In the realm of modern business, SAC finance has emerged as a game-changer, providing businesses with innovative financing solutions that go beyond traditional methods. This guide delves into the intricacies of SAC finance, exploring its types, advantages, and legal aspects, offering valuable insights for businesses seeking alternative funding options.

SAC finance, short for supply chain finance, is a financing mechanism that focuses on optimizing the flow of goods and services within a supply chain. It involves the collaboration of multiple parties, including suppliers, buyers, and financial institutions, to improve cash flow and reduce financial risks.

Overview of SAC Finance

SAC finance, or special acquisition company finance, refers to the financial mechanisms and strategies used in special acquisition companies (SACs).

SACs are shell companies formed to raise capital through an initial public offering (IPO) with the specific purpose of acquiring or merging with an existing private company, thereby taking it public. SAC finance encompasses the financial aspects of this process, including capital raising, acquisition evaluation, and post-merger integration.

Key Objectives of SAC Finance

The key objectives of SAC finance are to:

- Raise capital through an IPO to fund the acquisition or merger with a target company.

- Identify and evaluate potential target companies for acquisition or merger.

- Negotiate and structure the acquisition or merger agreement.

- Integrate the acquired company into the SAC’s operations and management.

Principles of SAC Finance

SAC finance adheres to several key principles:

- Timeliness:SACs have a limited time frame, typically 18-24 months, to complete their acquisition or merger.

- Fiduciary Duty:SAC management has a fiduciary duty to act in the best interests of its shareholders.

- Transparency:SACs are required to disclose detailed information about their operations and financial performance.

Role of SAC Finance in Modern Business

SAC finance has become increasingly popular in recent years as a means for private companies to access public markets and for investors to participate in the growth of promising businesses.

SACs offer several advantages over traditional IPOs, including:

- Reduced time to market:SACs can take companies public much faster than traditional IPOs.

- Flexibility:SACs have more flexibility in their acquisition targets and deal structures.

- Access to capital:SACs provide access to a broader pool of investors.

Types of SAC Financing

SAC financing offers various options to cater to diverse business needs. These financing types differ in terms of their characteristics, benefits, and suitability for different business scenarios.

Term Loans

Term loans are traditional financing options that provide a lump sum of money to businesses. These loans have fixed repayment schedules, usually with monthly or quarterly installments. They offer competitive interest rates and can be secured or unsecured, depending on the borrower’s creditworthiness.

The Indiana Pacers’ Buddy Hield has been a consistent performer for the team this season, averaging 18.2 points per game. Hield is a sharpshooter who can create his own shot and is also a threat from beyond the arc, shooting 39.4% from three-point range.

Term loans are suitable for businesses seeking long-term financing for capital expenditures, expansion, or debt consolidation.

Lines of Credit

Lines of credit provide businesses with access to a predetermined amount of funds that can be drawn upon as needed. Unlike term loans, lines of credit offer flexibility in borrowing and repayment. Businesses can draw funds up to the approved limit and repay them as they generate revenue.

Lines of credit are ideal for businesses with fluctuating cash flow or seasonal needs.

Invoice Factoring

Invoice factoring involves selling unpaid invoices to a factoring company. The factoring company advances a percentage of the invoice amount to the business, typically 80-90%. Once the customer pays the invoice, the factoring company collects the remaining balance, minus its fees.

Invoice factoring provides immediate cash flow and eliminates the need for extended credit terms to customers.

Asset-Based Lending

Asset-based lending is a type of financing that uses a business’s assets as collateral. Lenders typically consider accounts receivable, inventory, and equipment as eligible assets. This financing option is suitable for businesses with valuable assets but limited cash flow. Asset-based lending provides access to larger loan amounts and can be tailored to the specific needs of the business.

Equity Financing

Equity financing involves selling a portion of the business to investors in exchange for capital. Unlike debt financing, equity financing does not require repayment. However, it dilutes the ownership stake of existing shareholders. Equity financing is often used by businesses seeking long-term growth capital or funding for high-risk ventures.

SAC Finance vs. Traditional Financing

SAC finance and traditional financing methods offer distinct approaches to funding business operations. Understanding their differences can help businesses make informed decisions about the best financing option for their specific needs.

Sacramento Kings guard Buddy Hield is set to return to the lineup on Wednesday after missing the last two games with a sprained ankle. Hield has been a key player for the Kings this season, averaging 16.9 points per game and shooting 39.4% from three-point range.

Advantages and Disadvantages

SAC Finance

- Advantages:Provides access to capital without diluting ownership or incurring debt, offers flexible repayment terms, and aligns incentives between investors and businesses.

- Disadvantages:Can be expensive, requires a high level of due diligence, and may involve complex contractual arrangements.

