When it comes to investing in cryptocurrency, the question of “what is the best crypto to invest in” is on every investor’s mind. With a vast and ever-evolving market, choosing the right cryptocurrency can be a daunting task. This comprehensive guide will delve into the key factors to consider, provide expert analysis, and Artikel effective investment strategies to help you make informed decisions in the crypto realm.

Understanding market trends, evaluating fundamental factors, and employing technical analysis are crucial steps in identifying potential investment opportunities. Risk management and diversification are equally important to safeguard your investments. By exploring successful case studies and emerging trends, you can gain valuable insights into the ever-changing landscape of cryptocurrency investing.

Investors seeking short-term gains in the cryptocurrency market may want to consider which crypto to buy today for short-term . By analyzing market trends and expert insights, traders can identify coins with high potential for rapid appreciation.

What is the Best Crypto to Invest In?

The cryptocurrency market has experienced significant growth in recent years, attracting investors seeking high returns. However, navigating the complex landscape and identifying the best cryptocurrencies to invest in can be challenging. This article provides a comprehensive guide to help investors make informed decisions, covering market analysis, fundamental factors, technical analysis, risk management, investment strategies, emerging trends, and case studies.

Market Analysis, What is the best crypto to invest in

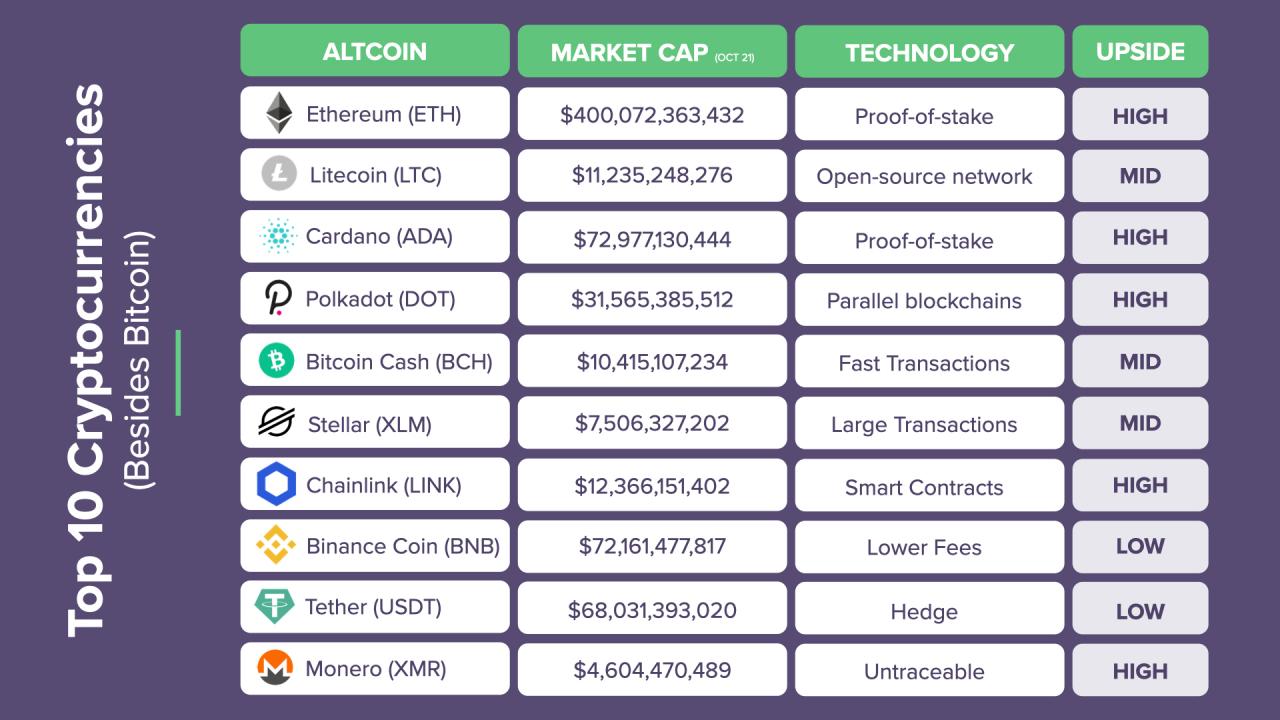

The cryptocurrency market has witnessed a surge in market capitalization, with Bitcoin and Ethereum dominating the landscape. Trading volume has also increased, indicating growing investor participation. Volatility remains a key characteristic of the market, with prices fluctuating rapidly. Emerging trends include the rise of decentralized finance (DeFi) and non-fungible tokens (NFTs), which have the potential to reshape the industry.

For those looking to invest in cryptocurrency for short-term gains, analysts recommend focusing on altcoins with strong fundamentals and a history of volatility.

Fundamental Factors

When evaluating cryptocurrencies, it is crucial to consider fundamental factors such as technology, team, adoption, and use cases. Technology refers to the underlying blockchain platform and its capabilities. Team refers to the experience and expertise of the development team. Adoption measures the extent to which a cryptocurrency is being used in real-world applications.

Use cases highlight the practical applications of the cryptocurrency.

| Cryptocurrency | Technology | Team | Adoption | Use Cases |

|---|---|---|---|---|

| Bitcoin | Proof-of-Work | Satoshi Nakamoto (pseudonym) | Widely accepted | Store of value, payments |

| Ethereum | Proof-of-Stake | Vitalik Buterin | Smart contracts, DeFi | dApps, NFTs |

| Binance Coin | Proprietary blockchain | Changpeng Zhao | Binance ecosystem | Trading fees, payments |

Final Review

In the dynamic world of cryptocurrency, staying informed and adapting to market shifts is essential. By following the principles Artikeld in this guide, you can navigate the crypto investment landscape with confidence, make informed decisions, and potentially reap the rewards of this transformative asset class.