Premium financing life insurance emerges as a compelling financial strategy, offering a unique approach to managing life insurance premiums. This article delves into the intricacies of premium financing, exploring its mechanisms, advantages, and potential drawbacks.

Premium financing life insurance empowers individuals and businesses to acquire life insurance coverage without the immediate outlay of substantial premiums. Instead, a loan is secured to cover the premium payments, which are then repaid over time.

The world of finance has witnessed the emergence of innovative funding solutions, such as home run financing . This financing model has gained traction among startups and entrepreneurs seeking alternative capital options. Home run financing provides a unique approach to funding, offering flexibility and potential upside for investors and entrepreneurs alike.

Introduction to Premium Financing Life Insurance

Premium financing is a financial arrangement that allows individuals or businesses to pay for life insurance premiums in installments rather than in a single lump sum. This can be a useful option for those who need life insurance but do not have the financial resources to pay for it upfront.

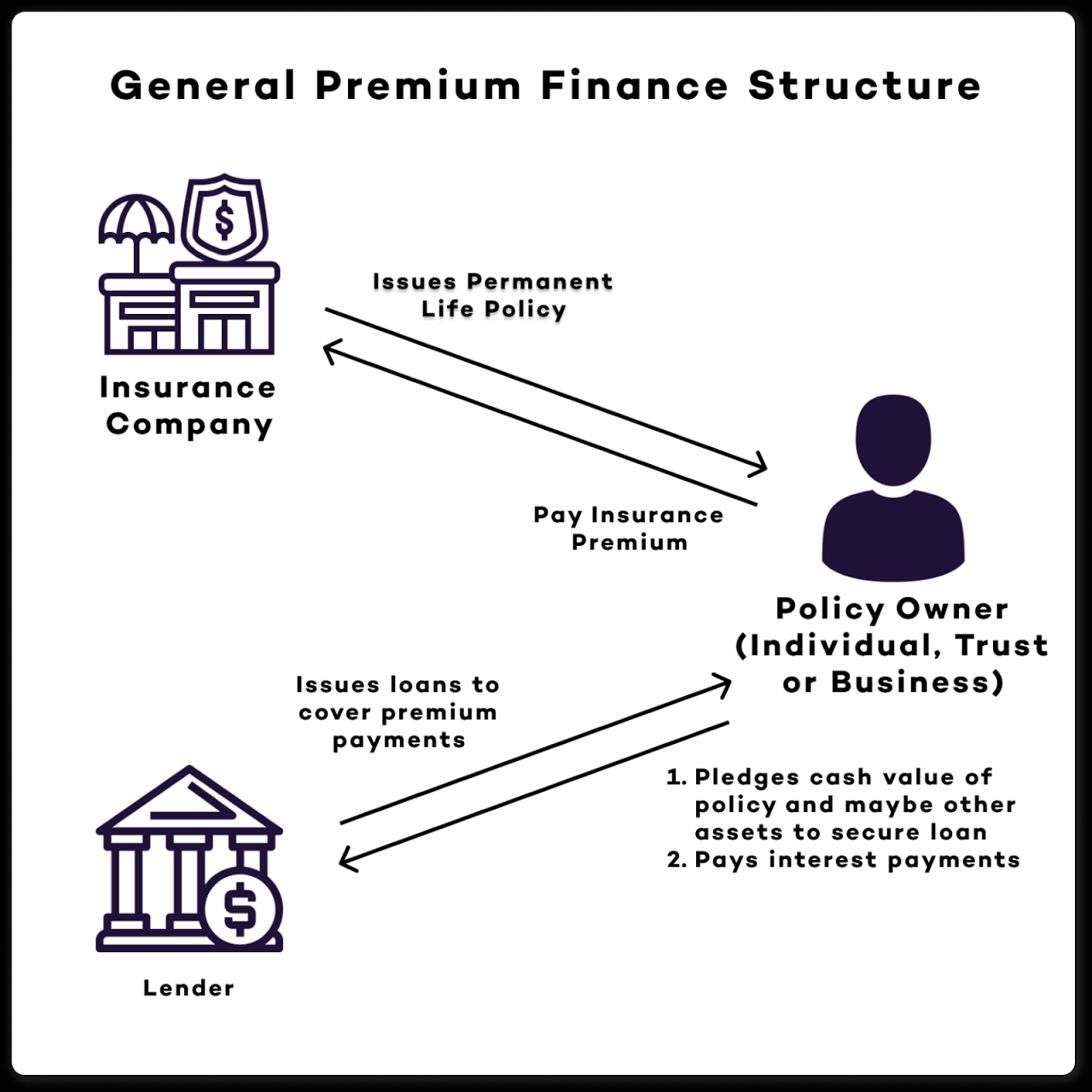

How Premium Financing Life Insurance Works

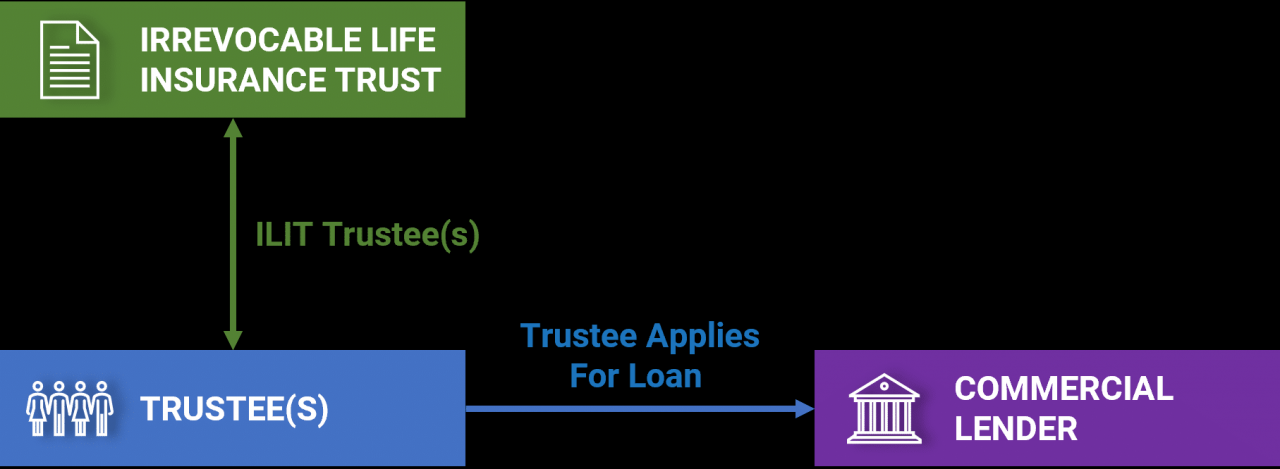

To obtain premium financing, the borrower takes out a loan from a lender, typically a bank or insurance company. The loan is secured by the life insurance policy itself, and the borrower makes monthly payments to the lender. The lender then pays the life insurance premiums on the borrower’s behalf.

