What caused the stock market crash of 1929 – The stock market crash of 1929 stands as a defining moment in economic history, its reverberations still felt today. This comprehensive analysis delves into the intricate web of factors that precipitated this catastrophic event, unraveling the interplay of economic, psychological, and international forces.

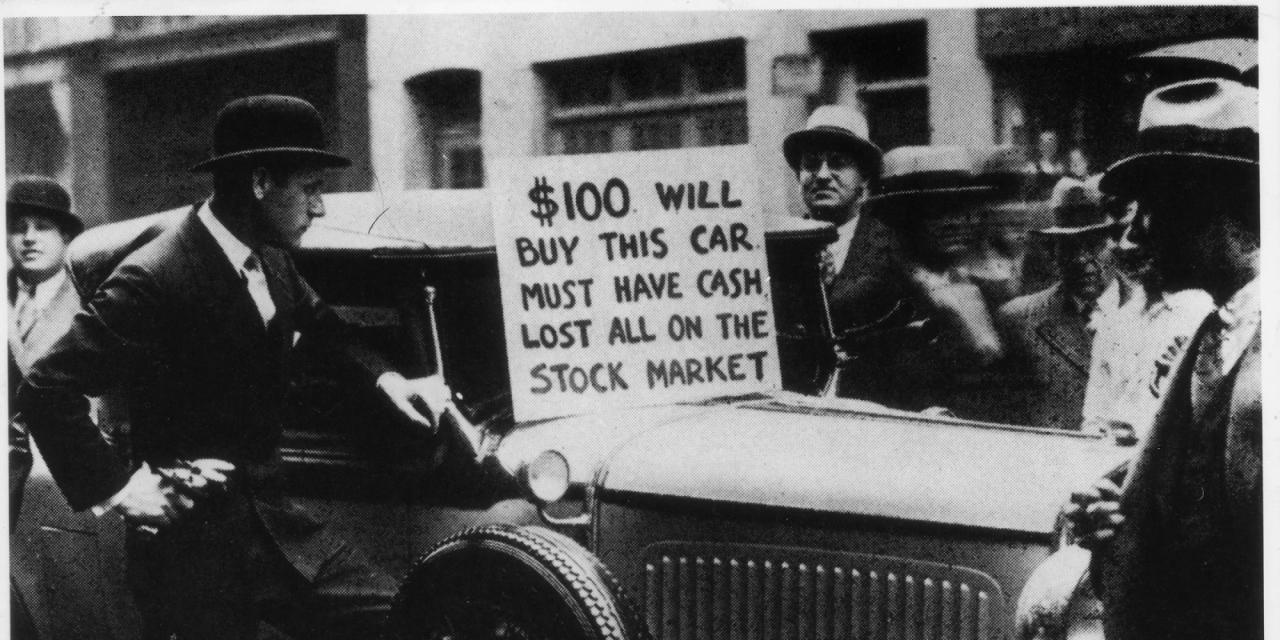

The seeds of the crash were sown in the exuberant optimism and speculative fervor that gripped the stock market in the 1920s. Overconfidence and excessive borrowing fueled a relentless rise in stock prices, creating a bubble that was destined to burst.

Historical Context

The 1929 stock market crash, also known as the Great Crash, was the most devastating stock market crash in the history of the United States, and one of the defining events of the Great Depression. The crash began on October 24, 1929, known as “Black Thursday”, and was followed by the even more devastating “Black Tuesday” on October 29, 1929, when the Dow Jones Industrial Average fell by 12%. The crash signaled the beginning of a decade of high unemployment, poverty, low profits, deflation, and lost opportunities for economic growth and personal advancement.

The crash was the culmination of a decade of economic expansion and speculation. The 1920s were a time of great economic growth in the United States. The country’s gross domestic product (GDP) grew by an average of 4.5% per year, and the stock market boomed.

By 1929, the Dow Jones Industrial Average had reached an all-time high of 381.17.

