In today’s rapidly evolving financial landscape, it’s imperative to equip our children with the knowledge and skills they need to navigate the complexities of money management. This comprehensive guide explores how to set your child up for financial success, fostering a lifelong foundation of financial literacy, responsible spending habits, and long-term financial well-being.

By understanding the importance of financial literacy, establishing a savings plan, budgeting and spending wisely, investing for the future, managing credit and debt, and promoting charitable giving, parents can empower their children to make informed financial decisions and achieve their financial goals.

Understanding Financial Literacy for Children

Teaching children about money and finance from a young age is crucial for their financial success. Financial literacy empowers children with confidence, promotes responsible spending habits, and sets the foundation for their future financial well-being. Introducing age-appropriate financial concepts, such as saving, budgeting, and the difference between needs and wants, can help children develop a strong understanding of money management.

Benefits of Financial Literacy for Children

* Increased confidence in handling money

- Responsible spending habits and financial planning

- Understanding the value of money and saving

- Reduced risk of financial problems in adulthood

Age-Appropriate Financial Concepts for Children

* Preschool:Introduce the concept of money, counting coins, and saving.

Elementary School

Teach about budgeting, needs vs. wants, and basic banking.

Middle School

Explore different types of savings accounts, investing, and credit.

High School

Prepare for financial independence, including credit management, investing, and retirement planning.

Establishing a Savings Plan

Saving money is essential for children, both for short-term goals like buying a new toy or long-term goals like college education. Different types of savings accounts offer varying features and benefits.

Types of Savings Accounts

* Passbook Savings Account:Basic account with low interest rates and easy access to funds.

Money Market Account

Offers higher interest rates but may have minimum balance requirements.

Certificate of Deposit (CD)

Long-term account with fixed interest rates and limited access to funds.

Tips for Setting Savings Goals

* Involve children in setting realistic goals.

- Break down large goals into smaller, achievable steps.

- Use a savings tracker to monitor progress and stay motivated.

Budgeting and Spending Wisely

Budgeting is a crucial skill that helps children manage their money effectively. Various budgeting methods and tools can simplify this process.

Budgeting Methods, How to set your child up for financial success

* Envelope System:Allocating cash into envelopes for different categories.

Mobile Budgeting Apps

Tracking expenses and income digitally.

Differentiating Needs and Wants

* Explain the difference between essential needs (e.g., food, shelter) and non-essential wants (e.g., toys, entertainment).

Encourage children to prioritize needs and make informed spending decisions.

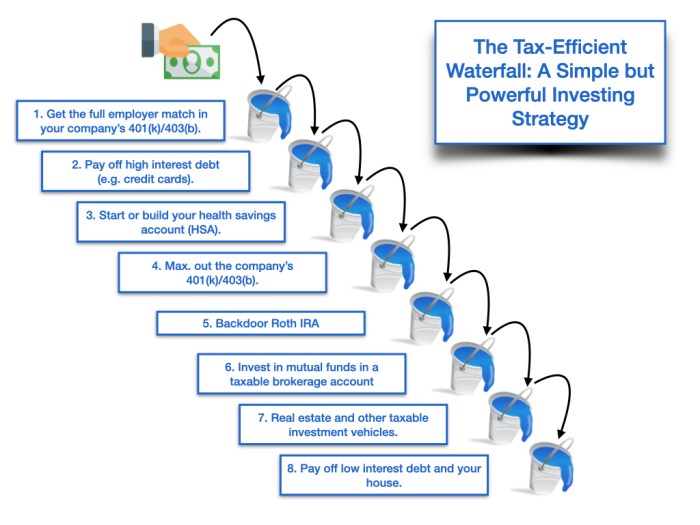

Investing for the Future

Investing can help children grow their wealth over time. Different types of investments offer varying levels of risk and return.

Types of Investments Suitable for Children

* Stocks:Ownership shares in companies with potential for growth but also risk.

Parents can teach their children about financial responsibility at a young age, encouraging them to save money and make smart spending decisions. As they grow older, children can benefit from joining organizations like the National Society of Leadership and Success , which provides opportunities for leadership development, networking, and scholarships.

By equipping children with financial literacy and access to resources that foster their growth, parents can set them up for a successful future.

Bonds

Loans to governments or corporations with fixed interest payments.

Mutual Funds

Diversified portfolios of stocks and bonds, offering lower risk than individual stocks.

Tips for Age-Appropriate Investing

* Start with small investments and gradually increase as children learn and understand.

- Consider age-based investment strategies, such as 529 plans for college savings.

- Teach children about investment risks and the importance of diversification.

Credit and Debt Management

Credit can be a useful tool, but it’s essential to use it responsibly. Different types of credit offer varying terms and conditions.

Types of Credit Available

* Credit Cards:Convenient way to make purchases, but can lead to debt if not used wisely.

Personal Loans

Borrowed funds for specific purposes, typically with fixed interest rates.

Avoiding Excessive Debt

* Encourage children to only borrow what they can afford to repay.

- Explain the consequences of late payments and high-interest rates.

- Help children build a positive credit history by making payments on time.

Charitable Giving and Financial Responsibility

Teaching children about charitable giving fosters empathy and a sense of community. Different ways to engage in philanthropy can help children develop a sense of financial responsibility.

Ways to Engage in Philanthropy

* Volunteering time to support local charities.

- Donating money to organizations they care about.

- Supporting fundraising events or initiatives.

Benefits of Charitable Giving

* Promotes empathy and compassion.Instills a sense of community and responsibility.- Provides opportunities for children to learn about financial planning and giving back.

Last Point: How To Set Your Child Up For Financial Success

Setting your child up for financial success is a journey that requires patience, guidance, and open communication. By instilling these principles from a young age, parents can nurture their children’s financial capabilities, enabling them to make responsible choices, build wealth, and secure a prosperous future.