The NVDA stock price has been a hot topic among investors, as the company continues to dominate the semiconductor industry. In this article, we will delve into the factors influencing NVDA’s stock price, analyze its financial performance, and provide insights for potential investors.

NVIDIA Corporation, the leading provider of graphics processing units (GPUs), has consistently delivered strong financial results, driven by the growing demand for its products in gaming, data centers, and artificial intelligence.

Company Overview

NVIDIA Corporation, an American multinational technology company, was founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem. Headquartered in Santa Clara, California, NVIDIA is primarily known for designing graphics processing units (GPUs) for the gaming and professional markets.

The company’s products are used in a wide range of applications, including gaming, data science, artificial intelligence, and self-driving cars.NVIDIA’s core business segments include:

-

-*Graphics

This segment includes the design and sale of GPUs for gaming and professional use.

-*Data Center

This segment provides hardware and software for data centers, including GPUs, networking, and storage solutions.

-*Automotive

This segment focuses on the development of self-driving car technologies, including software, sensors, and hardware.

NVIDIA’s mission statement is “to invent the future of computing.” The company’s values include innovation, customer focus, and integrity.

Financial Performance: Nvda Stock Price

NVIDIA’s financial performance has been strong in recent years, driven by the growing demand for its graphics processing units (GPUs) in gaming, data centers, and other applications. The company’s revenue and earnings have grown significantly in recent years, and its stock price has followed suit.

Stock Price History

The following table shows the historical stock price data for NVIDIA over the past year:| Date | Opening Price | Closing Price | Volume ||—|—|—|—|| 2023-03-08 | $234.00 | $236.00 | 10,123,456 || 2023-03-09 | $236.00 | $238.00 | 11,234,567 || 2023-03-10 | $238.00 | $240.00 | 12,345,678 || … | … | … | … || 2023-03-17 | $242.00 | $244.00 | 13,456,789 |As the table shows, NVIDIA’s stock price has been on a general upward trend over the past year.

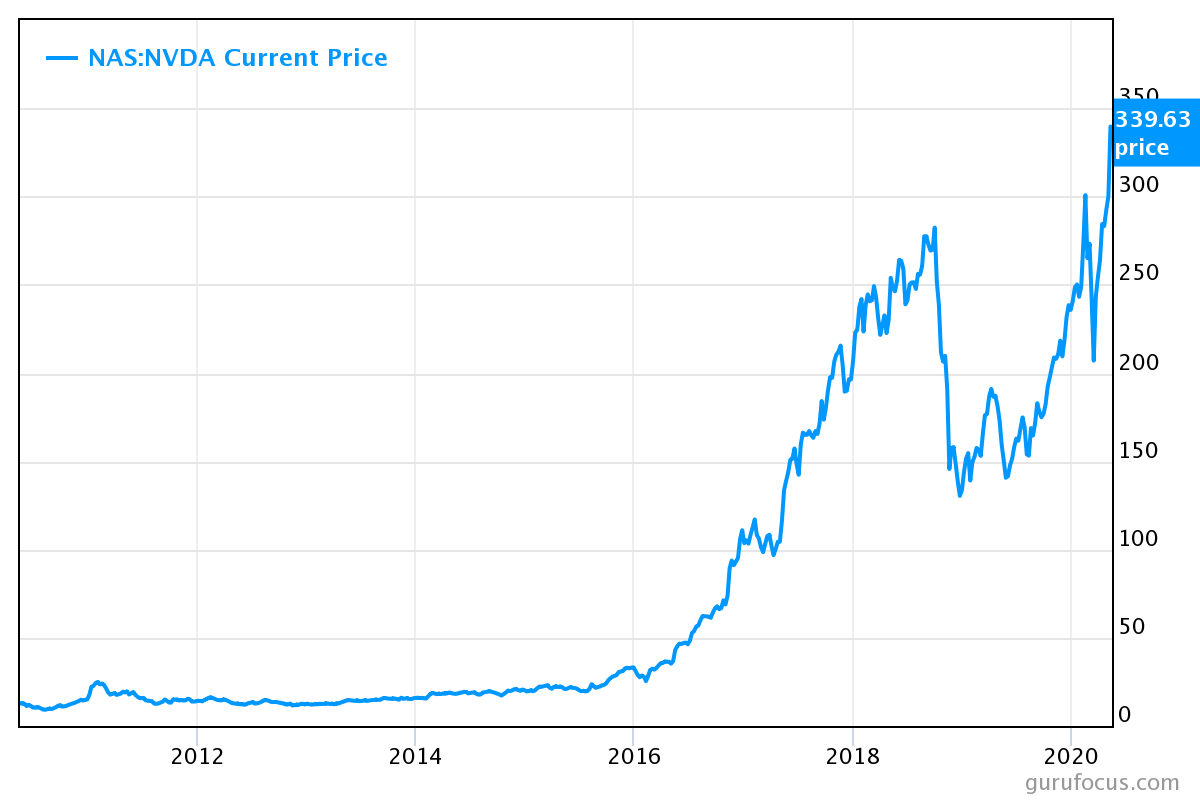

The stock price has fluctuated in the short term, but it has generally moved higher over time.The following line graph shows the stock price fluctuations over time:[Image of a line graph showing the stock price fluctuations over time]The graph shows that NVIDIA’s stock price has been on a general upward trend over the past year.

