Navigating financial uncertainties requires a safety net, and an emergency fund serves as your financial lifeline. In this guide, we’ll delve into the crucial question: How much money should I have in my emergency fund? Join us as we explore the factors to consider, strategies to build it, and tips to maintain your financial cushion.

Understanding the purpose and importance of an emergency fund is the cornerstone of financial preparedness. It’s a dedicated stash of money set aside for unexpected expenses that can arise at any moment, such as medical emergencies, job loss, or home repairs. Having an emergency fund provides peace of mind and prevents you from resorting to debt or depleting your savings.

Understanding Emergency Funds

An emergency fund is a financial cushion set aside to cover unexpected expenses that arise suddenly, such as medical emergencies, job loss, or car repairs.

Having an emergency fund is crucial for financial stability as it prevents the need to rely on debt or deplete savings for unexpected events. It provides peace of mind and ensures that individuals can navigate financial emergencies without significant financial stress or disruption to their long-term financial goals.

Determining an Appropriate Amount

Determining the appropriate amount for an emergency fund is crucial for financial stability. Factors to consider include monthly expenses, income stability, and financial obligations.

Before setting aside an emergency fund, it’s important to understand the importance of managing your finances effectively. For guidance on navigating personality disorders, refer to Tips to Manage Personality Disorders . By following these tips, you can gain valuable insights into handling various aspects of your financial life, including determining an appropriate amount for your emergency fund.

Monthly Expenses

- Calculate your essential monthly expenses, including housing, utilities, food, transportation, and healthcare.

- Consider variable expenses such as entertainment, dining out, and travel.

- Multiply your total monthly expenses by three to six months to establish a target emergency fund amount.

Income Stability

- Assess the stability of your income. If you have a stable job with a regular income, you may need a smaller emergency fund.

- If your income is irregular or seasonal, you may need a larger emergency fund to cover potential income gaps.

Financial Obligations

- Consider your existing financial obligations, such as mortgage or rent payments, car loans, and credit card debt.

- A larger emergency fund may be necessary if you have significant financial obligations that could impact your ability to meet essential expenses during an emergency.

Ultimately, the ideal amount for your emergency fund will vary based on your individual circumstances. By carefully considering these factors, you can determine an appropriate amount that will provide you with peace of mind and financial security.

Building an Emergency Fund

To build a substantial emergency fund, it is essential to establish a savings strategy and allocate funds effectively. Consider the following measures:

Automate Savings

Automating savings allows you to set aside a predetermined amount from each paycheck directly into a dedicated emergency fund account. This removes the temptation to spend these funds and ensures a consistent contribution.

When considering how much money to allocate to your emergency fund, it’s crucial to prioritize your overall well-being. Adequate sleep is vital for mental health, and exploring Ways to Improve Sleep Quality for Mental Health can significantly enhance your overall health.

By ensuring you have sufficient funds to address financial emergencies, you can reduce stress and promote restful sleep, which in turn supports your financial stability.

Establish Financial Goals

Setting clear financial goals, such as saving a specific amount for an emergency fund within a set timeframe, provides motivation and direction. Break down the goal into smaller, achievable milestones to make it more manageable.

Using an Emergency Fund

An emergency fund is a crucial financial safety net designed to cover unexpected expenses that arise beyond your regular budget. It provides peace of mind and prevents you from relying on debt or depleting your savings for emergencies.

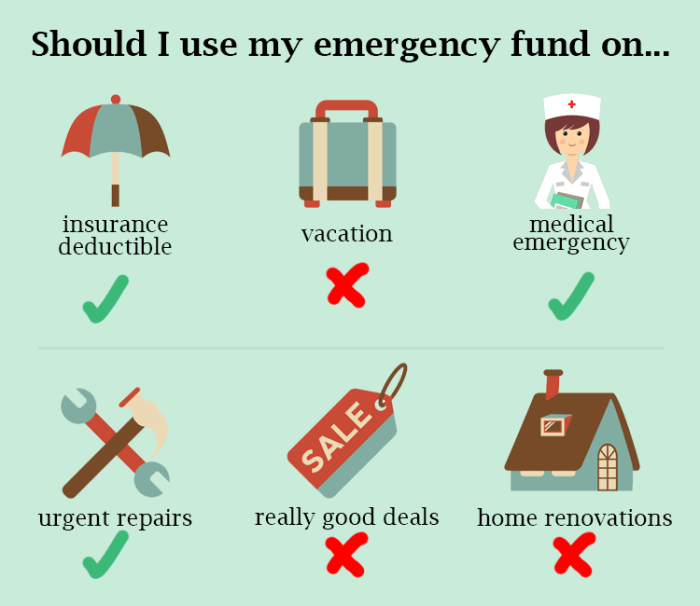

The appropriate uses of an emergency fund include:

- Medical expenses (uninsured or high deductibles)

- Car repairs or replacements

- Home repairs (major appliances, plumbing issues)

- Job loss or unexpected income disruptions

- Emergency travel expenses (family illness, natural disasters)

It’s essential to avoid unnecessary withdrawals from your emergency fund to maintain its integrity. This fund is not intended for non-essential expenses, such as vacations or entertainment. Preserving your emergency fund ensures its availability when genuine emergencies arise.

Avoiding Unnecessary Withdrawals, How much money should I have in my emergency fund

To prevent unnecessary withdrawals, consider the following:

- Establish a clear definition of emergencies and stick to it.

- Create a monthly budget to manage regular expenses and avoid overspending.

- Build a separate savings fund for non-essential purchases or unexpected expenses that fall outside the scope of emergencies.

- Seek professional financial advice if you struggle to manage your finances or control withdrawals.

Maintaining an Emergency Fund

Maintaining an emergency fund is crucial to ensure its effectiveness during unexpected events. Here are some tips to monitor, replenish, and adjust your emergency fund:

Regularly review your emergency fund to assess its adequacy. Life circumstances, expenses, and financial goals can change, so it’s important to adjust the amount accordingly. Consider factors such as income, expenses, debt, and future plans.

Monitoring and Replenishing

- Set up automatic transfers from your checking account to your emergency fund account.

- Round up your purchases to the nearest dollar and contribute the difference to your emergency fund.

- Use tax refunds or unexpected income to replenish your emergency fund.

Epilogue: How Much Money Should I Have In My Emergency Fund

Building and maintaining an emergency fund is a crucial aspect of financial planning. By following the strategies Artikeld in this guide, you can establish a financial safety net that will protect you from life’s unexpected events. Remember, an emergency fund is not just a savings account; it’s an investment in your financial well-being, providing you with the confidence to face the future with resilience.

FAQ Guide

What should I consider when determining the amount for my emergency fund?

Factors to consider include your monthly expenses, income, debt obligations, and lifestyle.

How can I build my emergency fund quickly?

Automate savings, create a budget, and explore additional income streams.

What are the appropriate uses of an emergency fund?

Emergency expenses such as medical bills, car repairs, or unexpected job loss.