Side by side financing – In the realm of financing, side-by-side financing emerges as a compelling alternative, offering unique advantages and considerations. This innovative approach allows borrowers to tap into multiple funding sources simultaneously, creating a flexible and potentially lucrative financial strategy.

Side-by-side financing provides a comprehensive solution for businesses and individuals seeking to maximize their funding potential. Its versatility extends across various industries, empowering borrowers to pursue ambitious projects and achieve their financial goals.

Overview of Side-by-Side Financing

Side-by-side financing is a unique financing structure where two separate loans are secured by the same collateral. This approach offers several advantages, including the ability to access additional funding, lower interest rates, and flexible repayment terms. However, it also comes with certain disadvantages, such as increased risk and potential complications in the event of default.

Advantages of Side-by-Side Financing

- Increased Funding:Side-by-side financing allows borrowers to access larger amounts of funding than they would be able to secure with a single loan. This can be particularly beneficial for businesses or individuals with high capital needs.

- Lower Interest Rates:By leveraging two separate loans, borrowers may be able to negotiate lower interest rates on both loans. This can result in significant savings over the life of the loan.

- Flexible Repayment Terms:Side-by-side financing offers flexibility in repayment terms, allowing borrowers to tailor their repayment schedules to meet their specific cash flow needs.

Disadvantages of Side-by-Side Financing

- Increased Risk:Securing two loans against the same collateral increases the risk to both lenders. In the event of default, both lenders have claims on the collateral, which can lead to complications and potential losses.

- Potential Complications:Managing two separate loans can be complex, especially in the event of changes in circumstances. Borrowers need to be prepared to navigate potential conflicts between lenders and ensure timely payments on both loans.

Examples of Side-by-Side Financing

Side-by-side financing is commonly used in various sectors, including real estate, construction, and equipment financing. In real estate, for example, a borrower may secure a first mortgage from a bank and a second mortgage from a private lender to finance the purchase of a property.

Key Features of Side-by-Side Financing

Side-by-side financing, also known as parallel financing, is a financing structure that involves two or more lenders providing financing for the same project or asset.

The key features of side-by-side financing include:

- Multiple Lenders:Side-by-side financing involves two or more lenders, each providing a portion of the financing.

- Joint Collateral:The collateral for the financing is typically shared among the lenders, with each lender having a security interest in the collateral.

- Shared Risk:The risk of the financing is shared among the lenders, with each lender bearing a portion of the risk.

- Independent Covenants:Each lender typically has its own set of covenants and restrictions, which may differ from the covenants and restrictions of the other lenders.

These features impact the terms and conditions of the financing, such as the interest rate, the loan term, and the repayment schedule.

Comparison to Other Financing Options

The following table compares the key features of side-by-side financing to other financing options:

| Feature | Side-by-Side Financing | Single-Lender Financing | Syndicated Financing |

|---|---|---|---|

| Number of Lenders | Multiple | Single | Multiple |

| Collateral | Shared | Single | Shared |

| Risk | Shared | Single | Shared |

| Covenants | Independent | Single | Uniform |

Eligibility Requirements for Side-by-Side Financing

Side-by-side financing, a type of equipment financing, has specific eligibility requirements that borrowers must meet to qualify for the loan. Lenders typically assess the borrower’s financial stability, creditworthiness, and the nature of the equipment being financed.

Financial Stability

Lenders will evaluate the borrower’s financial stability by examining their income, expenses, and assets. A strong cash flow and a low debt-to-income ratio are indicators of financial stability. Lenders may also consider the borrower’s business plan and financial projections to assess their ability to repay the loan.

Creditworthiness

The borrower’s credit history and score play a crucial role in determining their eligibility. Lenders prefer borrowers with a good credit history, indicating a responsible track record of managing debt. A high credit score demonstrates the borrower’s reliability and reduces the perceived risk for the lender.