Traditional Financing

- Advantages:More readily available, lower transaction costs, and offers greater flexibility in terms of loan amount and duration.

- Disadvantages:Dilutes ownership, incurs interest expenses, and can restrict future business decisions due to loan covenants.

Factors Influencing Choice

The choice between SAC finance and traditional financing depends on several factors:

- Business Stage and Funding Needs:Early-stage businesses with limited revenue may prefer SAC finance to avoid dilution, while established businesses with stable cash flow may find traditional financing more cost-effective.

- Risk Tolerance:Businesses with a higher risk profile may find SAC finance more attractive due to its non-recourse nature, while less risky businesses may prefer traditional financing for its lower cost.

- Investor Alignment:SAC finance aligns incentives between investors and businesses, making it suitable for situations where investors are actively involved in the business’s operations.

Due Diligence for SAC Financing: Sac Finance

Conducting thorough due diligence is crucial in SAC financing transactions to mitigate risks and ensure a successful outcome. Due diligence involves scrutinizing the financial health, legal compliance, and operational capabilities of both the sponsor and the underlying asset.

Key Considerations

- Sponsor’s Financial Strength:Assess the sponsor’s track record, financial stability, and ability to fulfill its obligations under the financing agreement.

- Underlying Asset’s Value and Risk:Determine the value of the underlying asset, including its cash flow, marketability, and potential risks.

- Legal and Regulatory Compliance:Ensure that the transaction complies with all applicable laws and regulations, including tax implications and environmental regulations.

- Operational Due Diligence:Review the asset’s operations, management team, and risk management practices to assess its ability to generate stable cash flow.

Due Diligence Process

The due diligence process typically involves the following steps:

- Information Gathering:Collect financial statements, legal documents, operational reports, and other relevant information.

- Site Visits and Interviews:Conduct on-site inspections of the underlying asset and interviews with key personnel.

- Financial Analysis:Analyze the sponsor’s financial performance, debt capacity, and cash flow projections.

- Legal Review:Review the financing agreement, underlying asset documents, and regulatory compliance.

- Operational Assessment:Evaluate the asset’s operations, management team, and risk management practices.

Importance of Due Diligence

Thorough due diligence is essential for mitigating risks in SAC financing transactions. It helps investors:

- Identify potential problems that could impact the investment’s value or return.

- Negotiate favorable terms in the financing agreement.

- Protect against legal and regulatory liabilities.

- Increase confidence in the investment decision.

Documentation and Legal Aspects of SAC Financing

![]()

SAC financing involves complex legal and documentation requirements that ensure the protection of both the lender and the borrower. These requirements vary depending on the specific type of SAC financing and the jurisdiction in which the transaction takes place.

Key Clauses and Provisions in SAC Financing Agreements

SAC financing agreements typically include several key clauses and provisions that govern the terms of the financing. These include:

- Repayment terms:Outlining the schedule and amount of repayments.

- Interest rate:Specifying the rate of interest charged on the loan.

- Collateral:Identifying the assets pledged as security for the loan.

- Covenants:Restricting the borrower’s activities to protect the lender’s interests.

- Events of default:Defining the circumstances that constitute a breach of the agreement.

Role of Legal Counsel in SAC Financing Transactions

Legal counsel plays a crucial role in SAC financing transactions. They advise clients on the legal implications of the financing, negotiate and draft the financing agreements, and ensure compliance with applicable laws and regulations. Legal counsel can also provide guidance on structuring the transaction to minimize tax and legal risks.

Case Studies and Examples of SAC Financing

SAC financing has emerged as a viable alternative to traditional financing for businesses seeking growth capital. Several real-world case studies showcase the successful implementation and benefits of SAC financing.

Case Study: XYZ Pharmaceuticals

XYZ Pharmaceuticals, a rapidly growing biotech company, sought funding to expand its clinical trials. Traditional financing options were limited due to the company’s early stage and lack of significant revenue. SAC financing provided XYZ Pharmaceuticals with the necessary capital to accelerate its research and development efforts.

Factors contributing to the success of this transaction included:

- Clear and concise business plan outlining the company’s growth potential and revenue projections

- Experienced management team with a proven track record in the industry

- Strong intellectual property portfolio protecting the company’s research and development efforts

Lessons Learned and Best Practices

These case studies provide valuable lessons for businesses considering SAC financing:

- Prepare a compelling business plan:Clearly articulate the company’s growth strategy, market opportunity, and financial projections.

- Build a strong management team:Experienced and reputable management teams increase the credibility of the business and its ability to execute its plans.

- Protect intellectual property:Patents, trademarks, and copyrights provide a competitive advantage and enhance the value of the business.

- Engage experienced advisors:Legal counsel, financial advisors, and industry experts can provide guidance and support throughout the SAC financing process.

