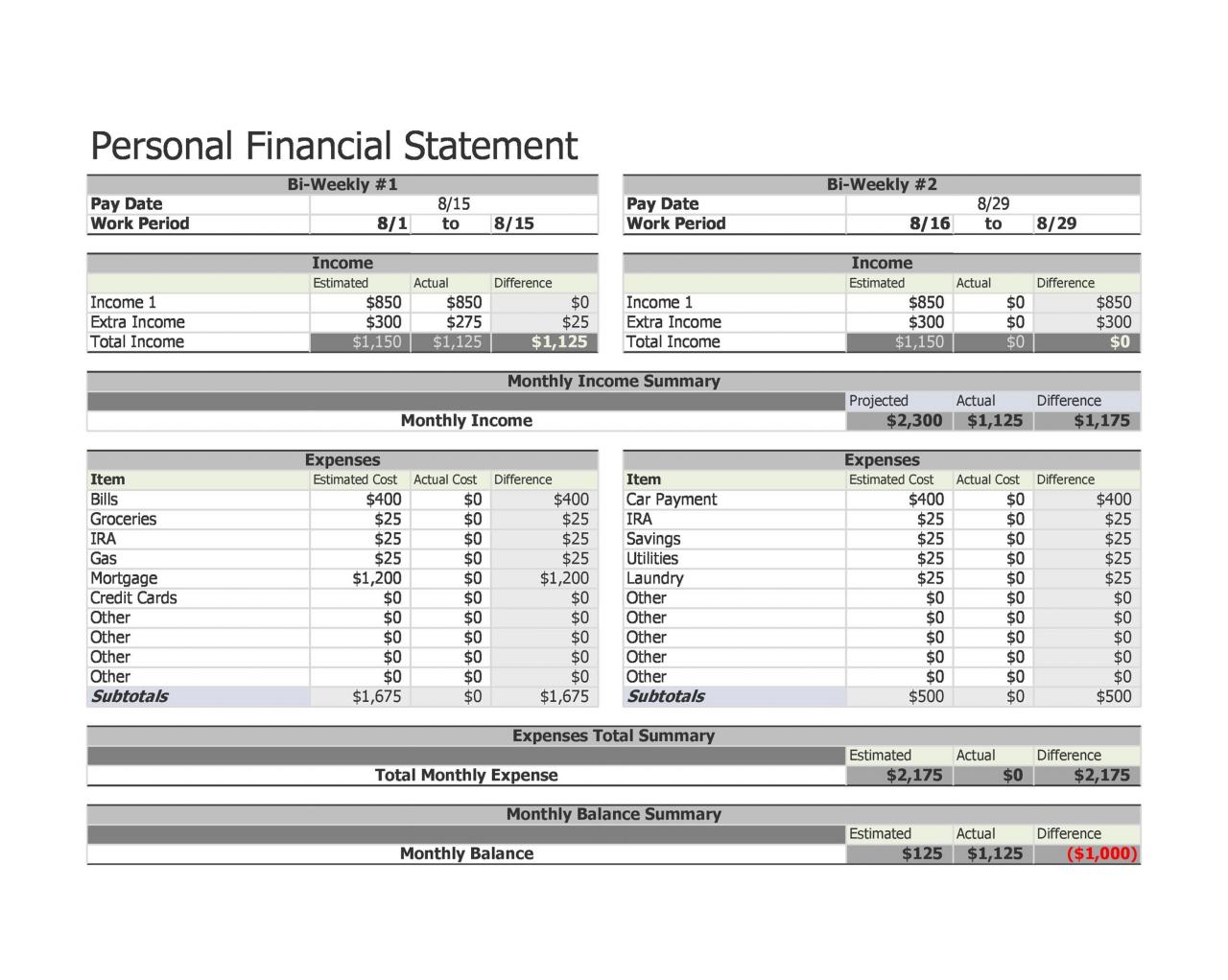

Unlocking financial well-being begins with the personal finance statement template, a powerful tool that empowers individuals to gain control of their finances, set achievable goals, and navigate the complexities of money management.

By providing a structured framework to track income, expenses, assets, and liabilities, this template transforms financial data into actionable insights, enabling users to make informed decisions and achieve their financial aspirations.

Seeking financial assistance to cover insurance premiums? Confie Premium Finance offers tailored solutions to meet your needs. Their comprehensive services and flexible payment plans provide a convenient and accessible way to manage your insurance expenses.

Introduction to Personal Finance Statement Templates

Personal finance statement templates are valuable tools that can help individuals gain a comprehensive overview of their financial situation. These templates provide a structured framework for organizing and analyzing financial data, making it easier to track income, expenses, assets, and liabilities.

Financial planning has become increasingly important in recent times, with individuals seeking innovative solutions to manage their financial obligations. One such solution is confie premium finance , a service that allows policyholders to finance their insurance premiums over time.

Using a personal finance statement template offers several benefits, including improved financial awareness, better budgeting and planning, and increased motivation to achieve financial goals. By providing a clear and organized view of one’s financial situation, templates empower individuals to make informed decisions and take control of their finances.

Components of a Comprehensive Personal Finance Statement Template

A comprehensive personal finance statement template typically includes the following sections:

- Income: This section lists all sources of income, such as wages, salaries, dividends, and interest.

- Expenses: This section categorizes and lists all expenses, such as housing, transportation, food, and entertainment.

- Assets: This section lists all assets owned, such as cash, investments, and property.

- Liabilities: This section lists all debts owed, such as mortgages, loans, and credit card balances.

- Net Worth: This section calculates the difference between assets and liabilities, providing a snapshot of one’s overall financial health.

Different Types of Personal Finance Statement Templates

Various types of personal finance statement templates are available, each tailored to specific needs and goals. These include:

- Basic templates: These templates provide a simple and straightforward framework for tracking income and expenses.

- Advanced templates: These templates offer more detailed sections and calculations, allowing for in-depth financial analysis.

- Templates for specific financial goals: These templates are designed to help individuals achieve specific financial goals, such as budgeting, debt repayment, or retirement planning.

How to Use a Personal Finance Statement Template

Effectively using a personal finance statement template involves the following steps:

- Choose the right template: Select a template that aligns with your financial complexity and goals.

- Gather your financial data: Collect all necessary financial documents, such as bank statements, investment statements, and loan agreements.

- Input your data accurately: Carefully enter all financial data into the template, ensuring accuracy and consistency.

- Analyze your results: Review the completed template to identify areas of strength and weakness in your financial situation.

- Make adjustments: Based on your analysis, make adjustments to your budget or financial plan as needed.

Benefits of Using a Personal Finance Statement Template

Utilizing a personal finance statement template offers numerous advantages:

- Improved financial awareness: Templates provide a clear and organized view of one’s financial situation, fostering greater financial awareness.

- Better budgeting and planning: By tracking income and expenses, templates help individuals create realistic budgets and make informed financial decisions.

- Increased motivation to achieve financial goals: Templates serve as a visual reminder of financial goals and progress, boosting motivation to achieve them.

Conclusion

Embracing a personal finance statement template is not merely a financial exercise but a transformative journey towards financial freedom. Its comprehensive approach empowers individuals to take charge of their financial destiny, paving the way for a secure and prosperous future.