Equipment Eligibility

The equipment being financed must meet certain criteria to qualify for side-by-side financing. Lenders typically prefer equipment that is essential for the borrower’s business operations and has a proven track record of reliability and value retention. The age and condition of the equipment may also impact eligibility.

Other Considerations

In addition to these core requirements, lenders may consider other factors, such as the borrower’s industry experience, the purpose of the financing, and the presence of collateral. A strong business plan and a clear understanding of the intended use of the equipment can enhance the borrower’s chances of approval.

The finance sector offers a multitude of lucrative career opportunities, with finance manager jobs being highly sought after. Finance managers play a crucial role in overseeing financial operations, budgeting, and investment strategies. They require a deep understanding of financial principles and a keen eye for detail.

Documents Required, Side by side financing

When applying for side-by-side financing, borrowers typically need to provide the following documents:

- Business plan and financial projections

- Income statements and balance sheets

- Tax returns

- Personal financial statements

- Equipment specifications and invoices

- Proof of insurance

Meeting the eligibility requirements for side-by-side financing increases the likelihood of loan approval and favorable loan terms. By understanding the lender’s assessment criteria and providing the necessary documentation, borrowers can position themselves for success in securing this type of equipment financing.

The job market for finance manager jobs is highly competitive, with many qualified candidates vying for a limited number of positions. To stand out in this competitive field, it’s essential to have a strong resume and cover letter that highlight your skills and experience.

Application Process for Side-by-Side Financing

Applying for side-by-side financing involves a streamlined process with defined steps for both the lender and the borrower.

The application process typically begins with the borrower submitting a loan application to the lender. This application includes financial information, such as income, assets, and liabilities, as well as details about the proposed project or business.

Role of the Lender

- Review the loan application to assess the borrower’s creditworthiness and the viability of the proposed project.

- Determine the loan amount, interest rate, and repayment terms based on the borrower’s financial situation and the project’s risk profile.

- Provide guidance and support to the borrower throughout the application process, including answering questions and addressing any concerns.

Role of the Borrower

- Provide accurate and complete financial information on the loan application.

- Cooperate with the lender’s requests for additional documentation or clarification.

- Review and understand the loan terms and conditions before signing the loan agreement.

Timeline

The timeline for the application process can vary depending on the lender and the complexity of the project. However, in general, the process can take several weeks to complete.

