Quant finance jobs are highly sought-after positions in the financial industry, offering a unique blend of mathematical modeling, financial analysis, and programming skills. This comprehensive guide delves into the intricacies of quant finance, exploring the various job roles, required skills, career paths, and industry trends.

From quantitative analysts to risk managers, quant finance professionals play a pivotal role in developing and implementing complex financial models, analyzing market data, and managing risk. Their expertise is essential for investment banks, hedge funds, and other financial institutions seeking to maximize returns and minimize losses.

Types of Quant Finance Jobs

Quant finance jobs encompass a diverse range of roles that combine mathematical and statistical expertise with financial knowledge. These roles typically involve developing and implementing quantitative models to analyze and manage financial risks and opportunities.

Specific job titles and their descriptions include:

- Quantitative Analyst (Quant):Develops and applies mathematical and statistical models to analyze financial data, assess risks, and make investment decisions.

- Financial Engineer:Designs and structures complex financial products, such as derivatives and structured notes, using mathematical and financial models.

- Risk Manager:Identifies, measures, and manages financial risks within an organization, using quantitative methods and models.

- Data Scientist:Applies statistical and machine learning techniques to analyze large datasets and extract valuable insights for financial decision-making.

- Trading Strategist:Develops and implements trading strategies using quantitative models, statistical analysis, and market data.

Skills and Qualifications for Quant Finance Jobs

Quant finance roles require a strong foundation in mathematics, statistics, and computer science. Common technical skills include:

- Linear algebra

- Calculus

- Probability and statistics

- Financial modeling

- Programming languages (e.g., Python, R, C++)

- Machine learning

- Data analysis

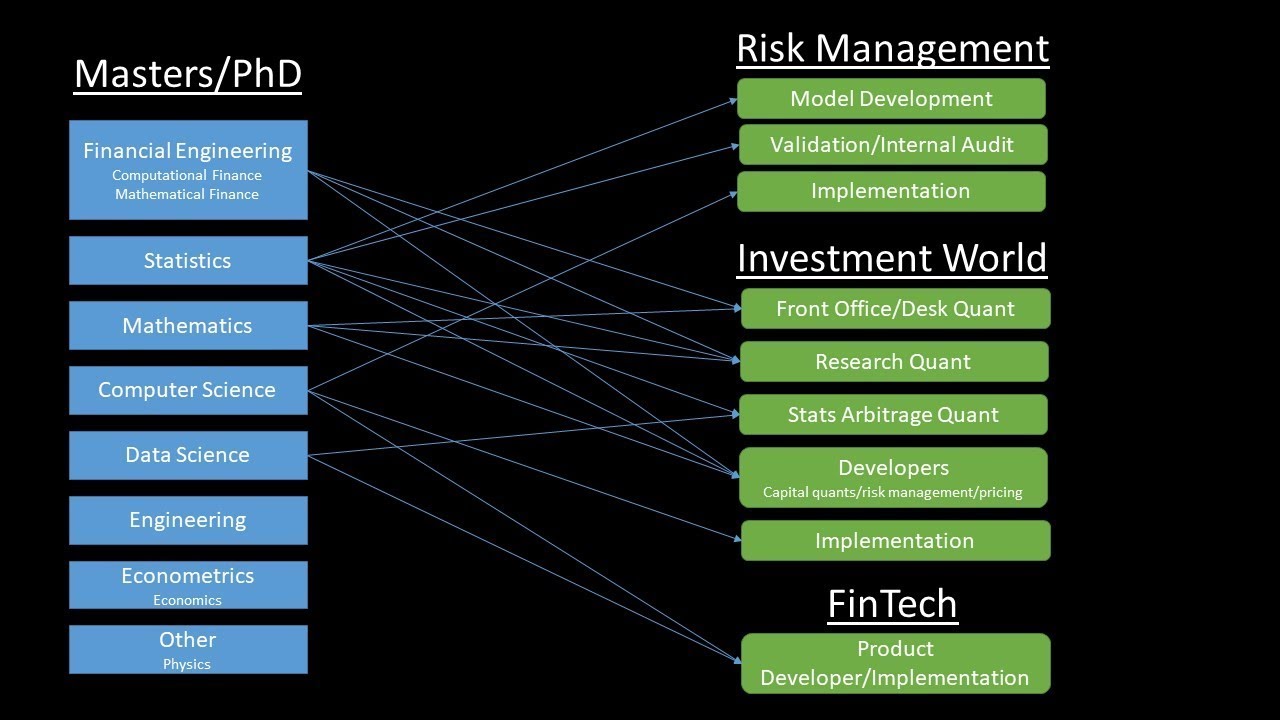

Educational background typically includes a master’s or doctoral degree in quantitative finance, financial engineering, or a related field. Relevant experience in financial services or consulting is also highly valued.