Future Trends and Innovations in SAC Finance

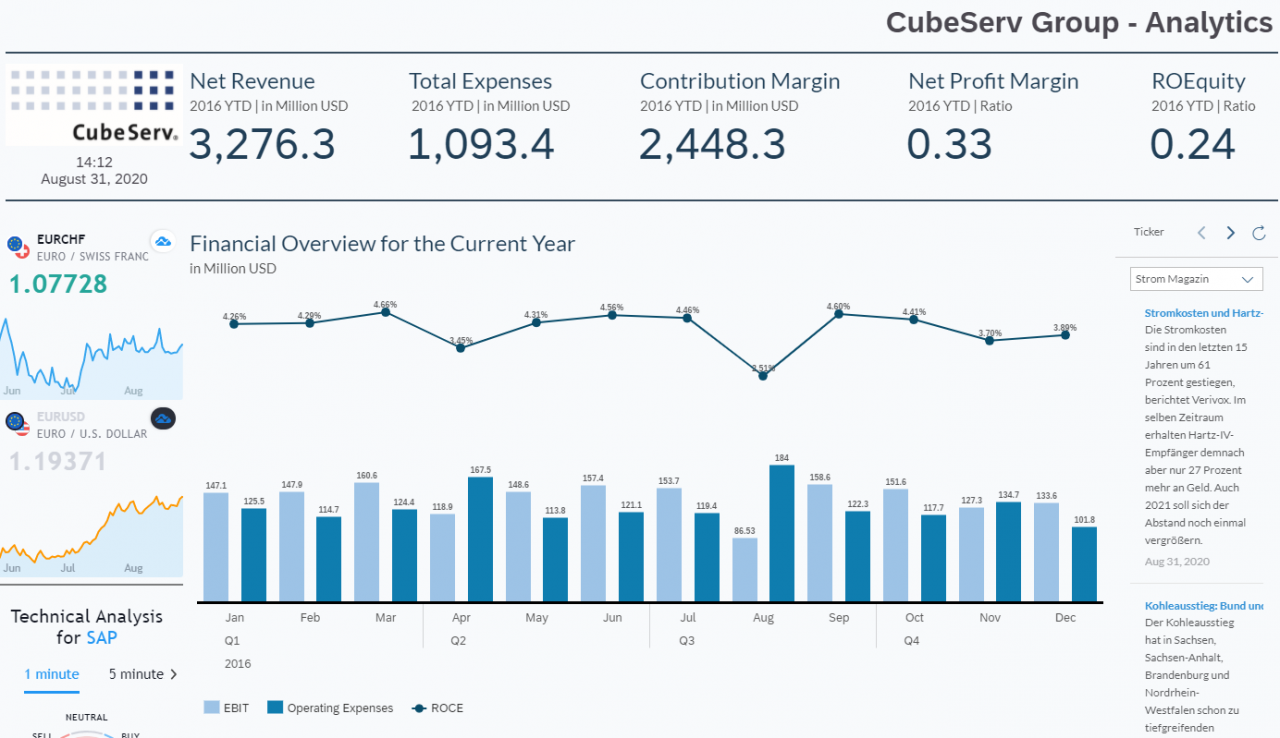

The SAC finance industry is constantly evolving, with new trends and innovations emerging all the time. These trends are being driven by a number of factors, including the increasing popularity of alternative lending, the rise of fintech, and the growing demand for transparency and efficiency in the lending process.

One of the most significant trends in SAC finance is the increasing use of data and analytics. Lenders are now using data to make more informed decisions about who to lend to and how much to lend. This is leading to more accurate risk assessments and better loan terms for borrowers.

Another major trend is the rise of fintech. Fintech companies are using technology to disrupt the traditional lending process, making it faster, easier, and more transparent. This is benefiting both borrowers and lenders, as it is reducing costs and increasing access to capital.

The Potential Impact of These Trends on SAC Financing Practices, Sac finance

The trends discussed above are having a significant impact on SAC financing practices. Lenders are becoming more sophisticated in their use of data and analytics, and they are increasingly relying on fintech to improve the efficiency of the lending process.

This is leading to a number of benefits for borrowers, including lower interest rates, faster loan approvals, and more flexible loan terms.

Opportunities and Challenges for the Future of SAC Finance

The future of SAC finance is bright. The industry is growing rapidly, and there are a number of opportunities for innovation. However, there are also a number of challenges that the industry must address, such as the need for greater regulation and the need to improve access to capital for underserved borrowers.

End of Discussion

As SAC finance continues to evolve, businesses should stay abreast of emerging trends and innovations to harness its full potential. By embracing the transformative power of SAC finance, companies can unlock new opportunities for growth and resilience in the ever-changing business landscape.