Hush money, a term shrouded in secrecy and illicit intent, has left an enduring mark on societies throughout history. This enigmatic practice, where payments are made to suppress or conceal information, has permeated various realms, from the corridors of power to the shadows of the underworld.

Hush money operates in a murky realm where legal consequences intertwine with ethical dilemmas. Its use has shaped historical events, casting a shadow over individuals and institutions alike. In modern society, it continues to lurk in various guises, posing challenges to the principles of transparency and accountability.

Definition of Hush Money

Hush money, also known as hush payments or hush funds, refers to any payment made with the intent to suppress or conceal information that could potentially damage the reputation or interests of an individual or organization.

The primary purpose of hush money is to prevent the disclosure of sensitive or embarrassing information that could lead to negative consequences, such as legal liability, financial loss, or reputational damage.

Legal Implications: Hush Money

Hush money transactions are illegal and carry serious legal consequences for both the payer and the recipient. Engaging in such activities can result in criminal charges, civil penalties, and reputational damage.

Individuals or organizations found guilty of paying or receiving hush money may face:

Criminal Charges

- Extortion: Demanding or receiving money or other valuable consideration to suppress information or influence testimony.

- Bribery: Offering, giving, receiving, or soliciting any item of value to influence the actions of a public official.

- Money Laundering: Concealing or disguising the source, ownership, or control of illegally obtained funds.

Civil Penalties

- Civil lawsuits: Victims of hush money schemes can file lawsuits to recover damages and seek injunctive relief.

- RICO (Racketeer Influenced and Corrupt Organizations Act): Hush money payments can be considered a predicate offense under RICO, leading to enhanced penalties.

Historical Examples

Hush money has a long and sordid history, with numerous cases of its use throughout the centuries.One notable example occurred in the early 20th century, when oil magnate Henry F. Sinclair paid hush money to various government officials to cover up his involvement in the Teapot Dome scandal.

This scandal involved the illegal leasing of government oil reserves to private companies, and Sinclair’s payments were intended to prevent the scandal from becoming public.Another infamous case of hush money occurred in the 1960s, when President Lyndon B. Johnson allegedly paid hush money to mistress Madeleine Brown to keep her from revealing their affair.

Brown had threatened to go public with the affair, and Johnson’s payments were intended to silence her.These are just a few examples of the many historical cases where hush money has been used. This practice has been used by individuals and organizations throughout history to cover up scandals, prevent embarrassing revelations, and protect reputations.

Hush Money in Political Scandals

Hush money has often been used in political scandals to silence witnesses and prevent damaging information from being released.In the Watergate scandal of the 1970s, President Richard Nixon’s administration paid hush money to various individuals involved in the break-in of the Democratic National Committee headquarters.

These payments were intended to keep the individuals from testifying against Nixon and his administration.In the Iran-Contra affair of the 1980s, the Reagan administration paid hush money to Iranian officials to secure the release of American hostages held in Lebanon.

These payments were intended to keep the affair from becoming public and damaging Reagan’s presidency.These are just a few examples of the many political scandals in which hush money has been used. This practice has been used by politicians and their associates to cover up wrongdoings and protect their reputations.

Modern Applications

Hush money continues to play a significant role in contemporary society, spanning various industries and professions. Its prevalence stems from the desire to suppress embarrassing or damaging information that could harm reputations or financial interests.

One prevalent application is in the entertainment industry, where hush money is often used to silence victims of sexual harassment or assault. In the corporate world, it may be employed to conceal financial irregularities or unethical practices. The legal profession also witnesses its use in exchange for dropping charges or influencing the outcome of cases.