In addition to technical skills, soft skills and personality traits that are advantageous in quant finance include:

- Strong analytical and problem-solving abilities

- Excellent communication and presentation skills

- Attention to detail and accuracy

- Teamwork and collaboration skills

Career Path in Quant Finance

The typical career progression for individuals in quant finance begins with entry-level roles as junior quants or financial analysts. With experience and demonstrated skills, individuals can advance to senior-level positions, such as lead quant, portfolio manager, or chief risk officer.

For those with poor credit scores, financing a lawn mower can be a daunting task. Fortunately, there are options available to help you get the equipment you need without breaking the bank. Lawn mower financing with bad credit can be obtained through a variety of lenders, including banks, credit unions, and online lenders.

By exploring these options, you can find a loan that fits your budget and credit history.

Potential growth opportunities and specializations include:

- Front Office:Trading, portfolio management, and investment research

- Middle Office:Risk management, financial engineering, and data science

- Back Office:Operations, compliance, and regulatory reporting

Earning potential in quant finance is typically high, with top performers earning significant bonuses and incentives. The job market outlook is generally positive, with increasing demand for skilled professionals in the field.

Comparison of Quant Finance Jobs to Other Financial Roles

Quant finance jobs differ from other financial roles in terms of their technical focus and analytical depth. Compared to traditional finance roles, such as investment banking or wealth management, quant finance requires a stronger emphasis on mathematics, statistics, and computer science.

However, quant finance roles also offer unique advantages:

- Higher earning potential:Quant finance professionals typically earn higher salaries and bonuses than their counterparts in other financial roles.

- Strong job security:The demand for skilled quants is expected to remain high, ensuring job security and stability.

- Intellectual challenge:Quant finance roles offer a stimulating and intellectually challenging work environment, where professionals can apply their mathematical and analytical skills to solve complex problems.

How to Get Started in Quant Finance

To break into the quant finance industry, individuals should focus on developing a strong foundation in mathematics, statistics, and computer science. This can be achieved through coursework, online courses, or self-study.

Those with poor credit history can now rejoice, as they can access lawn mower financing with bad credit . This groundbreaking financial solution enables homeowners to acquire essential lawn care equipment without being held back by credit limitations. With flexible payment plans and accessible lending criteria, this financing option empowers individuals to maintain pristine outdoor spaces without straining their finances.

Networking and building connections within the industry is also crucial. Attending industry events, joining professional organizations, and reaching out to professionals on LinkedIn can help open doors to potential opportunities.

Building a portfolio of relevant work experience is essential. This can be done through internships, research projects, or open-source contributions. Demonstrating practical skills and knowledge in quantitative finance will make candidates more competitive in the job market.

Professional development is ongoing in quant finance, as the field is constantly evolving. Attending conferences, taking courses, and staying abreast of industry trends is essential for career advancement.

Industry Trends and Innovations in Quant Finance

The quant finance industry is constantly evolving, driven by technological advancements and regulatory changes. Emerging trends include:

- Artificial intelligence (AI) and machine learning (ML):AI and ML are increasingly used to automate tasks, enhance risk management, and develop more sophisticated trading strategies.

- Big data and cloud computing:The availability of large datasets and powerful cloud computing resources enables quants to analyze and process vast amounts of data in real time.

- Regulatory technology (RegTech):RegTech solutions leverage technology to improve compliance and risk management, which is becoming increasingly important in the financial industry.

These innovations are shaping the field of quant finance and creating new job opportunities for skilled professionals.

Ending Remarks

In conclusion, quant finance jobs offer a rewarding and challenging career path for individuals with a strong foundation in mathematics, finance, and programming. The industry is constantly evolving, presenting ample opportunities for growth and innovation. With the right skills and dedication, individuals can embark on a fulfilling career in this dynamic and lucrative field.