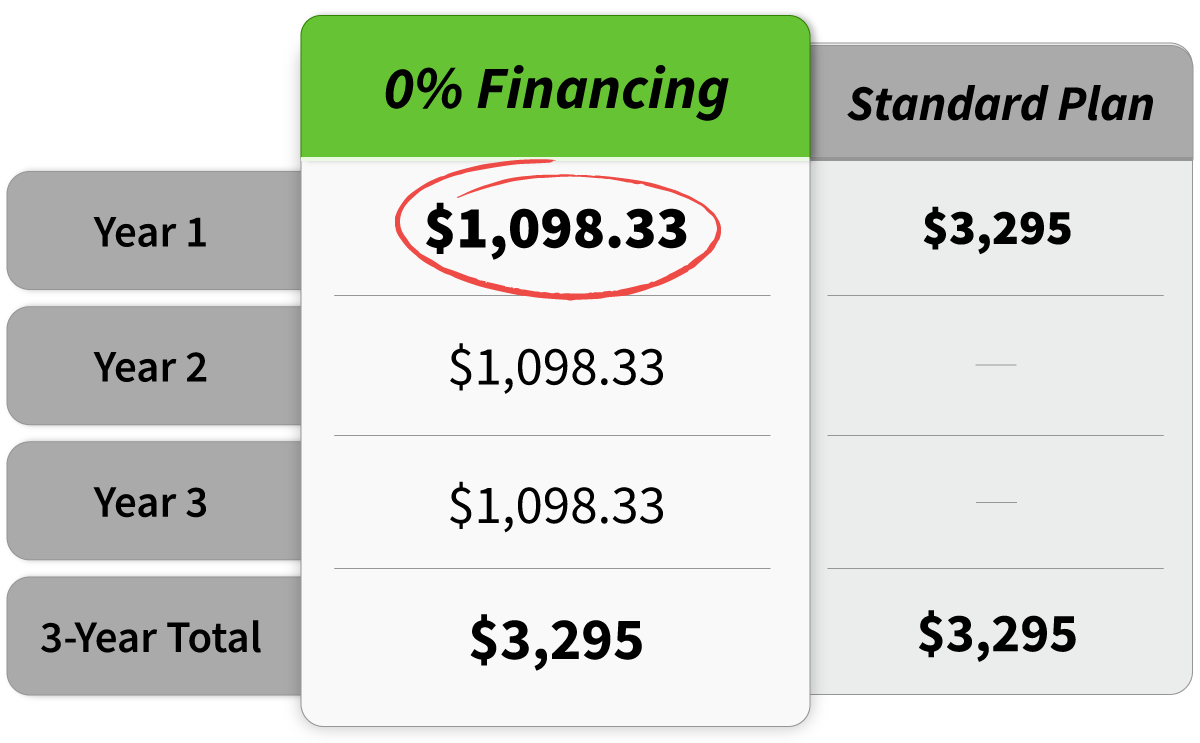

Repayment Terms for Side-by-Side Financing

Side-by-side financing offers flexible repayment terms that cater to the specific needs of borrowers. The repayment schedule is typically tailored to align with the cash flow and revenue generation of the financed project.

There are two primary types of repayment schedules for side-by-side financing:

Equal Principal Payments

Under this schedule, borrowers make fixed payments that consist of both principal and interest. The principal amount is reduced evenly over the loan term, resulting in a consistent payment amount throughout the repayment period.

Interest-Only Payments

This schedule allows borrowers to make interest-only payments during an initial period, typically for the first few years of the loan term. After the interest-only period, borrowers begin making principal and interest payments. This structure provides flexibility and allows borrowers to conserve cash flow during the early stages of the project.

| Side-by-Side Financing | Conventional Loan | Venture Capital | |

|---|---|---|---|

| Repayment Schedule | Flexible, tailored to project cash flow | Fixed, equal payments | Equity stake, no fixed repayment schedule |

| Interest Rate | Competitive, based on project risk | Typically higher than side-by-side financing | Varies depending on investor expectations |

| Collateral | Project-specific collateral | May require personal or business assets | Company equity or assets |

Alternatives to Side-by-Side Financing: Side By Side Financing

In certain circumstances, borrowers may find alternatives to side-by-side financing more suitable for their needs. These alternatives offer varying advantages and disadvantages that warrant careful consideration.

Some common alternatives to side-by-side financing include:

Conventional Mortgage

- Advantages:Lower interest rates, longer repayment terms, and no requirement for a second property.

- Disadvantages:Higher down payment requirements, stricter credit score requirements, and potential for private mortgage insurance (PMI).

Home Equity Loan or Line of Credit (HELOC)

- Advantages:Lower interest rates than personal loans, tax-deductible interest (in some cases), and potential to borrow against the equity in an existing home.

- Disadvantages:Requires home equity as collateral, can impact credit score if not managed properly, and may have closing costs.

Personal Loan

- Advantages:Can be used for any purpose, including down payment assistance, and typically has lower closing costs than other alternatives.

- Disadvantages:Higher interest rates than secured loans, shorter repayment terms, and may require a good credit score.

401(k) Loan

- Advantages:Lower interest rates than most other alternatives, no credit check required, and potential tax benefits.

- Disadvantages:Reduces retirement savings, may have early withdrawal penalties, and can impact credit score if not repaid on time.

Epilogue

In conclusion, side-by-side financing presents a transformative approach to financing, offering a blend of flexibility, affordability, and growth potential. By embracing this innovative strategy, borrowers can unlock a world of financial possibilities and propel their ventures to new heights.