Uber stock has emerged as a hot topic in the financial world, captivating investors and analysts alike. This in-depth analysis delves into Uber’s business model, financial performance, market position, growth strategy, and key challenges, providing valuable insights into the company’s trajectory and potential.

Uber, a pioneer in the ride-sharing industry, has revolutionized urban transportation globally. Founded in 2009, the company has grown exponentially, amassing a vast customer base and becoming a household name. Its mission to “ignite opportunity by setting the world in motion” underscores its commitment to innovation and convenience.

Company Overview: Uber Stock

Uber Technologies, Inc. (Uber) is an American multinational ride-hailing company headquartered in San Francisco, California. The company’s primary business is providing on-demand transportation services through its mobile application, connecting riders with drivers who use their personal vehicles.

Uber was founded in 2009 by Travis Kalanick and Garrett Camp. The company initially launched in San Francisco and has since expanded to over 900 cities in more than 70 countries worldwide. Uber’s rapid growth has been fueled by its innovative technology, which allows riders to request rides, track their progress, and pay for their fares all through the Uber app.

Mission Statement

Uber’s mission statement is “Transportation as reliable as running water, everywhere for everyone.”

Values

- Customer obsession

- Innovation

- Execution

- Diversity and inclusion

- Community

Corporate Culture

Uber’s corporate culture is characterized by its focus on innovation, speed, and execution. The company is known for its willingness to take risks and its ability to adapt quickly to changing market conditions.

Financial Performance

Uber’s financial performance has been a rollercoaster ride in recent years. The company has reported both strong growth and significant losses, as it navigates the competitive ride-sharing industry.

In 2022, Uber reported revenue of $29.1 billion, a 44% increase from the previous year. The company’s earnings per share (EPS) were $0.54, a significant improvement from the loss per share of $0.61 reported in 2021.

Uber’s stock performance has been closely watched by investors, with its recent gains attributed to the company’s expansion into new markets. The stock market opens at different times depending on the exchange, so it’s important to check what time the stock market opens before placing trades.

Uber’s stock is expected to continue to be volatile in the coming months as the company navigates the competitive ride-sharing market.

Revenue Growth

Uber’s revenue growth has been driven by a number of factors, including the expansion of its ride-sharing business into new markets, the launch of new services such as Uber Eats, and the acquisition of competitors such as Careem.

Profitability Challenges

Despite its strong revenue growth, Uber has struggled to achieve profitability. The company has reported operating losses in each of the past three years, due to high expenses related to driver incentives, marketing, and research and development.

Financial Ratios

Uber’s key financial ratios also provide insights into its financial performance. The company’s gross margin, which measures the profit margin on its core ride-sharing business, has improved in recent years, but remains below the industry average.

Uber’s operating margin, which measures the profit margin on its overall operations, has also improved in recent years, but remains negative.

Uber’s net income margin, which measures the profit margin on its overall revenue, has also improved in recent years, but remains negative.

Uber stock prices have been on a steady decline in recent months, leading some analysts to question the company’s long-term viability. However, there may be a glimmer of hope for Uber in the form of portable toilets for camping . As more and more people embrace the great outdoors, the demand for portable toilets is expected to increase.

Uber could capitalize on this trend by partnering with campgrounds and RV parks to provide convenient and affordable toilet rentals.

Market Analysis

Uber’s target market encompasses individuals seeking convenient and affordable transportation options. Its demographic primarily consists of urban dwellers, including commuters, travelers, and those without access to personal vehicles. The company caters to a wide range of needs, from daily commutes to special occasions, offering flexibility and personalization in its services.

Competitive Landscape

The ride-sharing industry is highly competitive, with Uber facing major players such as Lyft, Didi, and Grab. Each company holds a significant market share in different regions, with Uber maintaining a dominant position in the United States and several international markets.

Intense competition has led to price wars, promotional campaigns, and ongoing innovation to attract and retain customers.

Industry Trends

Key trends shaping the ride-sharing industry include:

- Technological advancements: Advancements in mobile technology, GPS tracking, and artificial intelligence enhance the user experience and operational efficiency.

- Regulatory changes: Governments worldwide are implementing regulations to address safety, insurance, and labor issues, impacting the industry’s operations and profitability.

- Changing consumer behavior: Increasing environmental awareness and urbanization are driving demand for sustainable and convenient transportation options.

