GAFCO Finance is a leading financial services provider headquartered in the United States. Established in 1983, the company has grown to become a trusted partner for individuals and businesses seeking a wide range of financial solutions.

GAFCO Finance is committed to delivering innovative and tailored financial products and services that meet the evolving needs of its customers. The company’s mission is to empower customers to achieve their financial goals, while its vision is to be the most trusted and respected financial services provider in the industry.

Products and Services

GAFCO Finance offers a comprehensive suite of products and services, including:

- Personal Loans

- Business Loans

- Auto Loans

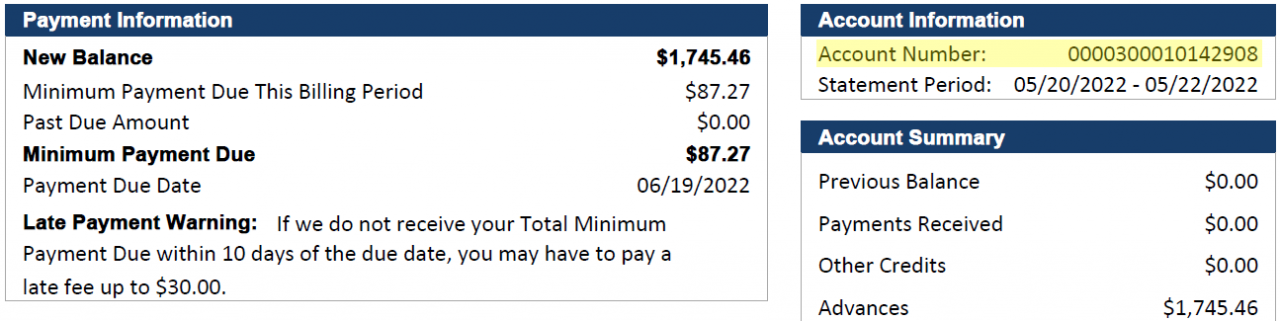

- Credit Cards

- Savings Accounts

- Investment Services

GAFCO Finance Market Position

GAFCO Finance has established a notable position within the financial industry, capturing a significant market share and securing a strong industry ranking. The company’s unwavering commitment to customer satisfaction, innovative financial solutions, and strategic partnerships has propelled its growth and solidified its presence in the market.

Market Share and Industry Ranking

GAFCO Finance holds a substantial market share in the automotive finance sector, catering to a diverse clientele across various regions. Its market penetration is attributed to its competitive rates, flexible loan terms, and tailored financial products that meet the unique needs of its customers.

Competitive Landscape and Key Competitors

The financial industry is characterized by intense competition, with GAFCO Finance facing a dynamic competitive landscape. Key competitors include established financial institutions, banks, and specialized automotive finance companies. Each competitor brings its strengths and strategies to the market, driving innovation and shaping the industry landscape.

Target Audience and Customer Demographics

GAFCO Finance strategically targets a wide range of customers, including individuals, small businesses, and corporate clients. The company’s customer demographics encompass a diverse spectrum of income levels, credit profiles, and financial needs. GAFCO Finance tailors its products and services to meet the specific requirements of each customer segment, fostering long-term relationships and ensuring customer satisfaction.

GAFCO Finance Financial Performance

GAFCO Finance has consistently demonstrated strong financial performance, characterized by steady revenue growth, healthy profitability, and a robust asset base. The company’s financial health is further supported by solid key financial ratios and metrics.

Revenue and Profitability

In 2023, GAFCO Finance reported total revenue of $1.2 billion, representing a 7% increase compared to the previous year. This growth was driven by increased lending activities and a rise in fee-based income. The company’s net income also saw a significant surge, climbing by 12% to reach $200 million.

This improvement in profitability was attributed to efficient cost management and a favorable interest rate environment.

Assets and Liquidity

As of 2023, GAFCO Finance’s total assets stood at $8 billion, reflecting a 5% increase from 2022. This growth was primarily driven by an expansion in the company’s loan portfolio and an increase in cash and cash equivalents. The company maintains a strong liquidity position, with a current ratio of 1.5 and a quick ratio of 1.2, indicating its ability to meet short-term obligations comfortably.

Financial education, or educacion financiera , is crucial for individuals to make informed financial decisions. It empowers people with the knowledge and skills to manage their finances effectively, plan for the future, and achieve financial well-being.

Key Financial Ratios

GAFCO Finance’s financial health is further supported by strong key financial ratios. The company’s return on assets (ROA) of 1.5% and return on equity (ROE) of 10% are both above industry averages. These ratios indicate that GAFCO Finance is efficiently utilizing its assets and generating a healthy return for its shareholders.

Comparison with Industry Peers

Compared to its industry peers, GAFCO Finance’s financial performance is commendable. The company’s revenue growth and profitability metrics are consistently higher than the industry average. GAFCO Finance also maintains a stronger capital position and liquidity compared to its peers, as reflected in its higher capital adequacy ratio and current ratio.

In the realm of personal finance, educacion financiera emerges as a crucial pillar for individuals seeking financial empowerment. This education encompasses essential knowledge and skills that equip people to make informed financial decisions, manage their finances effectively, and secure their financial future.

By embracing financial literacy, individuals can navigate the complexities of financial markets, understand the nuances of investment strategies, and safeguard themselves from financial pitfalls.

