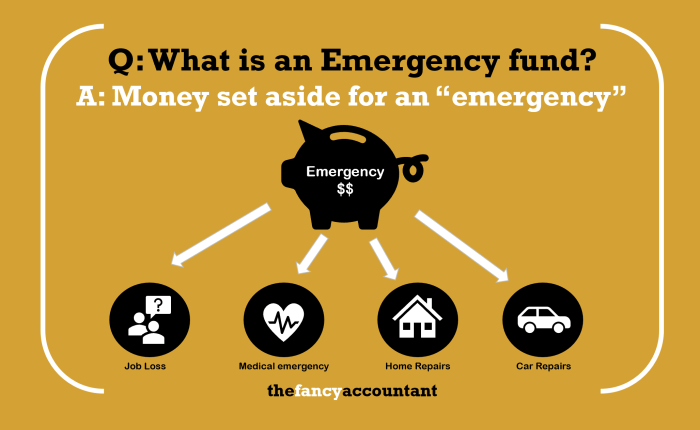

What is an emergency fund? It’s a financial safety net, a beacon of hope amidst life’s unforeseen storms. An emergency fund is the cornerstone of financial stability, providing peace of mind and the ability to weather unexpected expenses without derailing your financial well-being.

In this comprehensive guide, we’ll delve into the depths of emergency funds, exploring their purpose, ideal size, effective strategies for building them, common uses, and best practices for maintenance. Join us as we navigate the financial landscape, ensuring you’re equipped to handle life’s unexpected turns with confidence.

Understanding the Purpose of an Emergency Fund

An emergency fund serves as a financial safety net, providing peace of mind and financial security during unexpected events that may disrupt income or incur significant expenses.

Maintaining an emergency fund offers numerous advantages, including:

- Financial stability: Prevents the need for high-interest debt or selling assets during emergencies.

- Reduced stress: Provides a sense of financial preparedness and reduces anxiety related to unexpected expenses.

- Protection of savings: Prevents the depletion of long-term savings or retirement funds for emergency situations.

Types of Emergency Expenses

Emergency funds are intended to cover a wide range of unexpected expenses, such as:

- Medical emergencies

- Job loss or income reduction

- Car repairs or replacements

- Home repairs or renovations

- Natural disasters

Determining the Ideal Amount for an Emergency Fund

Determining the ideal amount for your emergency fund depends on several factors, including your income, expenses, and financial goals. A good starting point is to save enough to cover three to six months of living expenses. This amount will provide a financial cushion to help you weather unexpected events, such as job loss, medical emergencies, or home repairs.

Factors to Consider

* Income: The amount you earn each month will impact how much you can save for an emergency fund. If you have a high income, you may be able to save more aggressively.

* Expenses: Your monthly expenses will also play a role in determining the size of your emergency fund. If you have high expenses, you may need to save more to cover potential emergencies.

* Financial Goals: Your financial goals, such as buying a house or retiring early, may also influence the amount you need to save for an emergency fund. If you have ambitious financial goals, you may need to save more to ensure you can reach them.

Common Methods for Calculating Emergency Fund Targets

* Three to Six Months of Expenses: This is a common rule of thumb that suggests saving enough to cover three to six months of living expenses.

* Annual Income: Some experts recommend saving an amount equal to one to three months of your annual income.

* Variable Percentage: This method involves saving a percentage of your income each month, typically between 5% and 10%. The percentage you choose will depend on your income, expenses, and financial goals.

Remember, the ideal amount for your emergency fund is not a one-size-fits-all solution. Consider your individual circumstances and adjust the target amount accordingly.

Effective Strategies for Building an Emergency Fund: What Is An Emergency Fund

Creating and maintaining an emergency fund is essential for financial security. Here are practical steps to build an effective emergency fund.

An emergency fund is a crucial financial cushion for unexpected expenses, providing peace of mind and reducing stress. However, managing the anxiety associated with financial instability can be challenging. To cope with these feelings, consider reading our article How to Manage Stress and Anxiety , which offers practical tips and techniques for maintaining emotional well-being.

By addressing both financial preparedness and emotional resilience, you can create a more secure and fulfilling financial future.

Begin by establishing a savings goal. Aim for 3-6 months of living expenses. Then, create a budget that includes regular contributions to your emergency fund. Explore options like automatic transfers from your checking to your savings account.

Saving Habits

- Set up automatic transfers from your checking to your savings account.

- Use a separate savings account specifically for emergencies.

- Consider a high-yield savings account for higher interest rates.

Budgeting Techniques

- Create a monthly budget that includes regular contributions to your emergency fund.

- Use budgeting apps or spreadsheets to track your expenses and identify areas for savings.