For entrepreneurs seeking funding, home run financing offers a unique approach. Unlike traditional loans, home run financing is a performance-based funding model where investors receive a share of revenue generated by the funded business. This innovative funding option provides businesses with access to capital without incurring debt or diluting ownership.

Benefits of Premium Financing Life Insurance

There are several benefits to premium financing life insurance:

- It allows individuals and businesses to obtain life insurance coverage without having to pay a large upfront premium.

- It can help to improve cash flow by spreading the cost of life insurance premiums over time.

- It can provide tax benefits, as the interest paid on the loan may be tax-deductible.

Drawbacks of Premium Financing Life Insurance

There are also some drawbacks to premium financing life insurance:

- It can be more expensive than paying for life insurance premiums upfront, as the borrower will have to pay interest on the loan.

- If the borrower defaults on the loan, the life insurance policy may lapse, leaving the borrower without coverage.

- Premium financing can lead to debt if the borrower is not careful.

Alternatives to Premium Financing Life Insurance

There are several alternatives to premium financing life insurance, including:

- Paying for life insurance premiums upfront

- Using a life insurance policy with a lower premium

- Taking out a term life insurance policy, which has a lower premium than whole life insurance

Ending Remarks: Premium Financing Life Insurance

In conclusion, premium financing life insurance presents a multifaceted financial tool that can provide access to life insurance coverage while optimizing cash flow. However, careful consideration of the potential risks and alternatives is essential to determine if this strategy aligns with individual circumstances and financial objectives.