Imperial Premium Finance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Prepare to delve into the intricacies of premium financing, exploring the services, advantages, and considerations associated with Imperial Premium Finance, a leading provider in the industry.

In the realm of financial markets, PayPal Holdings, Inc. (PYPL) has emerged as a dominant force, capturing the attention of investors and analysts alike. Yahoo Finance serves as a trusted source of real-time stock market data, providing investors with comprehensive insights into PYPL’s performance and market trends.

Throughout this comprehensive guide, we will navigate the types of premium financing offered, delve into the application process and requirements, and shed light on the repayment options and fees involved. Additionally, we will explore customer service and support channels, conduct comparisons with competitors, and provide insights into market trends and the future outlook of Imperial Premium Finance.

The financial performance of PayPal Holdings, Inc. (NASDAQ: PYPL ) has been under scrutiny by investors and analysts. The company’s latest earnings report revealed mixed results, with revenue growth exceeding expectations but earnings per share falling short.

Overview of Imperial Premium Finance

Imperial Premium Finance is a leading provider of premium financing solutions for businesses and individuals. Premium financing allows policyholders to pay their insurance premiums in installments, spreading the cost over time and improving cash flow. Imperial Premium Finance plays a crucial role in the insurance industry by enabling businesses to secure essential insurance coverage without straining their financial resources.

Benefits of using premium financing from Imperial Premium Finance include:

- Improved cash flow by spreading premium payments over time

- Access to necessary insurance coverage without upfront payment

- Competitive rates and flexible payment options

Types of Premium Financing Offered

Imperial Premium Finance offers various types of premium financing to cater to different business and individual needs:

- Monthly Installment Financing:Regular monthly payments over the policy term

- Quarterly Installment Financing:Payments made quarterly throughout the policy term

- Semi-Annual Installment Financing:Payments made twice a year

- Annual Installment Financing:One-time payment annually

- Term Loans:Loans with fixed terms and monthly payments

Application Process and Requirements: Imperial Premium Finance

To apply for premium financing with Imperial Premium Finance, businesses and individuals must meet certain eligibility criteria and provide required documentation:

- Eligibility:Good credit history and sufficient cash flow

- Documentation:Business license or tax ID, financial statements, and insurance policy details

The approval process typically involves a credit check and review of submitted documentation. Approval timelines vary depending on the complexity of the application.

Repayment Options and Fees

Imperial Premium Finance offers flexible repayment options to suit different financial situations:

- Automatic Payments:Payments deducted directly from a bank account

- Manual Payments:Payments made online or via mail

Fees associated with premium financing include:

- Origination Fee:One-time fee charged at the start of the financing term

- Interest:Charged on the outstanding balance

- Late Payment Fees:Penalties for missed or late payments

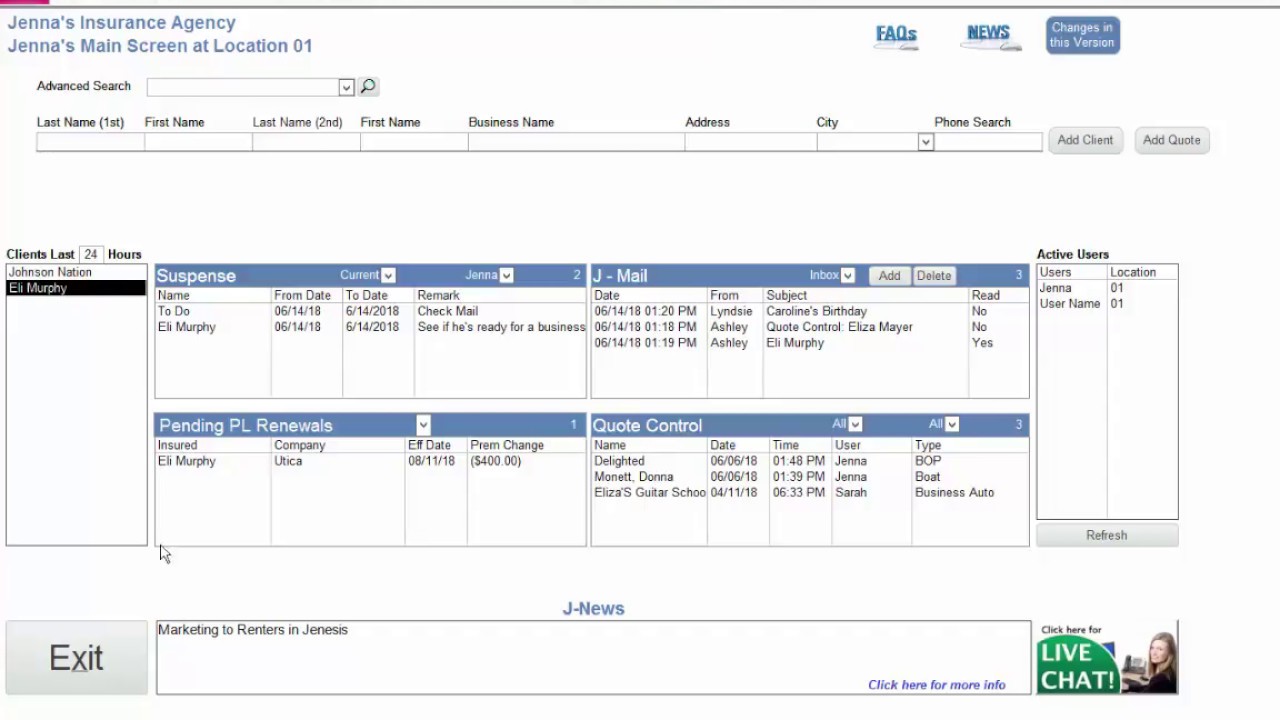

Customer Service and Support

Imperial Premium Finance provides comprehensive customer service and support channels:

- Phone Support:Dedicated phone lines for inquiries and assistance

- Online Account Management:Access to account information and payment options

- Email Support:Email address for general inquiries and support

Imperial Premium Finance also has a team of experienced professionals available to resolve disputes or inquiries promptly and efficiently.

Comparisons with Competitors

Imperial Premium Finance stands out in the premium financing industry due to its:

- Competitive Rates:Industry-leading rates and flexible payment options

- Wide Range of Financing Products:Diverse financing solutions to meet different business and individual needs

- Excellent Customer Service:Dedicated support team and convenient communication channels

Market Trends and Future Outlook

The premium financing market is expected to experience steady growth in the coming years due to:

- Rising Insurance Premiums:Increasing insurance costs drive demand for financing solutions

- Economic Volatility:Businesses and individuals seek flexible payment options to manage cash flow

- Technological Advancements:Digital platforms and online applications simplify the financing process

Imperial Premium Finance is well-positioned to capitalize on these trends and maintain its position as a leading provider in the premium financing industry.

Last Point

In conclusion, Imperial Premium Finance stands as a trusted and reliable partner for individuals and businesses seeking premium financing solutions. With a commitment to customer satisfaction, competitive rates, and a wide range of financing options, Imperial Premium Finance empowers policyholders to manage their insurance premiums effectively.

As the industry continues to evolve, Imperial Premium Finance remains at the forefront, embracing innovation and adapting to meet the ever-changing needs of its clients.