- Negotiate lower bills or explore cost-cutting measures to free up funds for your emergency fund.

Investment Options

- Consider a money market account for higher interest rates than traditional savings accounts.

- Invest in short-term bonds or certificates of deposit (CDs) for slightly higher returns.

- Remember that your emergency fund should be easily accessible, so avoid investments with long lock-up periods.

Examples of Successful Strategies

- Jane set up an automatic transfer of $200 each month from her checking to her savings account.

- John negotiated a lower rent and used the savings to build his emergency fund.

- Mary invested in a money market account and earned a higher interest rate on her emergency savings.

Common Uses of Emergency Funds

An emergency fund serves as a financial cushion to help you navigate unforeseen circumstances that can disrupt your financial stability. These funds are typically utilized to cover unexpected expenses that cannot be met through regular income or savings.

Common scenarios where an emergency fund proves invaluable include:

Medical Emergencies

- Unexpected medical expenses, such as hospital bills, doctor’s fees, or prescription medications

- Dental emergencies, including root canals, extractions, or crowns

- Vision emergencies, such as eye surgery or glasses replacement

Job Loss or Income Reduction, What is an emergency fund

- Loss of employment or unexpected layoff

- Temporary work stoppage due to illness, injury, or family emergencies

- Reduction in work hours or salary

Home Repairs and Emergencies

- Urgent home repairs, such as roof leaks, electrical issues, or plumbing problems

- Natural disasters, such as floods, earthquakes, or hurricanes

- Unexpected moving expenses

Car Problems and Transportation Emergencies

- Major car repairs, such as engine failure or transmission problems

- Unexpected car accidents or breakdowns

- Emergency transportation costs, such as plane tickets or rental cars

Other Unforeseen Expenses

- Legal fees for unexpected legal issues

- Funeral expenses for a loved one

- Pet emergencies, such as unexpected vet bills or surgery

It is crucial to use emergency funds wisely and responsibly. These funds should be reserved for genuine emergencies and not for frivolous spending. By maintaining an adequate emergency fund, you can provide yourself with peace of mind and financial stability during life’s unexpected challenges.

Maintaining and Monitoring an Emergency Fund

Maintaining and monitoring your emergency fund is crucial to ensure it remains effective and accessible when needed. Here are some best practices:

Regularly review your fund balance and adjust it as necessary. Consider factors such as income changes, expenses, and life events that may impact your financial situation. If your expenses have increased or your income has decreased, you may need to increase your fund balance.

An emergency fund is a financial cushion that provides a safety net for unexpected expenses. It’s like having a spare tire in your car – it gives you peace of mind knowing you’re prepared for the unexpected. While it’s essential to have an emergency fund, it’s also important to manage your mental health.

Tips to Manage Personality Disorders can help you understand the symptoms, causes, and treatments for various personality disorders. By understanding and managing your mental health, you can live a more fulfilling and balanced life. And remember, an emergency fund is a key part of financial well-being, providing you with the security to face life’s unexpected challenges.

Monitoring Your Fund

Keep track of withdrawals and deposits to ensure your fund is always up-to-date. Regularly reconcile your fund balance with your bank statements to avoid errors or discrepancies.

Consider setting up automatic transfers from your checking account to your emergency fund to maintain a consistent balance. This helps ensure you’re consistently building your fund without relying on manual contributions.

Final Summary

In the tapestry of personal finance, an emergency fund is an indispensable thread, providing resilience and financial freedom. By understanding its purpose, determining the optimal size, and implementing effective strategies, you can build a robust emergency fund that serves as a pillar of financial stability. Remember, life’s unexpected events are inevitable, but with an emergency fund, you can face them with financial fortitude and peace of mind.

Frequently Asked Questions

What is the primary purpose of an emergency fund?

An emergency fund serves as a financial cushion to cover unexpected expenses, such as medical emergencies, job loss, or home repairs, preventing you from resorting to debt or dipping into long-term savings.

How do I determine the ideal amount for my emergency fund?

The ideal emergency fund size varies based on individual circumstances. A good rule of thumb is to aim for 3-6 months’ worth of living expenses, covering essential costs like housing, food, transportation, and healthcare.

What are some effective strategies for building an emergency fund?

Effective strategies include creating a budget, automating savings, and exploring high-yield savings accounts or money market accounts that offer competitive interest rates.

What are some common uses of an emergency fund?

Emergency funds can be used for various unexpected expenses, such as medical bills, car repairs, home emergencies, or temporary unemployment.

How can I maintain and monitor my emergency fund?

Regularly review your emergency fund balance, adjust it based on changing circumstances, and consider seeking professional financial advice if needed to ensure it remains aligned with your financial goals.