These factors continue to influence the competitive dynamics and growth prospects of the ride-sharing industry, with Uber adapting its strategies to stay ahead in the evolving market.

Growth Strategy

Uber’s growth strategy revolves around expanding its global presence, diversifying its product offerings, and forming strategic partnerships. The company aims to capitalize on its ride-hailing success and leverage its platform to offer a wider range of services.

Uber’s expansion plans include entering new markets, both in developed and developing countries. The company is also looking to expand its product offerings by introducing new services such as food delivery, freight transportation, and healthcare.

Partnerships and Alliances

Uber has formed partnerships with various companies to enhance its growth strategy. These partnerships include:

- Alliances with automakers:Uber has partnered with automakers such as Toyota and Hyundai to develop and deploy self-driving cars.

- Food delivery partnerships:Uber has partnered with food delivery companies such as Grubhub and Postmates to offer food delivery services to its users.

- Healthcare partnerships:Uber has partnered with healthcare providers such as CVS Health and Walgreens to offer healthcare services such as transportation to medical appointments.

These partnerships allow Uber to expand its reach, enhance its product offerings, and access new customer segments.

Challenges and Opportunities

Uber faces several challenges and opportunities that impact its growth and profitability. These include regulatory issues, competition, and driver retention. However, Uber’s strengths and weaknesses can be leveraged to overcome challenges and capitalize on opportunities.

One of Uber’s strengths is its large and loyal customer base. The company has over 100 million monthly active users, which gives it a significant competitive advantage. Uber also has a strong brand recognition, which helps it to attract new customers.

Regulatory Issues

Uber has faced regulatory challenges in many of the markets in which it operates. These challenges have included legal battles over the classification of Uber drivers as employees or independent contractors, as well as disputes over licensing and insurance requirements.

Uber has responded to these challenges by working with governments to develop new regulations that allow it to continue operating. The company has also invested in technology to improve safety and compliance.

Competition

Uber faces competition from a number of other ride-hailing companies, including Lyft, Didi, and Grab. These companies offer similar services to Uber, and they have been gaining market share in recent years.

Uber has responded to this competition by investing in new products and services, such as food delivery and freight transportation. The company has also expanded into new markets, such as India and Latin America.

Driver Retention

Uber has faced challenges in retaining drivers. Drivers have complained about low wages, long hours, and a lack of benefits. Uber has responded to these concerns by increasing driver pay and offering new benefits, such as health insurance and paid time off.

Uber’s ability to overcome these challenges and capitalize on opportunities will be critical to its long-term success. The company has a strong foundation, but it will need to continue to innovate and adapt to the changing market landscape.