However, the economic boom of the 1920s was built on a number of unsustainable practices. One of the most important of these was the widespread use of margin buying. Margin buying allowed investors to buy stocks with borrowed money. This practice inflated the stock market bubble and made it more vulnerable to a crash.

Timeline of Key Events

The following is a timeline of key events that contributed to the stock market crash of 1929:

- 1921:The Federal Reserve raises interest rates to curb inflation.

- 1927:The stock market begins to rise rapidly, fueled by speculation and margin buying.

- 1929:The stock market reaches an all-time high on September 3.

- October 24, 1929:The stock market crashes, losing 12% of its value on “Black Thursday”.

- October 29, 1929:The stock market falls by a further 12% on “Black Tuesday”.

Economic Factors

The stock market crash of 1929 was the culmination of several economic factors, including speculative practices, excessive borrowing, and the Federal Reserve’s interest rate policies.

Speculative Practices and Overconfidence

In the 1920s, the stock market became a breeding ground for speculation. Investors, lured by the promise of quick profits, bought stocks on margin, meaning they borrowed money to invest. This practice inflated the prices of stocks, creating a bubble that was unsustainable.

Overconfidence also played a role. Investors believed that the stock market would continue to rise forever, and they ignored the warning signs of an impending crash.

Excessive Borrowing and Margin Trading

The use of margin trading contributed significantly to the crash. Margin trading allowed investors to borrow money from their brokers to purchase stocks. This practice amplified both gains and losses, making the market even more volatile.

When the market turned, many investors were unable to repay their loans. This led to a wave of forced selling, which further depressed stock prices.

Federal Reserve’s Interest Rate Policies

The Federal Reserve’s interest rate policies also played a role in the crash. In the 1920s, the Fed raised interest rates to curb inflation. This made it more expensive for businesses to borrow money, which slowed down economic growth.

The combination of speculative practices, excessive borrowing, and the Fed’s interest rate policies created a perfect storm that led to the stock market crash of 1929.

Psychological Factors

The stock market crash of 1929 was not solely driven by economic factors but also by a complex interplay of psychological forces.

The stock market crash of 1929 was a watershed moment in American history. A combination of factors, including excessive speculation, overvalued stocks, and a lack of regulation, contributed to the crash. While the impact of the crash was far-reaching, its effects were not limited to the financial realm.

In the years that followed, the crash had a profound impact on the social and political landscape of the United States. Suns vs Timberwolves The crash also had a significant impact on the development of economic theory and the role of government in the economy.

Herd Mentality

The herd mentality, a cognitive bias that leads individuals to conform to the actions of the majority, played a significant role in the crash. As stock prices soared, investors rushed to buy shares, believing that the market would continue to rise indefinitely.

This irrational exuberance created a self-reinforcing cycle that fueled the bubble.

Rumors and Panic

Rumors and panic spread like wildfire through the financial markets, amplifying the negative sentiment. False reports of impending economic disasters or financial scandals sowed seeds of doubt among investors, causing them to sell their shares in a panic. The resulting sell-off created a domino effect, driving stock prices down even further.

Media Coverage

The media played a double-edged role in the crash. While it provided information about the market’s movements, it also sensationalized the negative news, contributing to the panic among investors. Headlines and articles that emphasized the severity of the downturn created a perception of a crisis, leading more people to sell their shares.

International Factors

The global economic landscape also played a significant role in the lead-up to the crash. The post-World War I era was marked by widespread economic instability, with many European countries struggling to recover from the devastation of the war. The United States, on the other hand, emerged from the conflict as a global economic powerhouse, attracting vast amounts of foreign investment.

Collapse of the International Gold Standard, What caused the stock market crash of 1929

One key factor that contributed to the crash was the collapse of the international gold standard. Under the gold standard, the value of a country’s currency was pegged to the value of gold. This system helped to stabilize exchange rates and promote international trade.

