Stock market open times play a crucial role in the global financial landscape, setting the stage for trading activities that impact investors and businesses worldwide. From the bustling streets of Wall Street to the vibrant markets of Asia, the opening bell marks the commencement of a day filled with anticipation, strategy, and the pursuit of financial gain.

This comprehensive guide delves into the intricacies of stock market open times, exploring their impact on trading strategies, the evolution of opening hours, and the unique characteristics of pre-market and after-hours trading sessions. Whether you’re a seasoned investor or a newcomer to the world of finance, understanding stock market open times is essential for navigating the ever-changing market landscape.

Stock Market Opening Times Globally

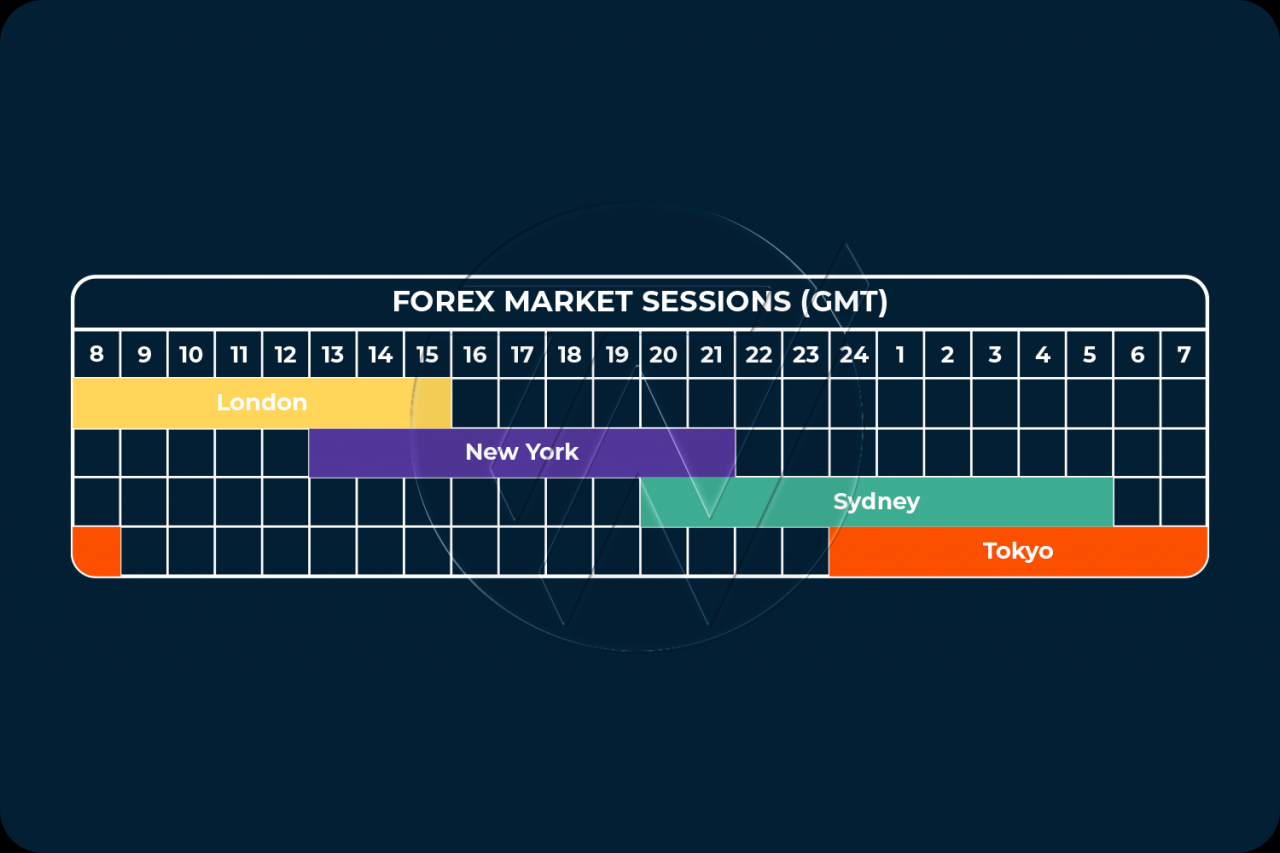

The opening times of stock markets around the world vary depending on the time zone in which they are located. This can have a significant impact on trading hours for investors who are looking to buy or sell stocks in different markets.

