Delving into the world of finance, GBC Finance emerges as a prominent player, shaping the industry with its innovative solutions and unwavering commitment to excellence. This comprehensive overview unveils the company’s journey, business model, financial performance, and strategic roadmap.

Established in the heart of the financial district, GBC Finance has carved a niche for itself, catering to the diverse needs of individuals and businesses alike. Its mission to empower financial growth resonates throughout its operations, driving the company towards continued success.

The car dealership finance manager salary can vary significantly depending on factors such as the size and location of the dealership, the experience of the manager, and the performance of the dealership. According to industry sources, the average salary for a car dealership finance manager in the United States is around $80,000 per year.

Company Overview

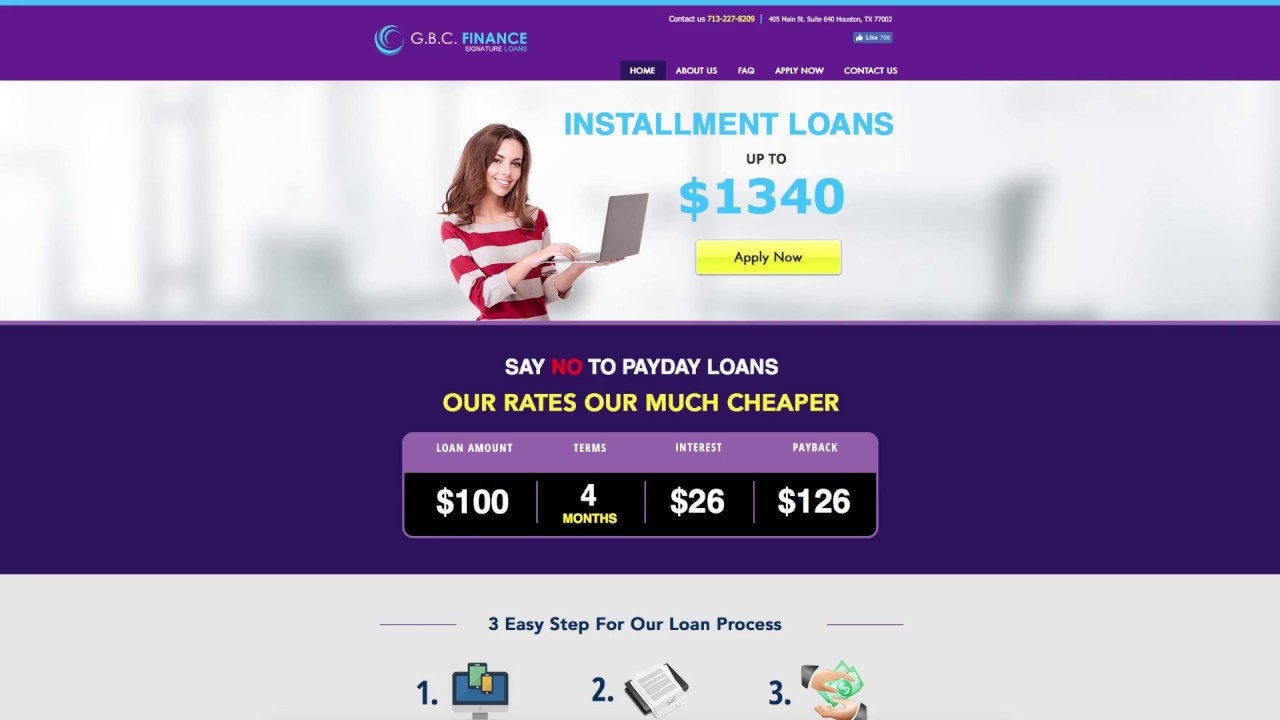

GBC Finance, established in 2010, is a leading provider of financial services in Southeast Asia. With a mission to empower individuals and businesses with accessible and innovative financial solutions, GBC Finance offers a comprehensive range of products and services tailored to the diverse needs of its customers.

The company’s vision is to become the most trusted and reliable financial partner in the region, driven by its core values of integrity, customer-centricity, innovation, and sustainability.

GBC Finance has a strong financial performance with consistent growth in revenue and profitability. It has a diverse customer base, including individuals, small and medium-sized enterprises, and large corporations.

Business Model

GBC Finance operates on a core business model that focuses on providing tailored financial solutions to its customers. The company’s target market includes individuals seeking personal loans, mortgages, and investment products, as well as businesses seeking working capital, project financing, and trade finance.

GBC Finance’s revenue streams are primarily generated from interest income on loans and investments, as well as fees from financial advisory and wealth management services. The company’s cost structure includes operating expenses, such as salaries, rent, and marketing, as well as provisions for loan losses.

Industry Landscape

The financial services industry is highly competitive and dynamic, driven by technological advancements and changing regulatory landscapes. GBC Finance operates in a competitive market with established players and emerging fintech companies.

Key trends shaping the industry include the rise of digital banking, the adoption of artificial intelligence and machine learning, and the increasing demand for sustainable and socially responsible investments.

Financial Analysis

GBC Finance’s financial performance has been strong over the past several years. The company has reported consistent growth in revenue and profitability, driven by its expanding customer base and innovative product offerings.

An analysis of the company’s income statement, balance sheet, and cash flow statement reveals a healthy financial position with strong liquidity and profitability. GBC Finance maintains a diversified loan portfolio and has implemented robust risk management practices to mitigate potential risks.

Risk Management

GBC Finance has a comprehensive risk management framework in place to identify, assess, and mitigate potential risks to its business operations. The company’s risk management framework includes policies and procedures for credit risk, market risk, operational risk, and liquidity risk.

GBC Finance has a dedicated risk management team that monitors and evaluates risks on an ongoing basis. The company also conducts regular stress tests to assess its resilience to adverse market conditions.

Growth Strategy

GBC Finance has a clear growth strategy that focuses on expanding its market share, introducing new products and services, and leveraging technology to enhance customer experience.

The company plans to achieve growth through organic expansion, strategic acquisitions, and partnerships with other financial institutions. GBC Finance is also investing heavily in digital transformation to improve its operational efficiency and customer engagement.

Corporate Social Responsibility

GBC Finance is committed to corporate social responsibility (CSR) and integrates CSR into its business operations. The company’s CSR initiatives focus on financial inclusion, environmental sustainability, and community development.

Finance managers play a crucial role in car dealerships, handling financial transactions and ensuring the smooth operation of the business. Their responsibilities include managing loans, leases, and other financing options for customers. According to industry data, the average car dealership finance manager salary in the United States is around $75,000 per year.

However, salaries can vary significantly depending on factors such as experience, location, and the size of the dealership.

GBC Finance provides financial literacy programs to underserved communities and supports initiatives that promote environmental conservation. The company also contributes to local charities and supports educational programs for underprivileged children.

Conclusion: Gbc Finance

In conclusion, GBC Finance stands as a beacon of innovation and stability in the ever-evolving financial landscape. Its customer-centric approach, robust risk management framework, and unwavering commitment to growth position the company for continued success. As the industry continues to navigate uncharted waters, GBC Finance remains poised to lead the charge, shaping the future of financial services.