However, during the 1920s, several countries, including the United Kingdom, abandoned the gold standard. This led to a devaluation of their currencies and made it more difficult for them to import goods from the United States.

Foreign Investors in the US Stock Market

The influx of foreign investment into the US stock market also contributed to the crash. Many foreign investors were attracted by the high returns available in the US market. However, when the market began to decline in 1929, these investors began to sell off their stocks, exacerbating the decline.

Structural Issues

The financial system in the 1920s was characterized by several weaknesses that contributed to the severity of the stock market crash. One major issue was the lack of regulation and oversight in the stock market. The Securities and Exchange Commission (SEC) was not established until 1934, and in the absence of such oversight, there was little to prevent fraudulent practices and excessive speculation.

The stock market crash of 1929, triggered by a combination of factors including rampant speculation and overvaluation, sent shockwaves through the global economy. As investors scrambled to sell their shares, the market plummeted, leading to widespread panic and economic turmoil.

The repercussions of the crash were far-reaching, casting a long shadow over the following decades. Meanwhile, the Phoenix Suns are set to embark on their playoff journey, facing off against the Dallas Mavericks in the first round. The Suns, led by All-Star Devin Booker, will be looking to make a deep run in the postseason, having secured the second seed in the Western Conference.

The team’s playoff schedule can be found here: suns playoff schedule . The upcoming series promises to be a thrilling spectacle, with both teams eager to prove their worth on the court.

Another structural issue was the lack of corporate governance and accounting practices. Many companies engaged in risky and unethical practices, such as issuing excessive amounts of stock and manipulating financial statements. This lack of transparency and accountability made it difficult for investors to make informed decisions about the value of stocks.

Role of Margin Buying

Margin buying, which allowed investors to borrow money to purchase stocks, played a significant role in amplifying the crash. When stock prices were rising, margin buying allowed investors to leverage their gains and increase their exposure to the market. However, when prices began to fall, margin calls forced investors to sell their stocks to cover their debts, leading to a downward spiral in stock prices.

Aftermath and Impact

The stock market crash of 1929 sent shockwaves through the global economy, triggering a series of events that would culminate in the Great Depression. The immediate aftermath was characterized by panic selling, bank runs, and a sharp decline in economic activity.

The long-term effects of the crash were even more devastating. The Great Depression, which lasted for over a decade, brought widespread unemployment, poverty, and social unrest. It led to a decline in global trade and investment, and it weakened the global financial system.

The Role of the Great Depression

The Great Depression had a profound impact on the global economy. It led to a decline in output, investment, and employment. The unemployment rate in the United States reached 25% at its peak, and millions of people lost their jobs.

The Great Depression also led to a decline in global trade and investment. The value of world trade fell by more than 60%, and investment in new businesses and industries plummeted.

The Great Depression had a devastating impact on the lives of millions of people around the world. It led to widespread poverty, hunger, and homelessness. It also led to a decline in social and political stability. In some countries, the Great Depression led to the rise of authoritarian regimes.

Lessons Learned and Regulatory Changes

The stock market crash of 1929 and the subsequent Great Depression led to a number of lessons being learned about the dangers of unregulated financial markets. In the aftermath of the crash, governments around the world implemented a number of regulatory changes to prevent future crashes.

These changes included the creation of the Securities and Exchange Commission (SEC) in the United States, which was tasked with regulating the stock market. The SEC was given the power to set rules for the issuance and trading of securities, and it was also given the authority to investigate and prosecute fraud.

Other regulatory changes included the introduction of margin requirements, which limit the amount of money that investors can borrow to purchase stocks. These changes were designed to make the stock market more stable and to prevent future crashes.

Conclusion: What Caused The Stock Market Crash Of 1929

The lessons learned from the crash of 1929 have profoundly shaped modern financial regulation, with measures implemented to prevent a recurrence of such a devastating event. However, the underlying dynamics that led to the crash serve as a cautionary tale, reminding us of the fragility of markets and the importance of vigilance in maintaining economic stability.