The following table provides a list of the opening times for some of the major stock markets around the world:

| Market | Opening Time (Local Time) | Opening Time (UTC) |

|---|---|---|

| New York Stock Exchange (NYSE) | 9:30 AM | 13:30 |

| London Stock Exchange (LSE) | 8:00 AM | 08:00 |

| Tokyo Stock Exchange (TSE) | 9:00 AM | 00:00 |

| Hong Kong Stock Exchange (HKSE) | 9:30 AM | 01:30 |

As you can see from the table, the opening times for stock markets around the world can vary by several hours. This is because the time zones in which these markets are located are different. For example, the NYSE is located in New York City, which is in the Eastern Time Zone (UTC-5).

This means that the NYSE opens at 9:30 AM Eastern Time, which is 13:30 UTC.

The opening times of stock markets can also be affected by holidays. For example, the NYSE is closed on all federal holidays in the United States. This means that if a federal holiday falls on a weekday, the NYSE will be closed on that day.

As the stock market prepares to open its doors, it’s worth noting that the average salary for porta potty cleaners in the United States is around $30,000 per year, according to this source . This figure can vary depending on factors such as experience, location, and the size of the company.

However, it provides a general idea of the compensation for those responsible for maintaining the cleanliness of these essential facilities.

Pre-Market and After-Hours Trading

The stock market’s official trading hours are typically between 9:30 AM and 4:00 PM local time on weekdays. However, there are also pre-market and after-hours trading sessions that allow investors to trade outside of these regular hours.

Pre-market trading takes place before the market opens, usually starting at 7:00 AM local time. After-hours trading occurs after the market closes, typically ending at 8:00 PM local time.

Advantages of Pre-Market and After-Hours Trading

- Extended trading hours allow investors to react to news and events that occur outside of regular trading hours.

- Increased liquidity, as more traders participate in the market during these extended sessions.

- Opportunity to adjust positions or execute trades before or after the market’s official opening or closing.

Disadvantages of Pre-Market and After-Hours Trading

- Lower trading volume and liquidity compared to regular trading hours.

- Increased volatility and price swings due to fewer participants.

- Potential for wider bid-ask spreads, resulting in higher trading costs.

Impact of Opening Times on Trading Strategies

The opening time of the stock market plays a significant role in shaping trading strategies. Early morning trading sessions, characterized by high volatility and liquidity, present opportunities for traders seeking short-term gains. Conversely, afternoon trading sessions often exhibit lower volatility and a more stable market environment, which can be beneficial for long-term investors.

Scalping and Day Trading

Scalping and day trading strategies thrive during the initial hours of the market’s open. The high volume and price fluctuations provide ample opportunities for traders to execute quick trades and capitalize on short-term market movements. These strategies require traders to be agile and capable of making rapid decisions based on real-time market data.

Swing Trading and Position Trading

Swing trading and position trading strategies are more suited to the afternoon trading sessions. During these times, the market tends to stabilize, and trends become more apparent. Traders employing these strategies hold positions for longer periods, aiming to capture larger market movements.

Successful Traders

Numerous successful traders have leveraged the opening times of the stock market to their advantage. Jesse Livermore, a legendary stock trader, famously profited from the volatile opening hours by identifying and exploiting market inefficiencies. George Soros, another renowned investor, utilized afternoon trading sessions to establish long-term positions based on fundamental analysis and macroeconomic trends.

The stock market opened on time today, despite the anticipation surrounding the upcoming mavericks vs thunder game. Traders were eager to get back to business after a long weekend, and the market responded positively, with major indices posting gains in the early hours of trading.

Historical Evolution of Stock Market Opening Times: Stock Market Open Time

The opening times of stock markets have undergone significant changes throughout history, reflecting advancements in technology, globalization, and changing market practices.

Early Beginnings:In the early days of stock trading, markets operated during daylight hours, typically from 10:00 AM to 3:00 PM. This was due to the limited means of communication and the need for traders to be physically present at the exchange.

Factors Influencing Changes

- Technological Advancements:The advent of electronic trading and communication systems in the 20th century allowed for extended trading hours and the ability to execute trades remotely.

- Globalization:As the global economy became more interconnected, the need arose for markets to operate across different time zones, facilitating trading between investors worldwide.

- Market Demand:Increased investor participation and the rise of institutional trading led to demands for longer trading hours to accommodate their needs.

Potential Future Changes, Stock market open time

As technology continues to evolve and market dynamics change, there is the potential for further adjustments to stock market opening times. These could include:

- 24-Hour Trading:Advances in technology and the globalization of markets may make it feasible for some exchanges to offer round-the-clock trading.

- Regionalized Opening Times:To cater to specific geographic regions, markets could adopt different opening times based on local market conditions and investor preferences.

Closure

As the sun sets on another trading day, the closing bell signals the end of a symphony of financial activity. The stock market open times have once again played their part in shaping the day’s market narrative, influencing trading decisions, and setting the stage for the next chapter in the ongoing saga of global finance.