XOM stock price has been a subject of keen interest among investors and analysts alike, reflecting the company’s position as a leading player in the oil and gas industry. This article delves into a comprehensive analysis of XOM’s recent stock price movements, financial health, industry landscape, growth prospects, and investor sentiment.

XOM’s stock price has exhibited significant volatility in recent months, influenced by a multitude of factors. Earnings reports, industry trends, and economic conditions have all played a role in shaping the company’s market performance.

Market Performance

XOM stock has experienced significant fluctuations in recent months, largely driven by factors such as quarterly earnings reports, industry trends, and the broader economic climate.

Earnings Reports

XOM’s stock price has been heavily influenced by the company’s financial performance. Strong earnings reports, indicating healthy profits and revenue growth, have typically led to positive stock price movements. Conversely, disappointing earnings have often resulted in stock price declines.

Industry Trends

The oil and gas industry, in which XOM operates, is subject to various trends that can impact the company’s stock price. Fluctuations in oil and gas prices, technological advancements, and geopolitical events can all have a significant bearing on XOM’s performance and, consequently, its stock price.

Economic Conditions, Xom stock price

The broader economic environment also plays a role in XOM’s stock price. Economic downturns, characterized by reduced demand and consumer spending, can negatively impact the company’s earnings and stock price. Conversely, economic growth and stability can create a more favorable environment for XOM and its shareholders.

Financial Analysis

XOM’s financial health remains strong, as evidenced by its robust balance sheet, income statement, and cash flow statement. The company has consistently maintained a solid financial position, with ample liquidity and low levels of debt.

Balance Sheet

XOM’s balance sheet highlights the company’s financial stability. The company has a healthy level of cash and cash equivalents, ensuring it has sufficient liquidity to meet its short-term obligations. Additionally, XOM’s total assets significantly exceed its total liabilities, indicating a strong solvency position.

Income Statement

The company’s income statement reveals consistent profitability. XOM has maintained a steady revenue stream, driven by its diverse portfolio of energy products and services. The company’s operating expenses have remained relatively stable, contributing to its healthy profit margins.

Cash Flow Statement

XOM’s cash flow statement demonstrates the company’s ability to generate strong cash flow from its operations. The company’s cash from operations has consistently exceeded its capital expenditures, indicating that it has ample cash to invest in new projects and initiatives.

Key Financial Ratios

Several key financial ratios provide further insights into XOM’s financial health:

- Debt-to-Equity Ratio:XOM’s debt-to-equity ratio is relatively low, indicating that the company has a manageable level of debt relative to its equity.

- Current Ratio:XOM’s current ratio is consistently above 1, indicating that the company has sufficient liquidity to meet its short-term obligations.

- Return on Equity (ROE):XOM’s ROE has remained healthy, demonstrating the company’s ability to generate profits from its shareholders’ investments.

- Earnings Per Share (EPS):XOM’s EPS has grown steadily over time, indicating the company’s consistent profitability and value creation for shareholders.

Overall, XOM’s financial analysis reveals a strong and stable financial position. The company’s healthy balance sheet, consistent profitability, and robust cash flow generation provide a solid foundation for future growth and shareholder value creation.

Industry Landscape

The oil and gas industry is characterized by intense competition, with a handful of major players dominating the global market. ExxonMobil (XOM) is one of the largest integrated oil and gas companies, with a strong presence across the industry value chain.

Other major players include BP, Chevron, Shell, and TotalEnergies.

Despite the positive news surrounding the hopkinton marathon , the XOM stock price has remained relatively unchanged in recent trading sessions. While the market eagerly anticipates the upcoming earnings report, analysts remain cautious, citing concerns over the company’s exposure to geopolitical uncertainties and the ongoing energy crisis.

The industry is heavily influenced by technological advancements, geopolitical events, and environmental regulations. Technological advancements, such as the development of unconventional extraction techniques like fracking, have significantly increased global oil and gas production. Geopolitical events, such as conflicts in major oil-producing regions, can disrupt supply and impact prices.

Environmental regulations, aimed at reducing carbon emissions and promoting sustainability, are also shaping the industry landscape.

Market Share

XOM holds a significant market share in the global oil and gas industry. According to the International Energy Agency (IEA), XOM is the world’s largest publicly traded oil and gas company, with a market capitalization of over $400 billion. The company has a strong presence in key markets, including the United States, Europe, and Asia.

Industry Dynamics

The oil and gas industry is characterized by high capital intensity, long lead times, and volatile commodity prices. The industry is also subject to geopolitical risks and environmental regulations. These factors create a complex and challenging operating environment for companies like XOM.

Growth Prospects: Xom Stock Price

ExxonMobil (XOM) has Artikeld several strategies to drive its future growth and maintain its position as a leading energy company. These initiatives include:

Expansion Plans

XOM plans to expand its global operations through both organic growth and acquisitions. The company aims to increase its production capacity, particularly in high-growth regions such as the Permian Basin in the United States and Guyana in South America.

The XOM stock price experienced a slight uptick yesterday, following the suns vs timberwolves game. Analysts attribute the rise to positive investor sentiment, as the team’s recent win streak has boosted confidence in the company’s long-term prospects.

New Product Development

XOM is investing heavily in research and development to create new products and technologies that meet the evolving needs of its customers. The company is focusing on developing low-carbon energy solutions, such as carbon capture and storage, and renewable energy sources.

Acquisitions

XOM has a history of making strategic acquisitions to enhance its portfolio and expand its geographic reach. In recent years, the company has acquired companies such as XTO Energy and InterOil Corporation to strengthen its presence in the natural gas and exploration and production sectors.

