Share rate of l&t finance – L&T Finance’s share rate has been a topic of interest for investors and analysts alike, with its performance reflecting the company’s financial health and growth prospects. This comprehensive analysis delves into the factors influencing the share rate, exploring market trends, financial performance, growth strategies, and investor sentiment.

L&T Finance, a leading non-banking financial company, has consistently delivered strong financial results, with its share price showing a steady upward trajectory in recent years. The company’s diversified portfolio and prudent risk management practices have contributed to its resilience in a competitive market.

Market Overview: Share Rate Of L&t Finance

The share price of L&T Finance Holdings Limited (NSE: L&TFH) has witnessed significant fluctuations in recent years. Factors influencing its share price include industry trends, competitive dynamics, and the company’s financial performance.

L&T Finance is a leading non-banking financial company (NBFC) in India, offering a range of financial products and services, including loans, insurance, and wealth management.

The NBFC sector in India has been growing steadily, driven by increasing demand for credit from various segments of the economy. However, the sector has also faced challenges, including rising interest rates and increased competition from banks and other financial institutions.

L&T Finance has a strong presence in the retail and corporate lending segments, with a focus on providing loans to small and medium-sized enterprises (SMEs).

Financial Performance

L&T Finance’s financial performance has been mixed in recent years. The company has reported strong revenue growth, but its profitability has been impacted by rising expenses and provisions for bad loans.

In the financial year 2022-23, L&T Finance reported a 15% increase in revenue to ₹26,486 crore. However, its net profit declined by 10% to ₹3,354 crore.

The company’s return on equity (ROE) and return on assets (ROA) have also declined in recent years, reflecting the impact of rising expenses and provisions.

The finance job market has been the subject of much speculation and rumor lately, with some experts predicting a surge in hiring and others warning of potential layoffs. While it’s too early to say for sure what the future holds, it’s clear that the industry is undergoing a period of transition.

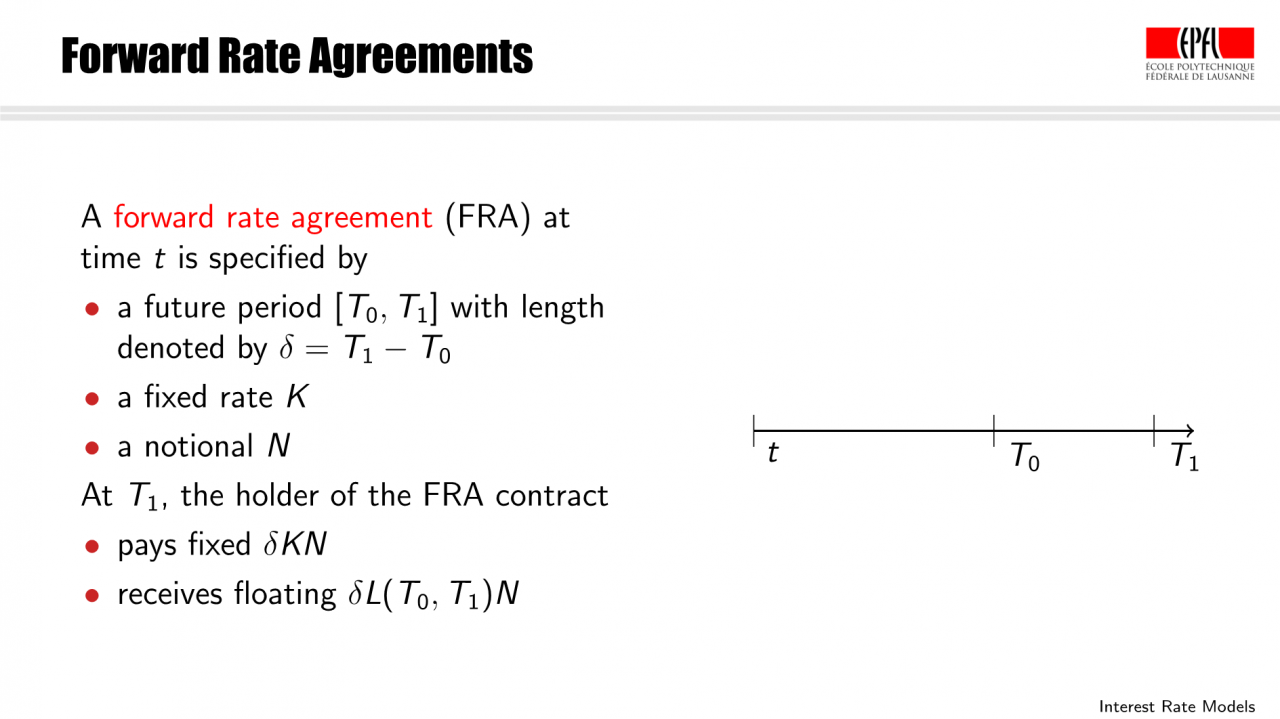

Debt-to-Equity Ratio and Interest Coverage, Share rate of l&t finance

L&T Finance’s debt-to-equity ratio has remained relatively stable in recent years, with a current ratio of 4.2.

The company’s interest coverage ratio has also been stable, indicating its ability to meet its interest payments.

Growth Prospects

L&T Finance has ambitious growth plans, with a focus on expanding its presence in the retail and corporate lending segments.

The company is also looking to launch new products and services, including digital banking and insurance products.

The finance job market is abuzz with rumors of a hiring freeze and potential layoffs. According to finance job market rumors , several major banks and financial institutions are considering cost-cutting measures to weather the current economic downturn.

L&T Finance’s growth prospects are supported by the growing demand for credit in India, particularly from the SME sector.

Last Point

In conclusion, the share rate of L&T Finance is a reflection of the company’s strong fundamentals, growth prospects, and investor confidence. With its focus on financial inclusion and sustainable growth, L&T Finance is well-positioned to continue delivering value to its shareholders in the years to come.