Which crypto exchanges do not report to irs – The topic of which crypto exchanges do not report to the IRS has sparked widespread attention. This comprehensive analysis delves into the intricacies of this issue, shedding light on the exchanges that fail to comply with IRS reporting requirements and exploring the ramifications of such actions.

This in-depth examination unravels the strategies employed by crypto exchanges to circumvent IRS reporting, showcasing real-world examples of exchanges that have utilized these tactics. Furthermore, it illuminates the consequences faced by exchanges that disregard reporting obligations, providing cautionary tales of penalties and enforcement actions.

Crypto Exchanges Not Reporting to the IRS: Which Crypto Exchanges Do Not Report To Irs

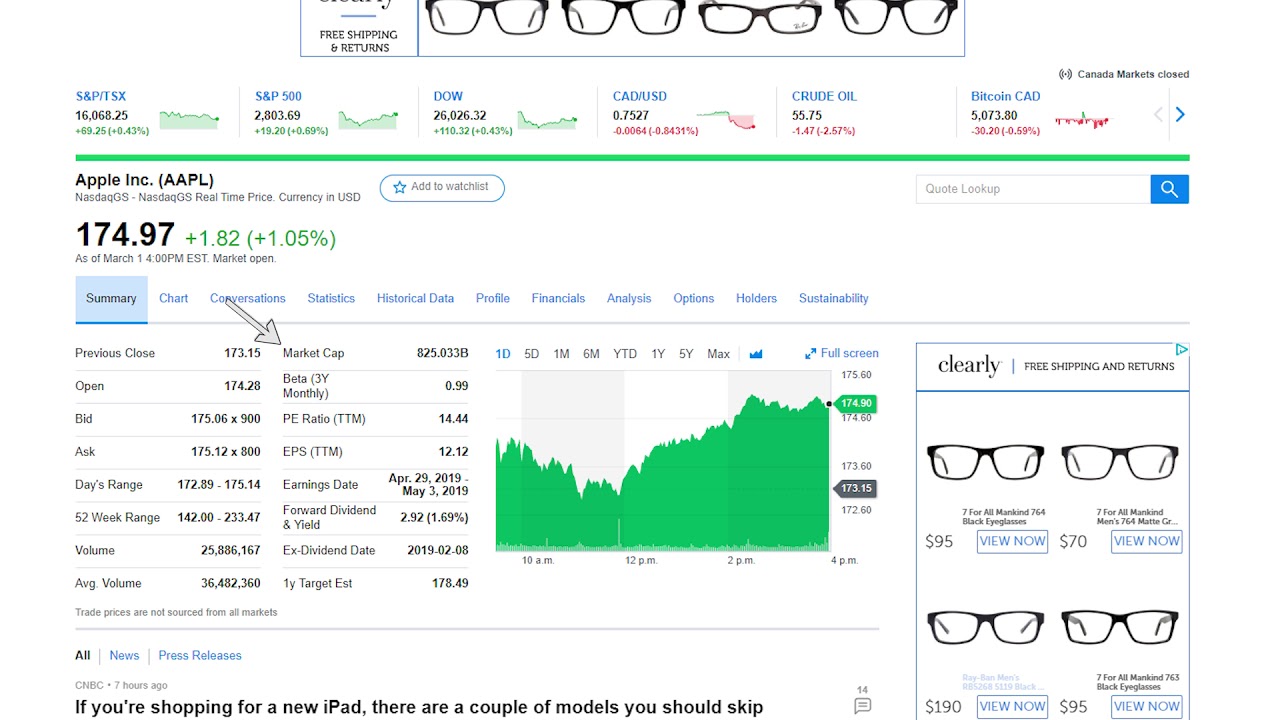

The Internal Revenue Service (IRS) requires cryptocurrency exchanges to report certain information to the agency, including the names and addresses of their customers, as well as the amounts of cryptocurrency they have bought and sold. However, some exchanges have been identified as not reporting this information to the IRS.

Cryptocurrency enthusiasts seeking lucrative opportunities can explore the crypto loko no deposit bonus codes offered by various platforms. These codes provide users with free credits or bonuses upon registration, enabling them to trade and potentially profit without making an initial deposit.

Methods of Avoiding IRS Reporting

There are a number of methods that crypto exchanges can use to avoid reporting to the IRS. One method is to simply not register with the IRS as a financial institution. This is a violation of the law, but it can be difficult for the IRS to enforce.

Cryptocurrency enthusiasts are in luck, as Crypto Loko is offering a generous no deposit bonus code. This exclusive offer allows users to get started with trading without having to make an initial deposit. By using the crypto loko no deposit bonus codes , traders can access a wide range of cryptocurrencies and start building their portfolios.

Another method that exchanges can use to avoid reporting is to locate themselves in a country that does not have a tax treaty with the United States. This makes it more difficult for the IRS to obtain information about the exchange’s customers.

Consequences of Not Reporting

Crypto exchanges that do not report to the IRS can face a number of consequences. These consequences include:

- Fines

- Imprisonment

- Loss of their license to operate

IRS Enforcement Actions

The IRS is taking a number of steps to enforce reporting requirements on crypto exchanges. These steps include:

- Auditing exchanges

- Issuing subpoenas

- Working with foreign governments to obtain information about exchanges

Best Practices for Compliance, Which crypto exchanges do not report to irs

Crypto exchanges can follow a number of best practices to ensure compliance with IRS reporting requirements. These best practices include:

- Registering with the IRS as a financial institution

- Maintaining accurate records of customer transactions

- Filing the appropriate tax forms

Closing Notes

As the IRS intensifies its efforts to enforce reporting compliance among crypto exchanges, this analysis underscores the importance of adhering to regulations. It emphasizes the benefits of compliance for crypto exchanges, highlighting the advantages of transparency and the avoidance of potential legal repercussions.