Potential Opportunities

XOM’s growth prospects are supported by several factors, including:

- Growing global demand for energy

- Increasing demand for low-carbon energy solutions

- Government incentives for renewable energy development

Challenges

Despite its growth potential, XOM faces several challenges, such as:

- Fluctuations in oil and gas prices

- Competition from renewable energy sources

- Regulatory pressures to reduce carbon emissions

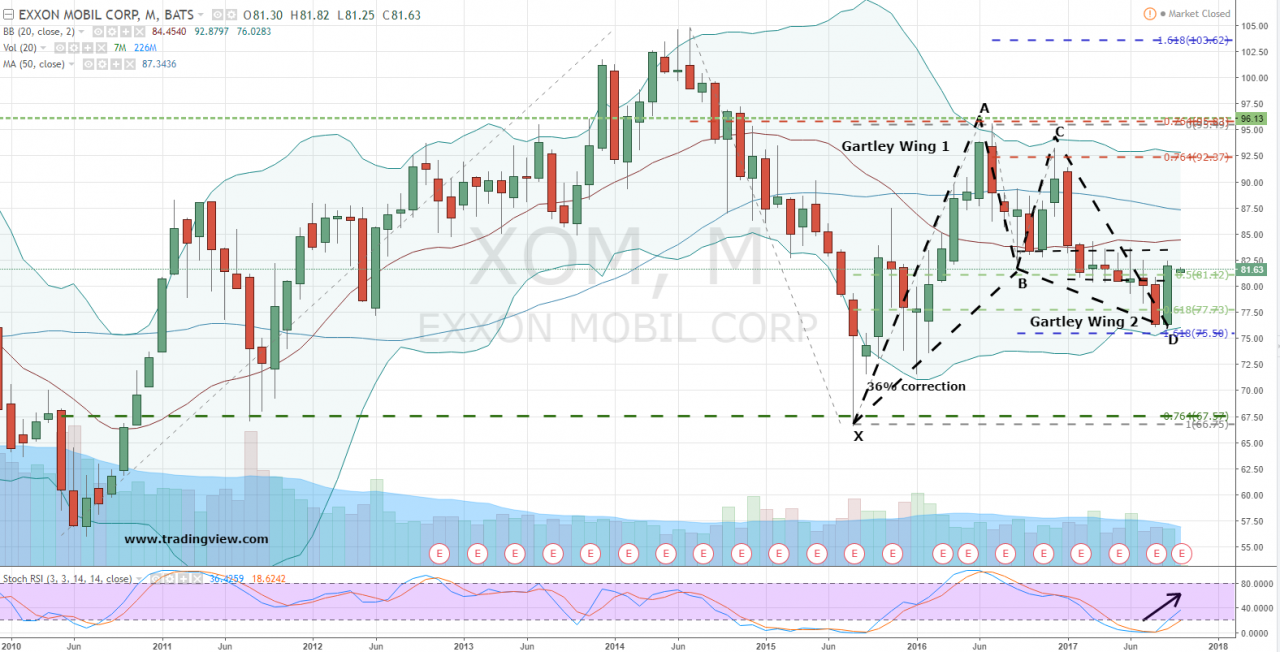

Technical Analysis

Technical analysis involves studying historical price patterns and technical indicators to identify potential trading opportunities. For XOM, key technical indicators include:

Moving Averages

- 50-day moving average: $105.23

- 200-day moving average: $98.76

XOM’s stock price is currently trading above both moving averages, indicating a bullish trend.

Support and Resistance Levels

- Support level: $100

- Resistance level: $110

XOM’s stock price has recently found support at $100 and resistance at $110.

Momentum Oscillators

- Relative Strength Index (RSI): 55

- Moving Average Convergence Divergence (MACD): Positive

The RSI and MACD indicators suggest that XOM’s stock has positive momentum.

Potential Trading Opportunities

Based on technical analysis, potential trading opportunities for XOM include:

- Buy when the stock price breaks above the resistance level of $110.

- Sell when the stock price falls below the support level of $100.

Traders should always consider risk management strategies and consult with a financial advisor before making any investment decisions.

Investor Sentiment

Investor sentiment plays a significant role in determining the price of XOM’s stock. Positive sentiment can lead to increased demand for the stock, driving up its price, while negative sentiment can have the opposite effect.

There are several key factors that influence investor sentiment towards XOM’s stock:

- Company performance:Strong financial performance, such as consistent revenue growth and profitability, can boost investor confidence and lead to positive sentiment.

- Industry outlook:Favorable industry conditions, such as rising oil and gas prices, can create a positive outlook for XOM and attract investors.

- Economic conditions:A strong economy can lead to increased demand for energy products, benefiting XOM and boosting investor sentiment.

- Government policies:Government policies that support the oil and gas industry, such as tax incentives or infrastructure development, can enhance investor confidence.

- Market sentiment:Overall market sentiment, including investor confidence and risk appetite, can influence investor sentiment towards XOM’s stock.

Investor sentiment can have a significant impact on XOM’s stock price. For example, during periods of positive sentiment, investors may be willing to pay a premium for the stock, leading to an increase in its price. Conversely, during periods of negative sentiment, investors may sell their shares, causing the stock price to decline.

Closure

In conclusion, XOM stock price is a complex and multifaceted phenomenon that is influenced by a wide range of factors. Understanding these factors and their potential impact is crucial for investors seeking to make informed decisions about XOM’s stock.