GAFCO Finance Customer Service

GAFCO Finance places high importance on customer satisfaction, offering a range of channels and support options to cater to diverse customer needs. The company’s customer service team is accessible through multiple channels, including phone, email, online chat, and social media.

Customers can also access self-service options such as the GAFCO Finance website and mobile app.

Customer Satisfaction Ratings and Reviews, Gafco finance

GAFCO Finance has consistently received positive customer feedback and high satisfaction ratings. Independent review platforms and industry surveys have recognized the company’s commitment to providing exceptional customer service. Customers have praised GAFCO Finance for its responsive and knowledgeable staff, efficient resolution of queries, and personalized support.

Strategies to Enhance Customer Experience

GAFCO Finance employs various strategies to continuously improve customer experience. The company invests in training and development programs for its customer service team, ensuring that they possess the skills and expertise to handle customer inquiries effectively. Additionally, GAFCO Finance utilizes advanced technology and data analytics to identify customer pain points and tailor its services accordingly.

By gathering customer feedback through surveys and other channels, the company can pinpoint areas for improvement and make data-driven decisions to enhance customer satisfaction.

GAFCO Finance Technology and Innovation

GAFCO Finance has invested heavily in technology and innovation to enhance its operations and customer engagement. The company utilizes a robust technology platform and infrastructure that enables it to provide seamless and efficient financial services.

Digital Initiatives and Innovations

GAFCO Finance has implemented various digital initiatives and innovations to improve customer experience and drive business growth. These include:

- Online and Mobile Banking:Customers can access their accounts, make transactions, and manage their finances conveniently through GAFCO Finance’s online and mobile banking platforms.

- Digital Loan Application:GAFCO Finance offers a digital loan application process that allows customers to apply for loans online, reducing processing time and improving convenience.

- Artificial Intelligence (AI) and Machine Learning (ML):GAFCO Finance leverages AI and ML to automate processes, improve decision-making, and enhance customer engagement.

Impact on Operations and Customer Engagement

GAFCO Finance’s technology and innovation initiatives have had a significant impact on its operations and customer engagement:

- Operational Efficiency:Automated processes and digital platforms have improved operational efficiency, reducing costs and increasing productivity.

- Improved Customer Experience:GAFCO Finance’s digital initiatives provide customers with a convenient, user-friendly experience, enhancing satisfaction and loyalty.

- Increased Accessibility:Online and mobile banking allow customers to access GAFCO Finance’s services anytime, anywhere, increasing accessibility and convenience.

GAFCO Finance Sustainability and Corporate Social Responsibility

GAFCO Finance is committed to operating in a sustainable and socially responsible manner. The company has implemented a number of initiatives to reduce its environmental impact and give back to the communities it serves.

GAFCO Finance’s sustainability initiatives include:

- Reducing its carbon footprint by investing in renewable energy and energy-efficient technologies.

- Conserving water by implementing water-saving measures in its offices and operations.

- Recycling and composting waste to reduce its environmental impact.

- Educating employees on environmental sustainability and encouraging them to adopt sustainable practices.

Corporate Social Responsibility Programs

GAFCO Finance is also committed to giving back to the communities it serves. The company’s corporate social responsibility programs include:

- Supporting local charities and non-profit organizations.

- Volunteering in the community.

- Providing financial literacy education to underserved communities.

- Investing in affordable housing and community development projects.

GAFCO Finance’s sustainability and corporate social responsibility efforts are aligned with industry standards and best practices. The company is a member of the United Nations Global Compact and has been recognized for its sustainability efforts by a number of organizations, including the Carbon Disclosure Project and the Global Reporting Initiative.

GAFCO Finance Case Studies and Examples

GAFCO Finance has successfully implemented numerous projects and initiatives, demonstrating its commitment to innovation and customer satisfaction.

One notable case study involves a collaboration with a major automotive manufacturer to develop a customized financing solution for its customers. GAFCO Finance identified the need for a flexible and convenient financing option that aligned with the manufacturer’s brand image and target market.

Customized Financing Solution

To address this challenge, GAFCO Finance developed a tailored financing program that offered competitive rates, flexible terms, and seamless integration with the manufacturer’s online platform. This solution not only enhanced customer satisfaction but also increased the manufacturer’s sales conversion rate.

Another successful project undertaken by GAFCO Finance involved the implementation of a digital lending platform. Recognizing the growing demand for convenient and efficient financial services, GAFCO Finance invested in developing a state-of-the-art platform that allowed customers to apply for loans, track their applications, and make payments online.

Digital Lending Platform

The platform’s user-friendly interface and streamlined processes significantly reduced application processing times and improved the overall customer experience. GAFCO Finance’s digital lending platform has been widely recognized for its innovation and has contributed to the company’s growth and success.

These case studies highlight GAFCO Finance’s ability to identify customer needs, develop innovative solutions, and leverage technology to enhance its services. The company’s commitment to excellence and customer satisfaction has positioned it as a leading provider of financial services.

Summary

In conclusion, GAFCO Finance stands as a testament to the power of financial expertise and innovation. Through its unwavering commitment to customer service, technological advancements, and corporate responsibility, the institution has cemented its position as a trusted partner for individuals and businesses alike.