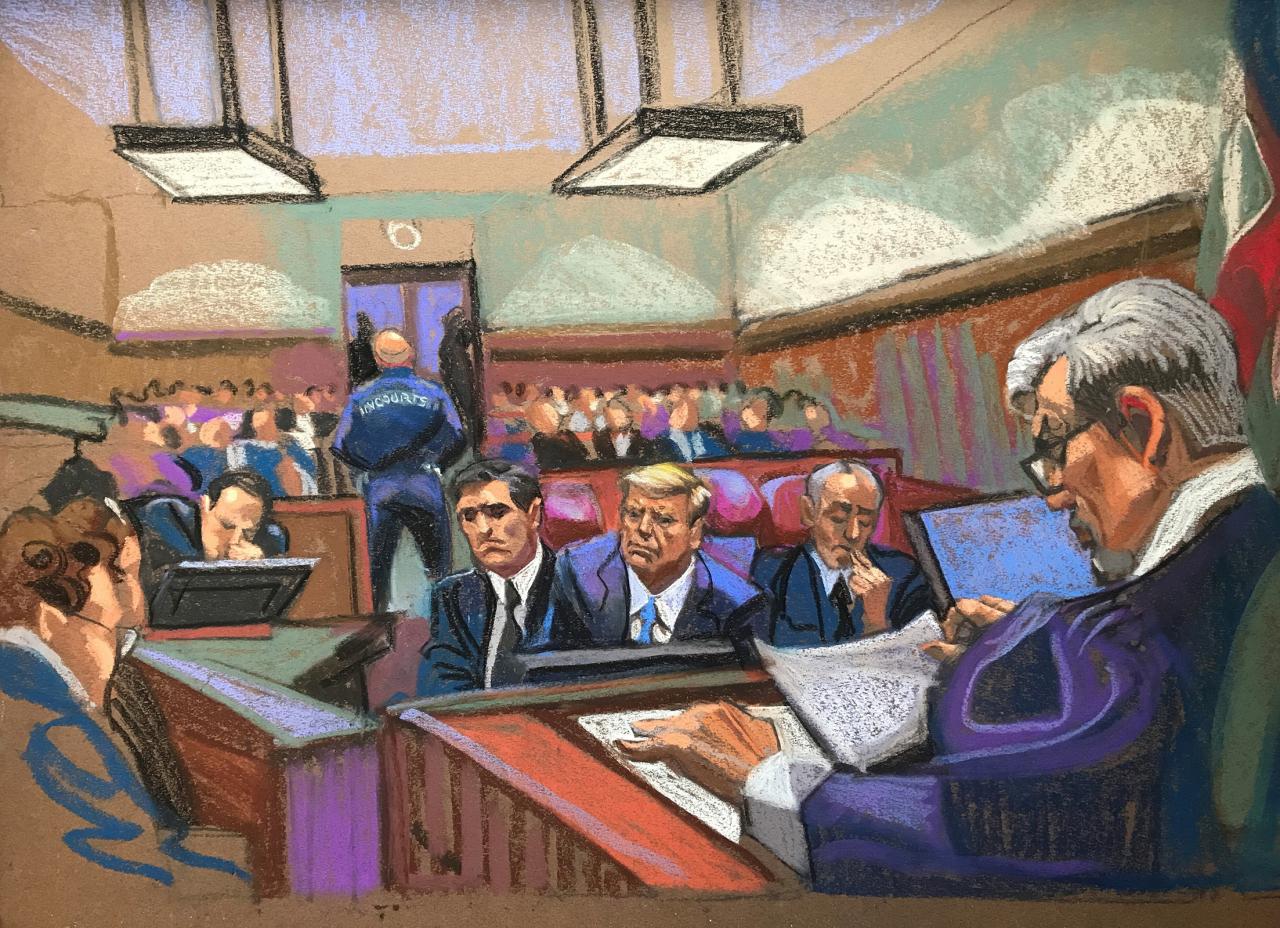

Political Hush Money

Hush money is also prevalent in the political arena, where it is used to suppress information that could damage candidates or elected officials. This may include allegations of corruption, extramarital affairs, or criminal activities. By paying hush money, politicians attempt to prevent such information from becoming public knowledge, safeguarding their careers and reputations.

Ethical Considerations

The use of hush money raises significant ethical concerns, presenting moral dilemmas that challenge societal values and legal frameworks.

One primary ethical consideration is the suppression of truth. Hush money transactions often involve the exchange of money or other inducements to silence individuals who possess potentially damaging information. This can lead to the concealment of wrongdoing, allowing perpetrators to evade accountability and victims to be denied justice.

Moral Dilemmas

- Protecting the innocent vs. shielding the guilty:Hush money can be used to protect innocent individuals from false accusations or harmful publicity. However, it can also be used to shield guilty parties from deserved consequences, undermining the principles of justice and accountability.

