Mortgage rates Today: Dive into the intricacies of mortgage rates, their impact on homeownership, and strategies for securing the best deal. From definitions and trends to forecasts and resources, this comprehensive guide provides a roadmap for navigating the mortgage landscape.

Mortgage Rate Definitions

Mortgage rates are the interest rates charged on loans used to purchase real estate. They are typically expressed as an annual percentage rate (APR), which includes the interest rate plus any additional fees or charges.

There are two main types of mortgage rates: fixed rates and adjustable rates.

Fixed Rates

Fixed rates remain the same for the entire term of the loan, regardless of changes in the market. This provides borrowers with stability and predictability in their monthly mortgage payments.

Adjustable Rates

Adjustable rates start at a lower rate than fixed rates, but they can fluctuate over time based on changes in an index, such as the prime rate or the London Interbank Offered Rate (LIBOR). This can lead to uncertainty in monthly mortgage payments.

Factors Influencing Mortgage Rates, Mortgage rates Today

Several factors influence mortgage rates, including:

- Economic conditions

- Inflation

- Federal Reserve policy

- Demand for mortgages

- Supply of mortgages

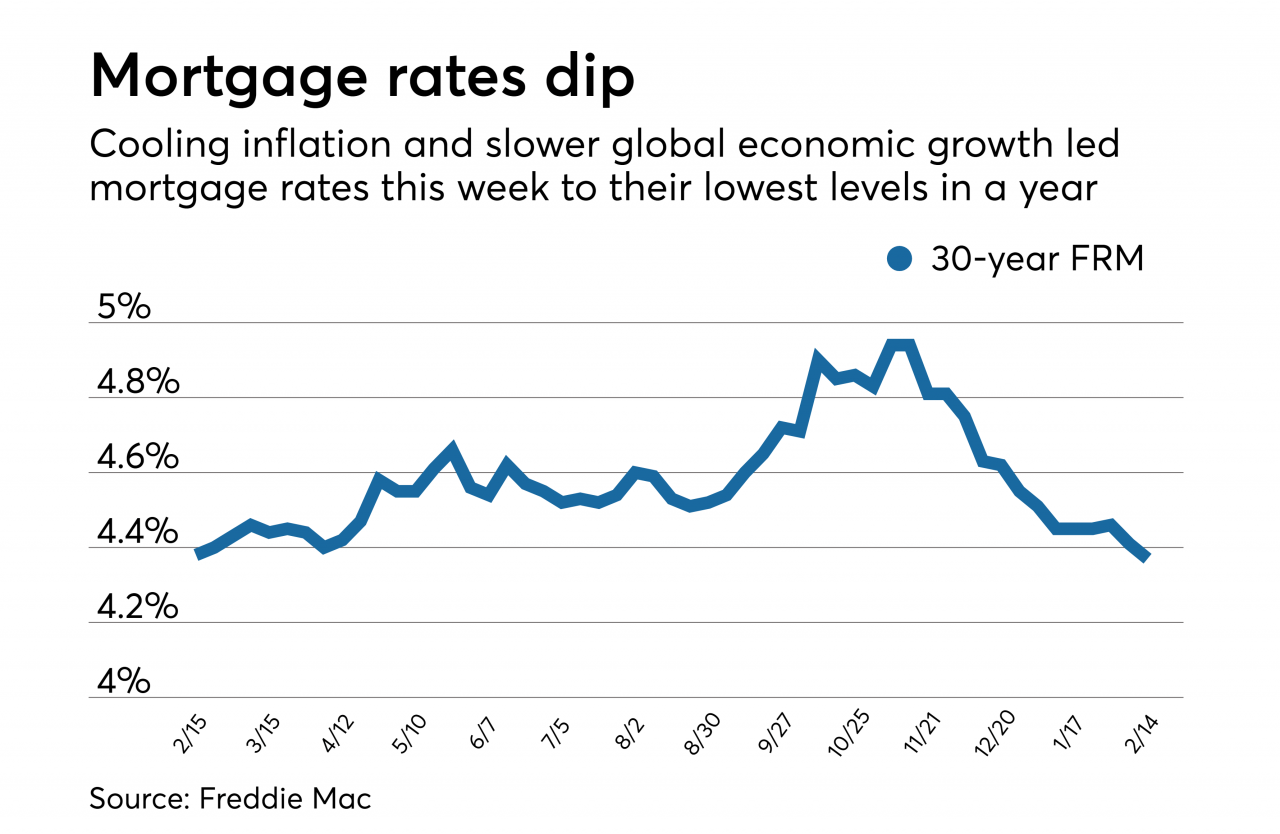

Mortgage Rate Trends

Mortgage rates have been trending downward in recent years, reaching record lows in 2021. However, they have started to rise in 2022 due to the Federal Reserve’s efforts to combat inflation.

Historically, mortgage rates have fluctuated significantly, with periods of high rates in the 1970s and 1980s and periods of low rates in the 2000s and 2010s.

Impact of Economic Factors

Economic factors, such as inflation and economic growth, can have a significant impact on mortgage rates. When the economy is strong, inflation tends to rise, which can lead to higher interest rates. Conversely, when the economy is weak, inflation tends to fall, which can lead to lower interest rates.

Mortgage Rate Impact

Mortgage rates have a significant impact on home affordability.

Home Affordability

Higher mortgage rates make it more expensive to buy a home, as they increase the monthly mortgage payment. This can reduce the number of homes that are affordable for buyers.

Housing Market Activity

Mortgage rates also affect housing market activity. When rates are low, more people are able to afford to buy homes, which can lead to increased demand and higher home prices. Conversely, when rates are high, fewer people are able to afford to buy homes, which can lead to decreased demand and lower home prices.

Economic Impact

Mortgage rates can also have an impact on the overall economy. When rates are low, it can stimulate economic growth by making it easier for people to buy homes and businesses to invest in new projects. Conversely, when rates are high, it can slow economic growth by making it more expensive for people to buy homes and businesses to invest.

Mortgage Rate Forecasts

Forecasting future mortgage rates is a complex task, but there are a number of factors that can be used to make predictions.

Methods of Forecasting

Common methods of forecasting mortgage rates include:

- Econometric models

- Expert surveys

- Historical data analysis

Factors Affecting Accuracy

The accuracy of mortgage rate forecasts depends on a number of factors, including:

- The accuracy of the economic data used in the forecast

- The skill of the forecaster

- The amount of uncertainty in the economic outlook

Outcome Summary: Mortgage Rates Today

In the dynamic world of real estate, understanding Mortgage rates Today is crucial for informed decision-making. By staying abreast of rate trends, evaluating mortgage options, and utilizing available resources, homebuyers can optimize their financial strategies and achieve their homeownership goals.