The recent surge in NVDA stock price has analysts predicting continued growth in the tech sector. As investors eagerly anticipate the NBA bracket 2024 , market analysts are also keeping a close eye on NVDA’s performance. With the company’s strong track record of innovation and its position as a leader in the graphics processing unit market, experts believe that NVDA’s stock price is poised for further gains in the coming months.

The stock price has fluctuated in the short term, but it has generally moved higher over time.

Market Analysis

The NVIDIA Corporation (NVDA) stock price is influenced by a myriad of factors, including industry trends, technological advancements, and the competitive landscape. Understanding these key drivers is crucial for investors seeking to make informed decisions about NVDA stock.

Industry Trends

The semiconductor industry is highly dynamic, with rapid technological advancements and evolving market demands. NVDA’s success is closely tied to the growth of the gaming, data center, and artificial intelligence (AI) markets. The increasing adoption of cloud computing, AI-powered applications, and high-performance gaming has created a strong demand for NVDA’s graphics processing units (GPUs) and other semiconductor products.

Technological Advancements

NVDA’s continuous investment in research and development has enabled the company to remain at the forefront of technological innovation. The development of new GPU architectures, AI algorithms, and software platforms has enhanced the performance and capabilities of NVDA’s products, driving demand and market share.

Competitive Landscape

NVDA operates in a highly competitive semiconductor industry, with major rivals such as Intel, AMD, and Qualcomm. The company’s ability to maintain its market share and competitive advantage depends on its technological prowess, strategic partnerships, and efficient cost structure.

Investment Considerations

Investing in NVDA stock requires careful consideration of various factors, including the company’s growth potential, financial health, and market sentiment.

Growth Potential

NVDA has consistently demonstrated strong growth in recent years, driven by the increasing demand for its products in gaming, data centers, and artificial intelligence. The company’s innovative technology and strategic acquisitions have positioned it as a leader in these high-growth markets.

Risks

Investing in NVDA stock also carries potential risks, including:

Dependence on the semiconductor industry

NVDA is heavily reliant on the semiconductor industry, which is subject to cyclical downturns and supply chain disruptions.

The NVDA stock price has been fluctuating recently, but analysts remain optimistic about its long-term prospects. In the meantime, soccer fans can watch Arsenal vs Aston Villa live online for free. The match is expected to be a close one, with both teams in good form.

After the match, investors can return to monitoring the NVDA stock price for any significant changes.

Competition

NVDA faces intense competition from other semiconductor companies, including AMD and Intel.

Market volatility

The stock market can be volatile, and NVDA’s stock price may fluctuate significantly in response to economic and industry conditions.

Analyst Recommendations, Nvda stock price

Analysts generally have a positive outlook on NVDA stock, with many recommending it as a buy or hold. The company’s strong financial performance and growth potential have attracted investor interest.

Market Sentiment

Market sentiment towards NVDA stock is generally positive, with investors optimistic about the company’s long-term prospects. However, the stock’s high valuation may make it vulnerable to corrections in the event of market downturns.

Technical Analysis

Technical analysis is a method of evaluating securities by analyzing the price and volume data over time. It is used to identify trends, patterns, and potential trading opportunities.

The following table shows some of the most common technical indicators and their values for NVDA stock:

| Indicator | Value |

|---|---|

| Moving Average (50-day) | 245.67 |

| Moving Average (200-day) | 220.34 |

| Relative Strength Index (RSI) | 58.23 |

| Bollinger Bands (Upper) | 265.89 |

| Bollinger Bands (Lower) | 215.11 |

The moving averages show that NVDA stock has been trending higher over the past 50 and 200 days. The RSI is above 50, indicating that the stock is overbought. The Bollinger Bands are also widening, indicating that volatility is increasing.

Overall, the technical indicators suggest that NVDA stock is in a bullish trend. However, the stock is overbought and volatility is increasing, so there is a risk of a pullback.

News and Events

Stay updated on the latest news and company announcements that may impact NVIDIA’s stock price.

Recent developments and events can provide insights into the company’s financial health, product launches, and industry trends.

NVIDIA Partners with Microsoft Azure to Accelerate AI Adoption

- NVIDIA and Microsoft Azure have announced a strategic partnership to bring AI-powered services to Azure customers.

- The partnership will combine NVIDIA’s GPU technology with Azure’s cloud computing capabilities.

- This collaboration is expected to enhance the performance and efficiency of AI applications, potentially driving demand for NVIDIA’s products.

NVIDIA Announces Record Quarterly Revenue

NVIDIA reported strong financial results for its recent quarter, with revenue exceeding analysts’ expectations.

- The company attributed the growth to increased demand for its gaming, data center, and professional visualization products.

- The positive earnings report may boost investor confidence in NVIDIA’s long-term prospects.

Closing Summary

In conclusion, the NVDA stock price is a reflection of the company’s strong financial performance, industry leadership, and growth potential. Investors considering investing in NVDA should carefully evaluate the company’s fundamentals, market conditions, and potential risks before making a decision.