- Balancing personal gain vs. public interest:Individuals receiving hush money may face the moral dilemma of choosing between personal financial gain and the potential harm to the public or their conscience. Accepting hush money can be seen as condoning wrongdoing and prioritizing personal interests over societal well-being.

Social Impact

Hush money can have a corrosive impact on society by undermining public trust and accountability. When powerful individuals or organizations are able to silence critics or suppress damaging information, it erodes the public’s faith in the fairness and transparency of the system.

Erosion of Public Trust

Hush money can create a perception that the truth is being hidden or manipulated, which can damage the public’s trust in institutions and leaders. This erosion of trust can lead to cynicism, apathy, and a loss of faith in the ability of society to hold those in power accountable.

Undermining Accountability

Hush money can also undermine accountability by allowing individuals or organizations to avoid consequences for their actions. When wrongdoing is covered up, it sends a message that certain people are above the law or that accountability is only for the weak and powerless.

This can create a culture of impunity and encourage further corruption and abuse of power.

Weakening of Democratic Institutions

In a democratic society, public trust and accountability are essential for the proper functioning of institutions. Hush money can weaken these institutions by undermining the public’s faith in their ability to protect the public interest and ensure justice.

Detection and Prevention

Hush money payments can be difficult to detect due to their covert nature. However, there are several methods that can be employed to identify and prevent these illicit transactions.One important step is to establish clear policies and procedures within organizations to prohibit the payment or receipt of hush money.

These policies should Artikel the consequences of violating these rules and should be communicated to all employees.Another effective measure is to conduct regular audits and financial reviews to identify any suspicious transactions. These reviews should be conducted by independent auditors to ensure objectivity and accuracy.Law

enforcement agencies play a crucial role in detecting and preventing hush money payments. They have the authority to investigate allegations of corruption and can use various tools, such as wiretaps and subpoenas, to gather evidence.Financial institutions also have a responsibility to help prevent hush money payments.

They can implement anti-money laundering (AML) programs to monitor transactions and report suspicious activities to law enforcement.

Role of Whistleblowers

Whistleblowers can play a vital role in exposing hush money payments. They may have firsthand knowledge of illegal activities and can provide valuable information to law enforcement or regulatory agencies.

Alternative Solutions

Hush money is often used as a quick and easy way to resolve disputes or conceal information. However, there are several alternative methods that can be used without resorting to illegal or unethical practices.

One alternative is to use mediation or arbitration to resolve disputes. Mediation involves a neutral third party who helps the disputing parties to reach an agreement. Arbitration is similar to mediation, but the arbitrator has the authority to make a binding decision.

Non-Disclosure Agreements

Non-disclosure agreements (NDAs) are another alternative to hush money. NDAs are contracts that prohibit the disclosure of confidential information. They can be used to protect sensitive information from being released to the public or to competitors.

Internal Investigations

Internal investigations can be used to uncover wrongdoing within a company or organization. These investigations can be conducted by internal auditors, lawyers, or other independent investigators. The results of an internal investigation can be used to take disciplinary action against employees or to implement new policies and procedures to prevent future wrongdoing.

Whistleblowing

Whistleblowing is the act of reporting wrongdoing to a supervisor, government agency, or the public. Whistleblowers can play an important role in exposing corruption and other illegal activities. However, they can also face retaliation from their employers or others who are involved in the wrongdoing.

Legal Action

In some cases, it may be necessary to take legal action to resolve a dispute or to expose wrongdoing. Legal action can be expensive and time-consuming, but it can be an effective way to get justice.

These are just a few of the alternative solutions that can be used to resolve disputes or conceal information without resorting to hush money. By using these alternatives, individuals and organizations can avoid the legal and ethical risks associated with hush money.

Closing Summary

The enduring presence of hush money underscores the complexities of human nature and the lengths to which individuals and organizations will go to safeguard their secrets. It is a corrosive force that erodes public trust and undermines the integrity of institutions.

As we navigate an increasingly interconnected and transparent world, the need for ethical and transparent practices becomes paramount.

By shedding light on the nature, implications, and consequences of hush money, we can foster a greater awareness of its insidious effects and empower ourselves to resist its allure. Only through collective action and unwavering commitment to truth and transparency can we create a society where justice prevails and the shadows of secrecy are dispelled.