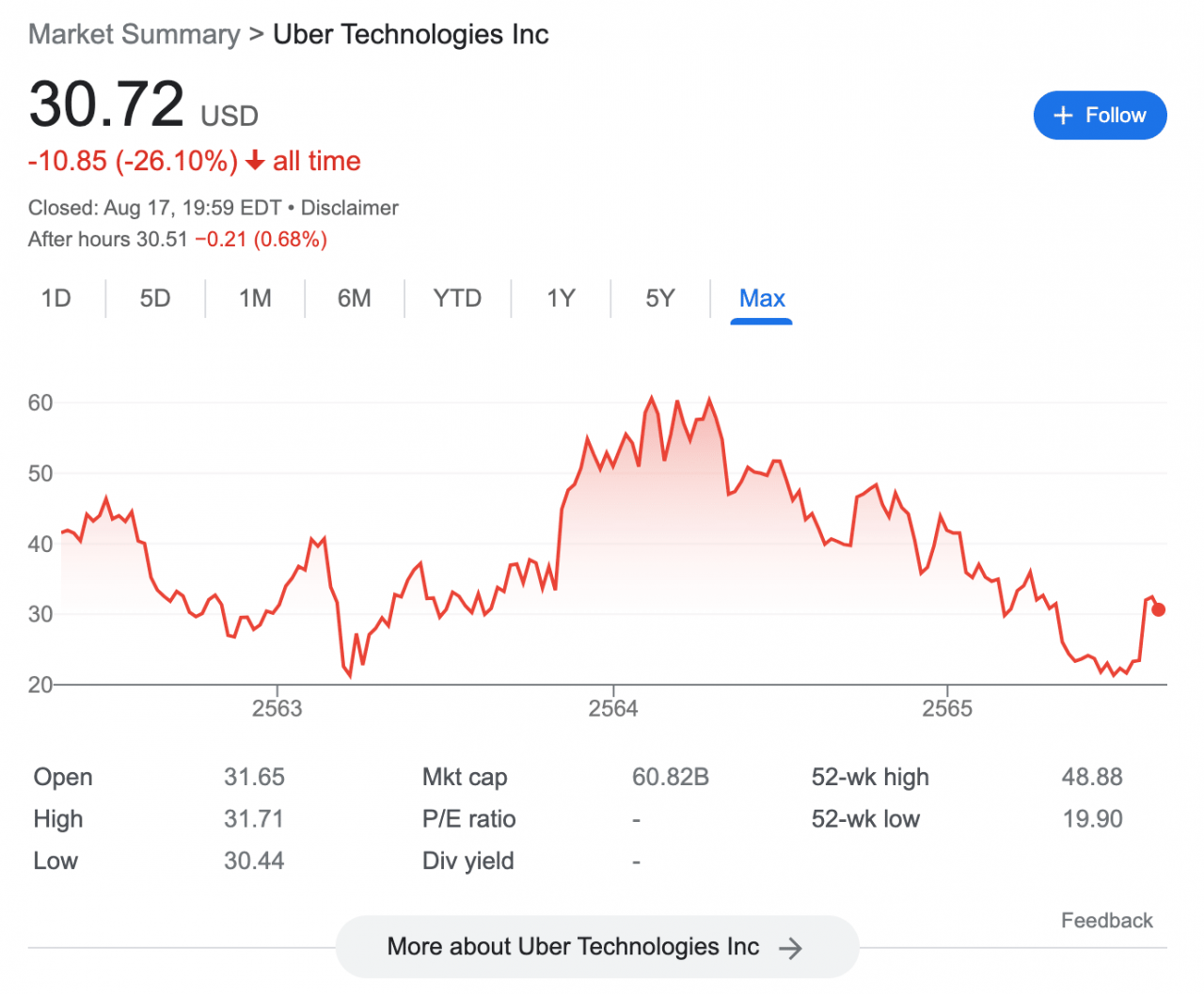

Stock Performance

Uber’s stock has experienced significant fluctuations over the past year, reflecting the company’s ongoing growth, challenges, and investor sentiment.

Initially, Uber’s stock price soared after its initial public offering (IPO) in May 2019, reaching a high of over $45 per share. However, the stock has since faced volatility, with a significant decline in early 2020 due to the impact of the COVID-19 pandemic on the ride-hailing industry.

Key Factors Influencing Uber’s Stock Performance

- Financial Results:Uber’s financial performance, including revenue growth, profitability, and cash flow, has a major impact on its stock price. Strong financial results can boost investor confidence and drive up the stock price, while weak results can have the opposite effect.

- Industry News:News and developments within the ride-hailing industry, such as regulatory changes, competition, and technological advancements, can also affect Uber’s stock price. Positive industry news can boost investor sentiment, while negative news can lead to sell-offs.

- Investor Sentiment:Investor sentiment towards Uber plays a significant role in determining its stock price. Positive sentiment, such as optimism about the company’s growth prospects, can drive up the stock price, while negative sentiment, such as concerns about competition or regulatory risks, can lead to sell-offs.

Technical Analysis, Uber stock

A technical analysis of Uber’s stock chart reveals key support and resistance levels that can provide trading opportunities.

- Support Level:The support level around $35 per share has acted as a floor for Uber’s stock price, preventing it from falling further. This level has been tested several times and has held, indicating strong buying pressure at that price point.

- Resistance Level:The resistance level around $45 per share has acted as a ceiling for Uber’s stock price, preventing it from rising further. This level has been tested several times and has been rejected, indicating strong selling pressure at that price point.

Traders may consider buying Uber’s stock when it approaches the support level and selling when it approaches the resistance level for potential profit opportunities.

Final Summary

Uber’s journey has been marked by both triumphs and challenges. Regulatory hurdles, competitive pressures, and driver retention issues have tested the company’s resilience. However, Uber’s strengths, such as its brand recognition, technological prowess, and global reach, position it well to overcome these obstacles and continue its growth trajectory.

As Uber navigates the ever-evolving landscape of the transportation industry, investors and analysts will closely monitor its progress. The company’s ability to adapt to changing market dynamics, capitalize on new opportunities, and address ongoing challenges will ultimately determine its long-term success.